Stellar Shows Resilience in the Face of Market Fluctuations

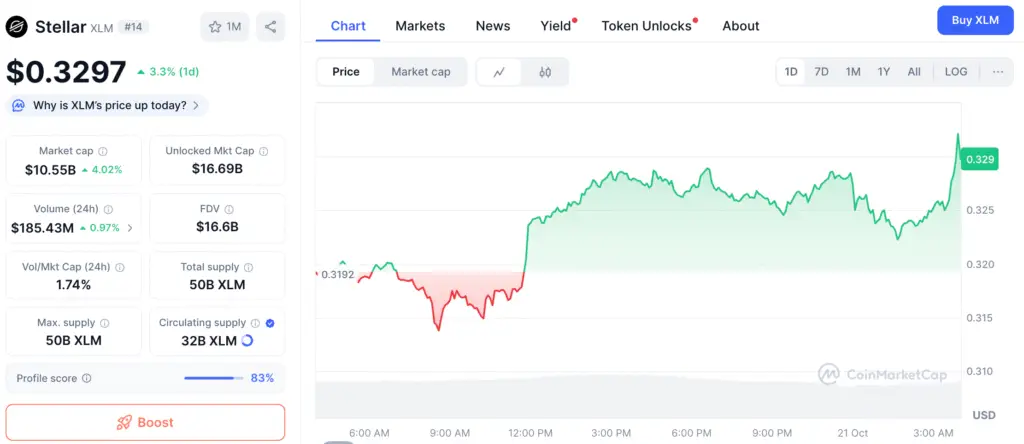

Stellar (XLM) remains in focus among investors, holding steady near $0.34 amid broader volatility in the cryptocurrency market. The token’s ability to preserve this key level underscores investor confidence, even as Bitcoin’s recent 3.2% drop triggered widespread altcoin sell-offs. This resilience highlights Stellar’s growing role in digital payments and remittance technology.

Despite brief intraday dips to $0.30, XLM swiftly rebounded, indicating renewed accumulation. Analysts view this as a sign that long-term holders are defending key technical zones in anticipation of a broader recovery phase.

XLM Price Forecast Indicates Gradual Bullish Shift

Forecasts suggest that Stellar could average around $0.37 by late 2025, representing a potential 33% gain from current levels. Longer-term projections point toward $0.50 by 2027 and $0.82 by 2030 — signaling total growth above 200% if adoption continues.

Technical readings reinforce this outlook. XLM’s RSI currently sits in neutral territory, leaving room for upside momentum without breaching overbought conditions. A decisive move above $0.35 could prompt retests of $0.38 to $0.40, validating the early stages of a fresh bullish trend.

Stellar’s Core Strengths Reinforce Its Long-Term Value

Stellar’s foundation lies in reliability, speed, and low-cost transactions. As financial institutions deepen blockchain exploration, Stellar’s interoperability and remittance efficiency remain compelling advantages. Its mission to connect global payment systems through fast, affordable transfers has continued to attract enterprise adoption.

Strategic partnerships with fintech companies and payment processors have boosted liquidity and strengthened network use. This mix of accessibility and scalability keeps Stellar positioned as a leading utility-driven cryptocurrency with real-world value.

Recommended Article: Stellar Rebounds as Buyers Return and Open Interest Resets

Rising Competition Adds Short-Term Volatility

While Stellar remains strong, new contenders such as Digitap and PayFi platforms like Remittix have introduced innovative models in cross-border payments. Analysts note that increased competition can temporarily influence sentiment, especially as newer tokens attract speculative attention.

Even so, Stellar’s established track record and compliance-friendly infrastructure give it a lasting edge. Its consistent uptime, robust developer ecosystem, and proven reliability distinguish it from less mature alternatives.

Stellar Drops 8% but Retains 213% Annual Gain

According to CoinMarketCap data, XLM currently trades near $0.2992, down 8.14% in the past 24 hours amid market-wide corrections. Despite short-term fluctuations, Stellar still holds an impressive 213% yearly gain, reflecting its long-term recovery strength.

Trading volumes remain steady, suggesting sustained participation from both retail and institutional investors. Experts interpret this as a reaccumulation phase, a healthy consolidation rather than a structural decline.

Technical Outlook: Key Levels to Monitor

Short-term resistance lies at $0.36 and $0.39, with a confirmed breakout above $0.40 potentially clearing the path toward $0.45 and $0.50. On the downside, maintaining support above $0.30 remains critical. A daily close below that level could trigger a retest of $0.28 before any rebound occurs.

Analysts expect prices to stabilize within the $0.31–$0.37 range in the coming weeks, forming a solid base for renewed upward momentum. If overall sentiment strengthens, Stellar could outperform competitors in Q4 2025 as investors pivot toward undervalued payment-focused tokens.

Stellar Positioned for Sustainable Long-Term Growth

Stellar’s steady performance around $0.34 continues to appeal to investors seeking utility over hype. As institutional adoption of blockchain-based payments grows, XLM’s consistent track record positions it as a reliable candidate for gradual, sustainable appreciation.

With forecasts projecting over 100% returns by 2027 and 200% by 2030, Stellar’s outlook remains decisively optimistic. For investors balancing innovation with practical utility, XLM stands out as a cornerstone digital asset in the evolving altcoin market of 2025.