Oobit Targets Brazil for Crypto Payment Revolution

Tether-backed fintech Oobit is launching in Brazil to bridge the gap between crypto ownership and real-world spending. With over 26 million crypto users, Brazil offers fertile ground for adoption. Oobit’s DePay feature enables users to pay merchants directly from self-custody wallets.

Closing the Crypto Utility Gap

While stablecoins have become popular stores of value, most holders rarely spend them. Oobit addresses this issue by allowing instant crypto-to-fiat transactions at point-of-sale. Users can pay merchants seamlessly without relying on exchanges or custodians, reducing friction between holding and spending.

Tether’s Role in Driving Adoption

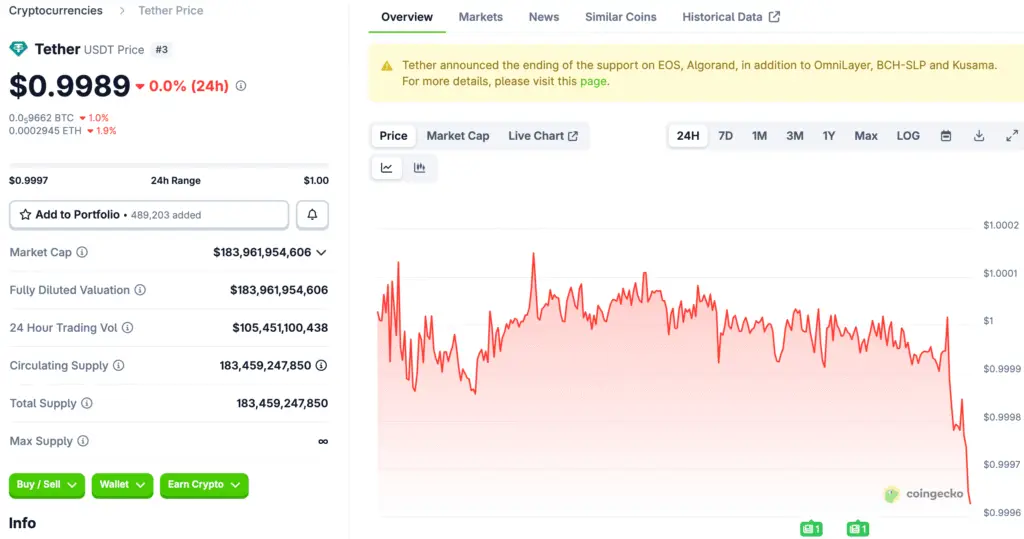

Tether’s USDT dominates Oobit’s transaction volume, accounting for 86% of processed payments. The stablecoin’s reliability and liquidity make it ideal for retail transactions. Backed by Tether’s global infrastructure, Oobit aims to redefine digital currency usability in emerging markets.

Recommended Article: Tether Hits $10 Billion Profit and Climbs to Top Treasury Holder Rank

A Shift in the Payments Landscape

Regulatory changes and pro-crypto sentiment have enabled traditional payment networks to integrate stablecoin rails. Visa, Mastercard, and Stripe now support digital settlements, paving the way for mainstream crypto payments. Oobit leverages this evolution to deliver non-custodial, tap-to-pay functionality similar to Apple Pay.

Self-Custody as a Core Feature

Unlike neobank-style solutions that hold user funds, Oobit preserves user control. Crypto assets remain in self-custody until the moment of payment. This model restores the original crypto ethos—offering both autonomy and convenience without intermediaries.

Brazil’s Digital Payment Ecosystem Fuels Growth

Oobit capitalizes on Brazil’s advanced payments ecosystem, where Pix has normalized digital transactions. The country’s familiarity with contactless systems makes it a prime testing ground for crypto payments. Beta data shows that 92% of Oobit’s volume comes from stablecoins, signaling real-world utility.

Bridging Crypto and Everyday Spending

With former N26 Brazil CEO Eduardo Prota leading LATAM expansion, Oobit is betting on consumer readiness. Its model mirrors early neobank growth phases, using existing financial rails to deliver better user experiences. The result is a frictionless bridge between decentralized finance and retail transactions.

Outlook: Brazil as Blueprint for Global Adoption

If Oobit succeeds in Brazil, it could inspire similar rollouts worldwide. By combining stablecoin reliability with self-custody flexibility, Oobit offers a scalable framework for mass crypto adoption. Its partnership with Tether positions it at the center of the next phase in digital payments innovation.