Solana Rebounds from $175 as Technical Patterns Align

Solana (SOL) remains in the spotlight for analysts following the emergence of a double-bottom pattern around the $175 mark in October. The recent expansion in Bollinger Bands, a volatility indicator created by the esteemed analyst John Bollinger, indicates that a significant price breakout may be on the horizon.

Bollinger’s analysis indicates that both Solana and Ethereum have formed bullish “W” bottom pattern configurations, typically signaling significant upward trends. Nonetheless, Solana’s configuration seems more established, bolstered by increased volume and tighter compression, suggesting that momentum may be accelerating more rapidly than that of its counterparts.

John Bollinger Highlights Solana’s W Bottom Setup

Bollinger, the pioneer of the Bollinger Band system in the 1980s, noted that Solana’s present formation mirrors a classic W-bottom reversal. This pattern usually emerges when the price revisits and bounces off a robust support level on two occasions, validating accumulation and setting the stage for a potential upward movement.

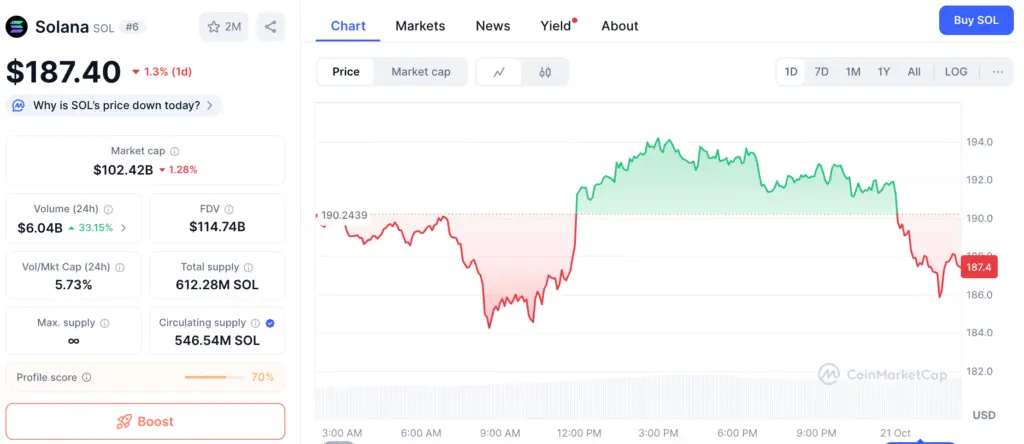

In Solana’s situation, the $175 support level has been examined on two occasions in October, with each instance prompting a bounce back toward the $190–$200 range. Should this double bottom be validated, analytical frameworks indicate a possible upward movement toward the $230–$250 range, which marks the subsequent significant resistance area. The arrangement has elicited parallels to Solana’s resurgence in early 2023, which came before a prolonged surge beyond $250.

Ethereum Mirrors Solana’s Structure but Momentum Differs

Ethereum has demonstrated a comparable double-bottom pattern near $3,700, yet Solana’s response strength seems notably stronger. Experts observe that SOL’s rebound has been marked by a surge in transaction activity and a consistent uptick in engagement within the DeFi and NFT ecosystems, offering tangible network backing for the technical turnaround.

Ethereum is currently navigating a tight range of consolidation in the market. The contrasting momentum between the two assets highlights an increasing sense of assurance among investors regarding Solana’s developing ecosystem and its strengthening on-chain fundamentals as we approach Q4 2025.

Recommended Article: Solana Faces Breakdown Risk as Analysts Warn of 75% Price Drop

Bitcoin’s Range Adds Context to Solana’s Setup

The recent V-shaped correction of Bitcoin, which saw it dip below $104,000 before making a comeback, has contributed to heightened volatility across the market. While BTC continues to fluctuate within the $107,000 to $111,000 range, the overall cryptocurrency market seems to be finding its footing. Experts indicate that a prolonged resurgence of Bitcoin beyond $112,000 may serve as a trigger for Solana’s forthcoming significant rally phase.

Traditionally, Bollinger’s essential “Squeeze” signals have foreshadowed significant market shifts. In mid-2024, the final signal indicated a remarkable surge in Bitcoin, climbing from $55,000 to surpass $100,000 within a span of six months. As Bollinger Bands expand once more across significant altcoins, market participants are gearing up for a new phase of heightened volatility and the possibility of decisive price movements.

Solana Maintains Bullish Structure With Key Support Near $175

Market analyst Sykodelic highlighted that Solana’s long-term framework remains robust, pointing out that the 50-week Simple Moving Average (SMA) has effectively served as dynamic support since early 2024. Every press of this key has historically sparked panic-induced sell-offs, quickly followed by rapid recoveries, suggesting that the broader market framework continues to exhibit bullish tendencies.

Provided that Solana stays above $175, experts anticipate that the pattern will develop into a definitive bullish turnaround. A significant close above $200 may act as the breakout indicator that confirms the double bottom, paving the way for a potential rise toward $230–$250 in the upcoming weeks.

On-Chain Momentum Supports Recovery Outlook

Recent data indicates a resurgence in investments within Solana-based DeFi protocols, alongside an increase in daily active addresses, reflecting a revival in user participation. The Solana network remains at the forefront of transaction processing, achieving remarkable speeds and keeping fees low, elements that bolster its enduring value as institutional interest grows.

Furthermore, the liquidity in Solana derivatives markets has seen an uptick, indicating a rise in speculative interest as traders prepare for a possible breakout. Should Bitcoin find stability and macroeconomic conditions take a turn for the better, Solana may rise to prominence as a leading Layer-1 asset as we approach the last quarter of 2025.

Solana Outlook: Consolidation Before Continuation

Despite ongoing short-term fluctuations, the present technical outlook for Solana appears optimistic. The formation of a double-bottom pattern, alongside the widening of Bollinger Bands and an uptick in on-chain engagement, suggests a strong case for ongoing momentum.

For traders, the critical levels stand at $175, serving as the protective support, and $200, marking the immediate breakout point. Consistent trading above these levels may signal the onset of a new upward trend aimed at $230–$250, with the possibility of reaching $300 if overall market sentiment improves throughout November.