Shiba Inu’s Speculative Nature Dominates Investment Conversations

Shiba Inu remains in the spotlight, fueled by cycles of excitement rather than solid fundamentals that would underpin lasting value creation. The extreme fluctuations have significantly benefited some early adopters, while others are left pondering the sustainability during consistently bearish market phases.

The token continues to be a speculative asset, experiencing significant spikes due to viral trends and celebrity endorsements, yet it faces challenges in maintaining investor trust. The fluctuations in price highlight the significant role sentiment plays in determining value, often overshadowing practical utility. This underscores the importance of timing for those considering investments in SHIB.

Price Remains Far Below Previous Peak Levels From 2021 Mania

The Shiba Inu cryptocurrency is presently valued at 87% less than its peak in October 2021, indicating a significant decline in market enthusiasm since those speculative highs. This significant decline reflects wider corrections seen in meme tokens after exuberant surges that were not supported by fundamental factors from the outset.

Even with sporadic surges, SHIB has struggled to regain the necessary momentum for a lasting recovery toward its historical peaks. This ongoing disparity highlights significant concerns regarding the long-term viability and potential for sustainable price growth for investors.

Shiba Inu Hype Cycles Expose Core Vulnerabilities for Investors

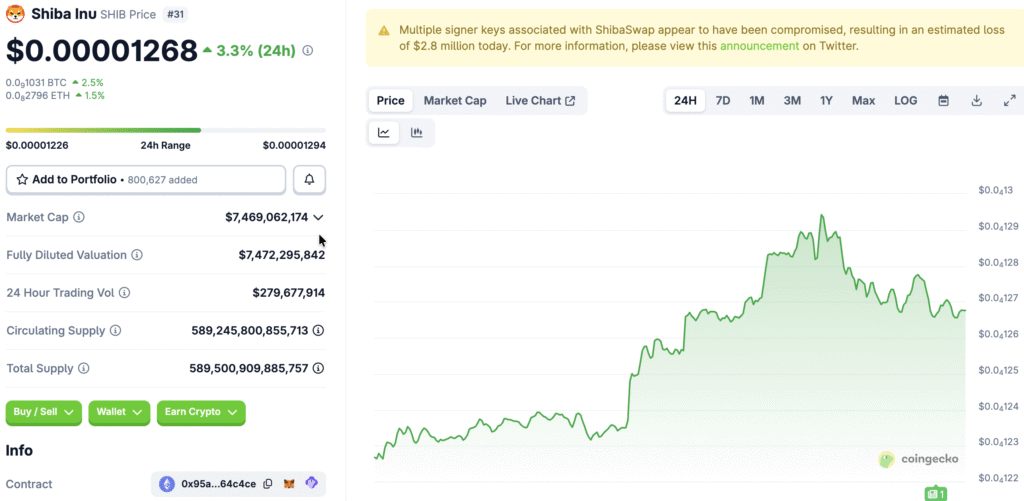

The Shiba Inu cryptocurrency boasts a market cap of $7 billion, yet its utility is quite limited, depending heavily on hype to maintain its appeal to investors. Despite the presence of metaverse initiatives and Layer-2 solutions, adoption is still limited, hindering SHIB’s progression beyond mere speculative stories.

Every time there is a public mention, it tends to trigger temporary price spikes, but this excitement fades rapidly as speculative enthusiasm diminishes without strong technological foundations. This dependence on hype cycles reveals core vulnerabilities that seasoned investors usually steer clear of when making strategic capital allocations.

Recommended Article: Shiba Inu Hits Critical Zone as Analysts Predict October Rally

Long-Term Investment Appeal Appears Weak Compared to Leading Assets

Experts contend that Shiba Inu does not possess significant long-term potential when compared to established cryptocurrencies that provide practical applications in the real world. The failure to sustain upward momentum after excitement-fueled surges highlights weaknesses in investor confidence and the frameworks of utility.

Bitcoin and Ethereum have shown remarkable resilience in bouncing back from downturns, thanks to their institutional adoption and ongoing technological advancements. The Shiba Inu continues to be primarily situated within speculative trading circles, which restricts its wider attraction to serious long-term investors at this time.

The Role of Risk Tolerance in SHIB Investment Decisions

Putting $1,000 into Shiba Inu at this moment means embracing considerable fluctuations and unpredictable future results, with little practical support. Although there are possible short-term benefits, significant risks persist because of dependence on volatile speculative market dynamics at present.

Careful evaluation is essential for investors to determine if their exposure fits within their overall portfolio strategies and risk management goals. For many, investing in fundamentally stronger assets might yield more reliable returns over extended periods.

Insights from Analysts Emphasize Doubts About Shiba Inu’s Prospects

Financial analysts highlight that Shiba Inu’s downward trend indicates a decline in market confidence regarding its long-term sustainability. The token is currently trading approximately 87% below its all-time highs, facing challenges in persuading investors of any significant recovery potential in the future.

Without broadening its real-world adoption or utility, SHIB faces the danger of being stuck in an endless cycle of speculative booms and busts. This skepticism showcases a developing sophistication among crypto investors who are now focusing on utility and fundamentals rather than being swayed by hype-driven narratives.

Shiba Inu Seen as Risky Bet Versus Diversified Quality Investments

Prior to investing $1,000 in Shiba Inu, it is essential for investors to assess other assets that may present more robust fundamentals and greater growth potential. Traditionally, putting money into innovative firms or robust cryptocurrencies has yielded better long-term gains compared to speculative tokens.

Top advisory firms persist in advocating for diversified portfolios that focus on quality assets, steering clear of the volatile trends associated with meme coins. For numerous individuals, exercising patience and strategically investing in established performers might result in more favorable outcomes than current speculative bets on SHIB.