TRX Holds Steady Despite Market Decline

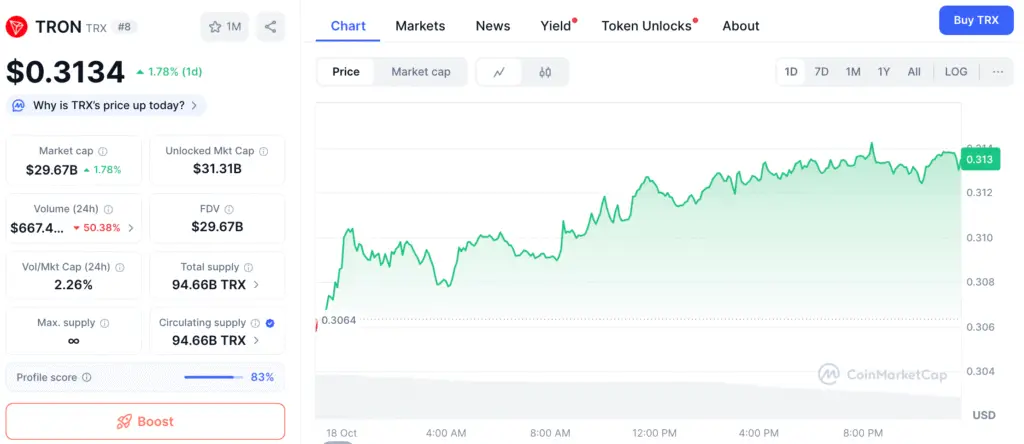

TRON (TRX) showcases notable strength in the face of wider market challenges, maintaining its position above the 250-day moving average close to the Mayer Multiple zone of 1.0. As of the latest update, TRX is trading at approximately $0.3119, showing a daily decline of 1.65% while still holding essential long-term structural support.

TRX boasts a market capitalization of $29.52 billion, with a 24-hour trading volume approaching $2.99 billion, securing a market dominance of 0.82%. Experts observe that the asset’s capacity to remain stable in this range suggests consistent accumulation, paving the way for a possible upward movement in the coming weeks.

TRX Accumulation Strengthens as 250-Day Moving Average Acts as Support

Experts in market analysis emphasize the significance of the 250-day moving average as a crucial benchmark that has historically marked points of trend reversals and the beginnings of bullish markets. Analyst Crypto Patel highlighted that TRX’s recovery from this level indicates fresh on-chain accumulation and a rise in investor confidence.

Historically, TRON has experienced significant upward movements following periods of consolidation within the Mayer Multiple zone. This resurgence in stability indicates that the network is gaining momentum for a prolonged upward trajectory, bolstered by steady purchasing behavior and robust foundational elements within decentralized finance and transaction statistics.

Wedge Pattern Formation Hints at Bullish Reversal

Chart analysis indicates that TRX’s recent pullback to the 0.382 Fibonacci level aligns with the formation of a bullish wedge pattern, which frequently signals an impending breakout. This trend indicates a tightening price movement, showcasing diminished volatility ahead of a significant upward shift.

The developing Potential Reversal Zone (PRZ) is in close alignment with the $0.30 support, which bolsters the argument for a bullish outlook. Experts indicate that should TRX hold its current position and experience an increase in volume, a surge propelled by momentum towards $0.35 and $0.42 may be imminent, signaling the beginning of a new upward trend.

Recommended Article: TRON Price Prediction 2025 Points to Breakout Near $0.40 Mark

TRON Ecosystem Demonstrates Growth in On-Chain Engagement

In addition to price charts, TRON’s on-chain metrics continue to demonstrate strength. The ecosystem is evolving, showcasing an array of new tokens and decentralized finance protocols that capitalize on its efficient and cost-effective framework. A token that is gaining significant interest is ARES, presently valued at $0.0106.

Analysts suggest it has the potential to yield returns ranging from 3x to 40x, provided market conditions are favourable. The growing momentum of ecosystem projects highlights the robustness of TRON’s network, prompting both institutional and retail investors to keep their stakes as part of a diversified blockchain strategy.

Technical Analysis Indicates Positive Momentum Ahead

The MACD indicator for TRX indicates a convergence, hinting that the bearish momentum is diminishing. Meanwhile, the RSI hovers around neutral, suggesting potential for upward movement. The $0.35 level has emerged as immediate resistance, while $0.42 represents the next significant target for upward movement should buying momentum increase.

On the other hand, not maintaining the $0.30 support level could hinder the rally, possibly leading to a retreat toward $0.28 before buyers regain dominance. Nonetheless, considering TRX’s strong standing above its long-term moving average, the likelihood presently leans towards a scenario of upward breakout.

TRX Set for a New Upward Trend

With the buildup intensifying and fluctuations diminishing, TRX seems ready for a significant turnaround. Historical data indicates that comparable trends have often led to 30%–40% rallies within weeks following a clear shift towards bullish momentum.

If TRX manages to break through the resistance at approximately $0.35, the subsequent movement may reach up to $0.42, indicating a shift from a phase of consolidation to one of growth. Amid robust ecosystem expansion and a resurgence of investor confidence, TRON’s long-term positive trajectory appears firmly established as it prepares for what may become one of the most eagerly awaited breakouts of Q4.