A New Stablecoin Enters Japan’s Market

In a significant development for Asia’s digital asset market, Ripple and its longtime partner, SBI Holdings, have announced a plan to roll out Ripple USD (RLUSD) in Japan. This new initiative is a strategic move to enter Japan’s emerging stablecoin market, which is now operating under new regulatory frameworks. The collaboration, sealed with a memorandum of understanding, designates SBI VC Trade as the key distributor.

SBI VC Trade, a licensed Electronic Payment Instruments Exchange Service Provider, aims to have RLUSD officially live and available in Japan during the first quarter of 2026. This partnership not only strengthens the ties between the two companies but also positions them at the forefront of a new era of regulated digital finance in the region.

RLUSD: A Standard for Regulatory Compliance

RLUSD is Ripple’s first stablecoin initiative, which was initially launched in December 2024. The token is designed to serve as a reliable bridge between traditional and decentralized finance. It is fully backed by highly liquid and secure assets, including U.S. dollar deposits, short-term Treasuries, and cash equivalents. To ensure complete transparency and build investor trust, the stablecoin undergoes monthly attestations from a reputable third-party firm.

Ripple executives, including Jack McDonald, Senior Vice President of Stablecoins, emphasize that this rigorous structure is what sets RLUSD apart from its peers. The focus on regulatory clarity and institutional-grade compliance is a core component of the stablecoin’s value proposition, which aims to appeal to both retail and institutional investors who prioritize security and trustworthiness.

Strengthening Japan’s Digital Financial Infrastructure

The introduction of RLUSD is more than just a new product launch; it is a major step in bolstering Japan’s digital financial infrastructure. SBI VC Trade CEO Tomohiko Kondo highlighted the importance of this partnership, stating that the stablecoin will “not just expand the option of stablecoins in the Japanese market but is a major step forward in the reliability and convenience of stablecoins.”

The move is particularly timely, as Japan recently approved the first yen-denominated stablecoin for issuance in the country. This regulatory progress signals that Japan is actively opening its doors to compliant digital assets, and the partnership between Ripple and SBI is perfectly positioned to capitalize on this positive trend. It also demonstrates a commitment to providing the Japanese market with a stable and reliable digital currency option.

The Expanding Ripple-SBI Partnership

The rollout of RLUSD further deepens the long-standing collaboration between Ripple and SBI. The two companies have been partners in Asia’s blockchain ecosystem for years, working together on a variety of projects. This latest initiative shows a shared vision for the future of finance, one that is built on the principles of trust, efficiency, and compliance.

By combining Ripple’s technology with SBI’s deep market knowledge and regulatory expertise, the partnership is well-equipped to navigate Japan’s complex financial landscape. This synergy allows them to bring a product to market that is not only technologically sound but also fully compliant with local regulations, a crucial factor for success in a highly regulated environment.

What This Means for Stablecoins and XRP

The launch of RLUSD is a significant moment for the stablecoin market. By providing a transparent, well-regulated, and auditable stablecoin, Ripple is attempting to set a new industry standard. This could potentially lead to greater institutional adoption of stablecoins as a whole, as it addresses many of the concerns around transparency and security.

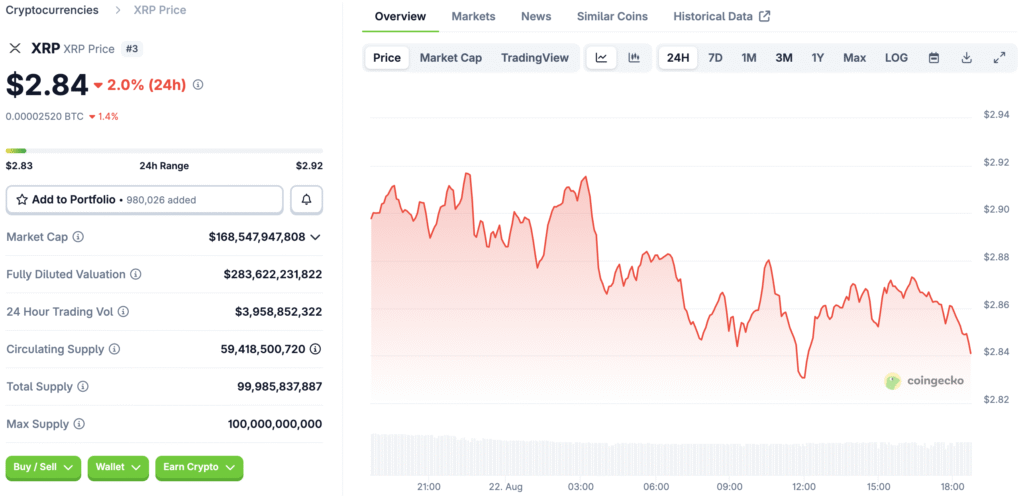

For XRP, this development is also notable. While RLUSD is an entirely separate asset, its successful launch could enhance Ripple’s overall reputation and standing in the financial world. The ability to successfully launch a regulated stablecoin in a major market like Japan is a testament to Ripple’s ongoing efforts to work within existing financial systems, which could be seen as a positive sign by regulators and investors.

Regulatory Clarity as a Key Differentiator

One of the main competitive advantages that Ripple is banking on with RLUSD is its focus on regulatory clarity. In a stablecoin market that has been plagued by questions of transparency and legal standing, RLUSD’s structure, which includes monthly third-party attestations and a clear backing by liquid assets, is designed to provide maximum confidence.

This approach directly addresses the concerns of regulators and traditional financial institutions, making it a more attractive option for those who are hesitant to enter the crypto space. This focus on compliance is likely to become a major theme in the future of digital finance, and RLUSD is a strong example of how projects can navigate the regulatory landscape successfully.

Ripple and SBI Pave the Way for Integration

The launch of RLUSD in Japan is a powerful signal of the direction in which digital finance is heading in Asia. As major economies in the region, including Japan, continue to develop and implement new regulatory frameworks for cryptocurrencies and stablecoins, we are likely to see more partnerships between established financial players and innovative blockchain companies.

This trend is moving away from the more speculative aspects of the market and toward a focus on utility, compliance, and real-world financial applications. The collaboration between Ripple and SBI is at the forefront of this evolution, paving the way for a more stable, secure, and integrated financial ecosystem for the future.

Read More: XRP and Stablecoins: What Ripple’s Bold Moves Mean for Investors in 2025