Solana’s Steep Revenue Decline

The Solana blockchain saw a steep revenue decline. This happened in the second quarter of 2025. It fell even as its DeFi ecosystem expanded. A report from Messari details the financial downturn. The app revenue, or “Chain GDP,” fell sharply.

The total application revenue dropped significantly. It was a 44.2% quarter-over-quarter slide. Revenue went from $1 billion to $576.4 million. The downturn was tied to reduced profit-making. This affected key decentralized applications.

Key Contributors to Revenue Slump

PumpFun was a leading contributor to Solana’s revenue. It generated $156.9 million during the three months. However, that figure marked a quarterly decline. The decline was 43.9% from the previous quarter. This reflected weaker memecoin activity.

Other applications also saw a decline. Phantom Wallet posted $53.5 million in revenue. This was down 65.4% from the previous quarter. Photon also slipped significantly. It was down 72.4% to $32.5 million.

Bright Spots in Application Performance

Not all apps saw a decline in revenue. Axiom moved in the opposite direction. Its revenue rose 641.3% in the quarter. It generated $126.6 million for the period. This was a very impressive performance.

Jupiter, a major DeFi aggregator, brought in $66.4 million. While this was a 15.6% drop from Q1. It still shows strong, consistent activity. This shows a mix of results for the ecosystem.

Recommended Article: DeFi Development to Invest Billions into Solana

Solana’s DeFi Sector Shows Resilience

Despite the revenue contraction, the DeFi sector showed resilience. The total value of assets locked climbed. TVL grew by 30.4% quarter-over-quarter. It reached a total of $8.6 billion. This is a very significant growth.

This rise has continued since the report. The sector’s TVL now sits above $11 billion. This solidifies Solana’s position. It is the second largest DeFi network. Ethereum is still the largest network.

Leading Platforms in the DeFi Space

Kamino Finance extended its market dominance. It saw a 33.9% increase in its TVL. The total was $2.1 billion. This gave it a 25.3% market share. This surge followed a new product launch.

Raydium also made a comeback in the quarter. It overtook Jupiter to reclaim second place. Its TVL grew by 53.5% to $1.8 billion. Raydium now commands 21.1% of Solana’s market. Jupiter holds 19.4% market share.

Trading Volume Lags Behind TVL

The growth in TVL did not translate to higher trading. The average daily spot DEX volume fell. It dropped by 45.4% in the second quarter. The total was $2.5 billion. This is a very significant decline.

Messari attributes this to one factor. Fading memecoin momentum is the cause. This had driven record trading activity. This occurred in the first quarter. The slowdown in trading is a major issue.

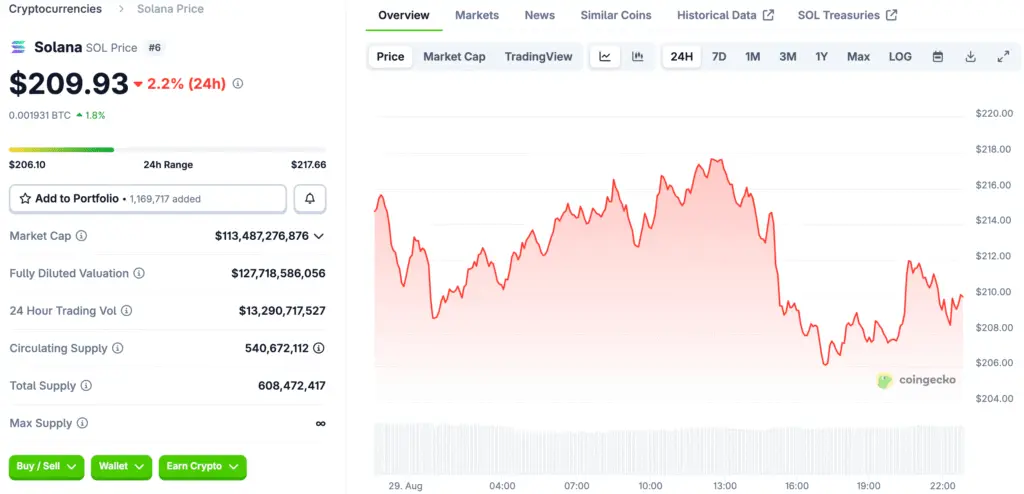

A Look at Solana’s Market Position

Solana has maintained its strong position. It is the second largest DeFi network. This is a very important achievement. It is a sign of a strong foundation. The network is built for the long term.

Despite some short-term challenges, Solana is growing. The DeFi ecosystem is expanding. The network is attracting new users. This paints a very positive future.