Solana Captures Wall Street’s Interest with Its Speed and Efficiency

Bitwise CIO Matt Hougan asserts that Solana is set to emerge as Wall Street’s favored blockchain for stablecoins and tokenization. He highlighted that audiences from traditional finance perceive stablecoins and tokenized assets as more concrete in comparison to Bitcoin.

The impressive speed of Solana, with settlement times decreasing from 400 microseconds to a mere 150, positions it as a compelling option for high-frequency financial settings. Hougan characterized Solana as the blockchain that best matches Wall Street’s trading preferences, positioning it as an attractive choice for upcoming financial applications.

Ethereum Continues to Lead in the Stablecoin Sector

Even with Solana’s increasing popularity, Ethereum remains the leader in the stablecoin market, commanding approximately 60% of the market share on its base layer. The value of Solana’s stablecoin has risen to $13.9 billion, accounting for 4.7% of the overall market. In comparison, Ethereum showcases an impressive $172.5 billion in on-chain stablecoin value.

With the inclusion of Layer-2 networks like Arbitrum, Base, and Polygon, Ethereum’s market share surpasses 65%. Experts, such as AJ Warner from Offchain Labs, contend that although Solana demonstrates potential, Ethereum’s well-established ecosystem continues to be the most robust for the innovation and adoption of stablecoins.

ETF Developments Could Reshape Competitive Landscape

Bitwise is currently anticipating the SEC’s ruling on its spot Solana ETF, which is set for October 16. This ETF may open up fresh opportunities for Solana, enhancing its institutional visibility and fostering growth, which could lead to a quicker adoption rate.

Currently, Bitwise’s Physical Solana ETP manages approximately $30 million in assets, which is significantly lower than the funds based on BTC or ETH. A positive ruling from the SEC could greatly enhance interest in Solana, particularly among investors focused on ETFs.

Recommended Article: Solana XRP Litecoin ETFs Reach Full Approval Odds

Solana’s Staking Edge Compared to Ethereum

Hunter Horsley, the CEO of Bitwise, emphasized Solana’s distinct edge in the staking ETF competition due to its quicker unstaking periods. This feature has the potential to draw ETF interest, as it enables investors to transfer funds more swiftly than what Ethereum’s staking systems allow.

Ethereum continues to be the primary choice for institutions, but Solana’s adaptability may enable it to seize a portion of the ETF market, especially as financial products develop.

Analysis of Market Trends and Institutional Strategies

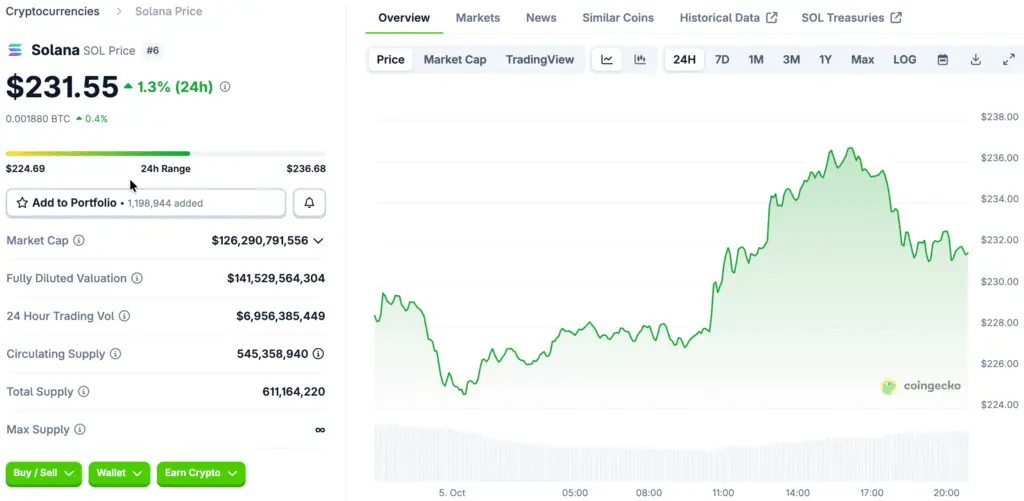

Solana is presently priced at approximately $227, reflecting a 2% decline for the day and remaining more than 22% lower than its peak in January 2025. Nonetheless, Bitwise’s robust support and strategic placement suggest a strong belief in Solana’s enduring significance in the realm of institutional cryptocurrency adoption.

Regardless of the SEC’s decision on the ETF, Solana’s technological advantages and increasing visibility in financial discussions indicate that it will continue to be a significant force in the upcoming stage of blockchain adoption.

Ethereum’s Layer-2 Ecosystem Strengthens Its Position

As Solana progresses, Ethereum’s robust Layer-2 ecosystem remains a significant competitive advantage. Networks such as Arbitrum, Base, and Polygon provide enhanced scalability and cost-effectiveness, rendering Ethereum appealing to both developers and institutions.

These networks solidify Ethereum’s leading position, offering strong infrastructure for stablecoin issuance and tokenization efforts.

Solana Rise Meets Ethereum Strength as Stablecoin Race Intensifies

The stablecoin and tokenization sectors are entering an intensely competitive landscape. Solana’s rapid performance and potential ETF benefits establish it as a formidable competitor to Ethereum’s dominance.

Nonetheless, Ethereum’s established ecosystem, growing institutional adoption, and Layer-2 scalability ensure it remains in a leading position for the time being. The forthcoming decision by the SEC regarding the ETF has the potential to serve as a pivotal moment, influencing whether the divide between these two prominent blockchain networks becomes more pronounced or diminishes.