XRP Faces Uncertainty After 7% Weekly Decline

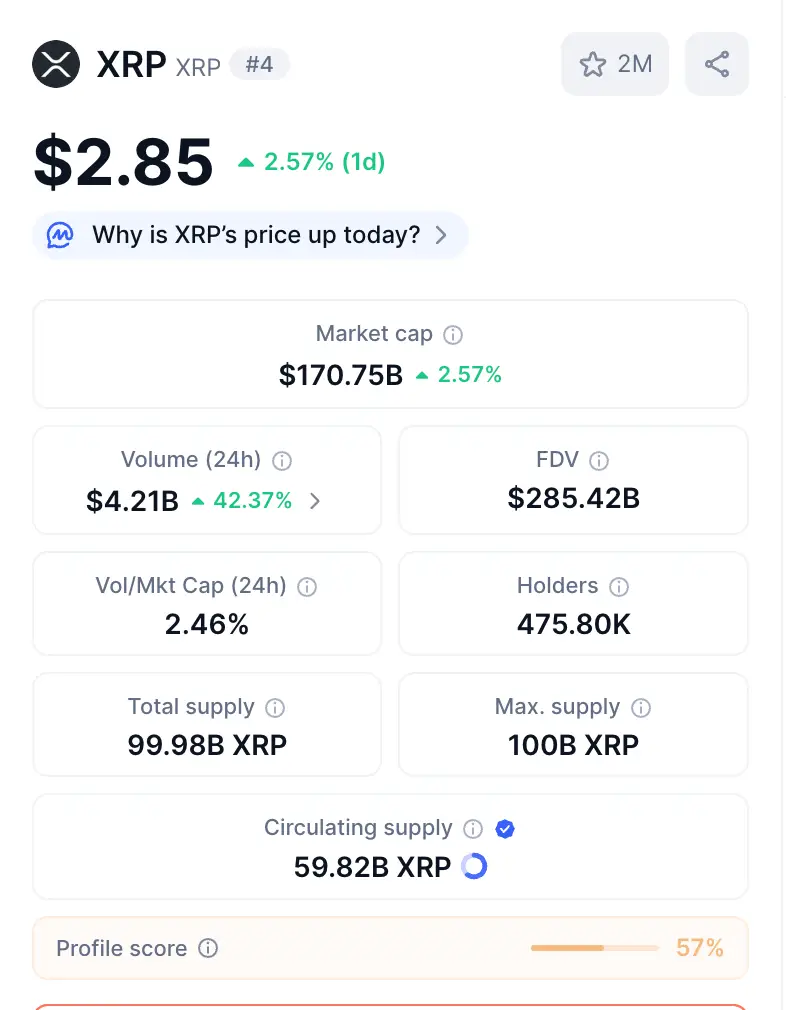

XRP has had a difficult stretch, falling from $3 to a multi-week low of $2.70. Bulls stepped in at this crucial support level, preventing a deeper slide. However, market sentiment remains fragile, and traders are watching closely for the next decisive move.

With September nearly over, XRP sits between key technical zones. Whether it rebounds or continues its downtrend will depend on holding the $2.70 support and reclaiming lost resistance levels.

September’s Momentum Reverses After Fed Rate Cut

Earlier this month, XRP briefly surged to $3.20 following the U.S. Federal Reserve’s first 2025 interest rate cut. This bullish momentum proved short-lived, as the token failed to maintain its gains and slipped back toward $3 support.

Once $3 cracked, selling pressure accelerated, sending XRP down to $2.70. Analysts now view this level as a critical pivot point that could shape the token’s short-term trajectory.

ChatGPT Issues Cautious “Strong Sell” Signal

When asked about the upcoming week, OpenAI’s ChatGPT flagged bearish indicators, labeling XRP a “strong sell” across multiple trading platforms, including Investing.com.

This caution stems from bearish technical setups, including descending patterns and weakening volume. According to ChatGPT’s analysis, XRP may face additional pressure if it fails to rebound quickly.

Recommended Article: Why XRP Price Is Dropping as Bitcoin Forecasts Gain Attention

Grok Highlights $2.70 as Key Bullish Line

Grok’s outlook aligned with market analysts, emphasizing that $2.70 remains the level to watch. As long as XRP holds above this threshold, bullish sentiment may remain intact.

However, Grok warned that reclaiming $2.83 resistance quickly is essential for any meaningful upside. Without that recovery, XRP’s chances of retesting $3 diminish considerably in the short term.

Gemini Warns of Weak Volume and Resistance Risks

Gemini focused on trading activity, noting that current volume levels are too weak to support a major upward move. This lack of participation raises doubts about a breakout above $3.

The AI cautioned that, without a surge in demand, XRP is unlikely to challenge critical resistance zones. Sideways or mildly bearish price action seems more probable in this scenario.

Consolidation Phase Expected After Volatile Trading

Despite different emphases, all three AIs agreed on one key point: after such a volatile week, XRP is likely to consolidate. They foresee the price stabilizing between $2.70 and $2.90 over the next seven days.

This sideways phase could serve as a cooling-off period, allowing traders to reassess positions. It may also set the stage for a larger move later if volume and momentum return.

Bulls Watch Support Closely Amid Mixed Signals

For bullish traders, maintaining the $2.70 floor is crucial. A breakdown below this level could trigger another wave of selling, pushing XRP toward deeper supports. Conversely, defending it could pave the way for a rebound toward $2.90–$3.00.

With mixed signals from AI analyses and lingering market volatility, traders should expect a week of cautious consolidation rather than dramatic breakouts or collapses.