Solana’s Surge Slows Down Following Weeks of Robust Growth

Solana’s recent upward movement is facing obstacles following weeks of consistent progress. The token’s price momentum seems to be slowing down, as fresh selling pressure suggests a potential short-term correction. Following a period of impressive gains, Solana is currently facing challenges in sustaining its upward momentum, as technical indicators suggest a waning enthusiasm among buyers.

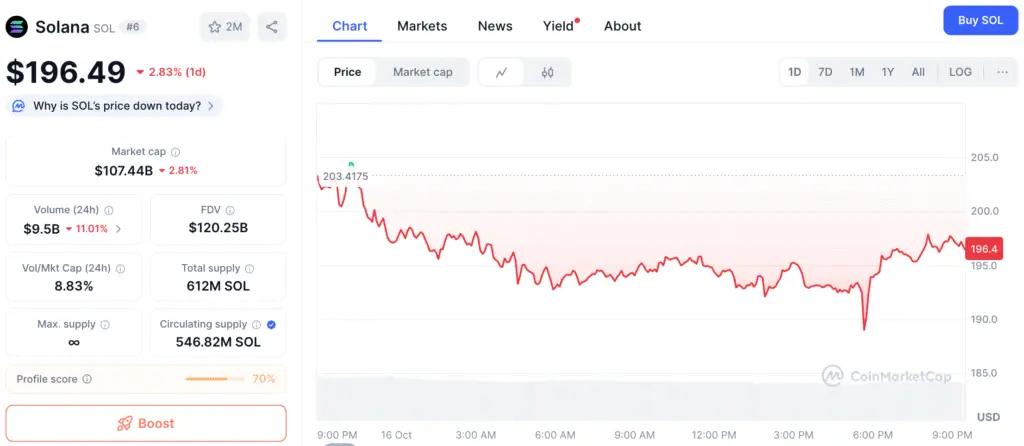

As of now, Solana (SOL) is priced around $196, indicating a cautious stance among traders who are closely monitoring key support levels to determine the forthcoming direction. As on-chain data reveals a downturn in activity alongside increased whale accumulation, the market is left to ponder whether this dip signifies a necessary correction or the onset of a more profound retracement.

Divergence Between Network Activity and Locked Value

Solana’s ecosystem reveals a growing disparity between its Total Value Locked (TVL) and the level of active user engagement. Despite the remarkable increase in total value locked from $6 billion to over $12 billion since early 2025, there has been a significant decline in active addresses, dropping from approximately 9 million to about 2–3 million. This divergence highlights a trend where capital is increasingly concentrated among major entities, rather than being widely distributed among retail participants.

Such disparities frequently signal impending cooling periods, as liquidity reserves grow while engagement in transactions diminishes. Experts caution that ongoing divergence may exert downward pressure on SOL’s price, possibly leading to a 10–15% correction if activity metrics do not bounce back to earlier levels.

Solana Breaks From Uptrend Channel as Volume Drops and Sentiment Fades

For several months, Solana exhibited a consistent upward trajectory, establishing higher highs and higher lows within a distinct support channel. Nonetheless, the recent decline disrupted this trend, causing SOL to fall beneath its upward trajectory and signaling a breakdown of its short-term positive framework.

This analysis has intensified the likelihood of a market adjustment, particularly as daily trading volumes diminish and overall sentiment falters. Experts anticipate a revisit to lower support levels unless Solana swiftly regains its previous channel around the $200 threshold.

Recommended Article: Solana ETF Fees Cut to 0.30% as VanEck Adds Staking Rewards

Key Support and Resistance Levels Define the Outlook

Solana’s price is currently at crucial technical junctures. The 20-day EMA positioned at $186.8 serves as a key support level, whereas the 50-day EMA at $199.4 and the 200-day EMA at $208.7 establish significant resistance thresholds. The capacity to maintain levels above the shorter-term average will be crucial in deciding if the token can evade more significant declines.

If buyers manage to take charge above $200, it may negate the current bearish scenario and restore the earlier upward momentum. On the other hand, if the $186 support is not upheld, SOL could decline towards the $172–$165 range, where there are more robust historical demand zones.

Solana Faces Drop in Active Wallets as On-Chain Participation Weakens

Even with an increase in TVL, the on-chain activity of Solana appears to be faltering. The recent weeks have seen a significant drop in both the number of active wallets and the frequency of transactions, indicating that a smaller group is responsible for larger volumes. This suggests effective use of resources while also revealing susceptibility to significant sell-offs.

A robust rally generally depends on widespread engagement from users to maintain liquidity and drive price momentum. The ongoing contraction suggests a reduced market base, potentially increasing volatility during corrections.

Signs Point to a Slowing Trend Throughout the Market

The Chaikin Money Flow (CMF) indicator stands at 0.11, indicating a slight buying pressure, yet it lacks the strong confirmation needed for a complete rebound. At this juncture, the relative strength indicators point towards a neutral-to-bearish outlook, aligning with the typical patterns observed during consolidation phases that frequently set the stage for either a recovery or a downturn.

Chart patterns indicate the emergence of a rising wedge formation, often suggesting a possible downturn when paired with diminishing volume. A decisive drop below $180 could confirm this negative trend, while a rise above $200 might restore positive momentum.

Solana Dip Seen as Buying Opportunity as Fundamentals Remain Strong

Despite the current pullback indicating a need for short-term vigilance, experts contend that the underlying strengths of Solana continue to hold firm over the long haul. The increasing number of developers, the flourishing decentralized finance ecosystem, and the impressive transaction speed all contribute to its status as a prominent Layer-1 blockchain.

This recent pullback could be seen as a chance for investors to capitalize on a dip, provided Solana holds its ground above $170. As consolidation appears imminent ahead of the next significant shift, market participants will closely observe on-chain recovery and price stability for indications of a resurgence in momentum toward $220 and beyond.