Pepe Falls 7% as Whale Profit-Taking Sparks Selling Pressure Across Memecoin Market

Profit-taking by significant holders continues to influence the wider memecoin market as major investors liquidate their positions to realize their gains. Recent data from Nansen and Bubblemaps reveals significant address clusters transferring PEPE holdings to exchanges, suggesting a deliberate liquidation strategy by prominent wallets.

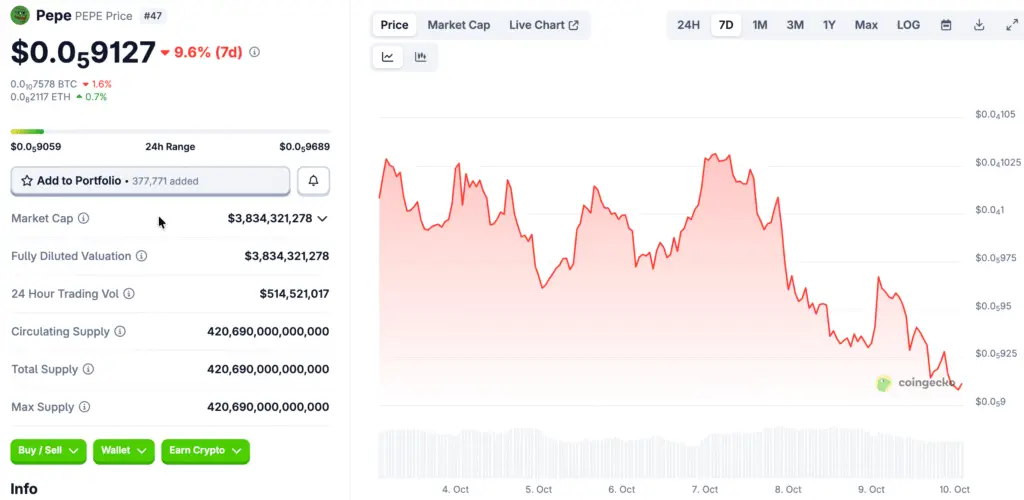

This trend shows that the risks of market manipulation remain as large investors take advantage of high prices to realize gains. As PEPE experiences a decline of approximately 7% due to significant selling pressure, the mood among investors turns negative, and smaller traders find themselves more vulnerable to fluctuations and liquidity challenges.

Investor Panic Rises As Memecoins Face Price Pressure

Retail participants frequently respond with heightened emotions to sudden price fluctuations in speculative areas such as memecoins, intensifying short-term volatility. Lack of transparent communication from PEPE developers increases uncertainty and fuels panic-driven sell-offs across trading platforms.

This unpredictable landscape highlights how a lack of transparency in challenging times can undermine trust within the community. With anxiety permeating social media, there is a shift in capital towards more stable assets, putting memecoin valuations at risk of additional downward adjustments.

Pepe Struggles to Hold Support as Selling Dominates and Volatility Intensifies

From a technical standpoint, PEPE faces challenges in sustaining support following a series of daily declines surpassing 7%. The heightened activity during downturns indicates that selling is currently prevailing in the order flow.

Experts note ongoing attempts to breach critical levels around $0.0000093, indicating a possible decline if selling continues. Traders are exercising caution, highlighting the importance of disciplined stop loss placement and minimizing leverage exposure in light of increased volatility.

Recommended Article: PEPE Price Drops 7% As Whales And Politics Pressure Market

Compliance Issues Surge Following Allegations of Whale Manipulation

Regulators are keeping a close eye on memecoin markets as worries about manipulation grow, particularly after significant coordinated transfers from concentrated wallets. The MiCA framework established by the European Union highlights the importance of transparency and accountability for those issuing tokens and operating exchanges.

Developers are now tasked with the ethical and practical duty to protect investors by enhancing communication and governance practices. Neglecting to tackle transparency gaps could lead to increased examination by international regulators aiming to safeguard retail participants against systemic manipulation threats.

Developers Encouraged To Enhance Community Engagement

The memecoin landscape flourishes through active community involvement, highlighting the importance of transparent communication during periods of heightened volatility. Experts highlight that regular communication from project teams can help maintain market confidence and lessen impulsive selling tendencies.

Developers that choose to stay quiet in times of turmoil may jeopardize their brand’s credibility and the trust of long-term holders. Engaging in proactive outreach, providing regular status updates, and implementing verified security measures can effectively reduce uncertainty and bolster ongoing investor confidence.

Market Recovery Dependent On Sentiment And Utility

Historical trends indicate that the recovery after whale-driven corrections is significantly influenced by the stabilization of sentiment and the expansion of token utility. Memecoins that possess real ecosystems or are integrated with exchanges tend to recover more swiftly after the initial wave of speculation diminishes.

The long-term success of PEPE could depend on effective community collaboration, the revival of liquidity, and clear leadership within the project. Creating steady involvement in the network may draw in new investments and restore confidence among wary traders and institutional watchers.

Pepe Traders Urged to Use Risk Management and Diversification in Volatile Markets

Traders should navigate the memecoin sector by implementing rigorous risk management strategies that prioritize diversification and disciplined position sizing. Reducing exposure to individual assets helps mitigate the risks associated with significant whale activity and unexpected liquidity shortages.

Staying informed about macroeconomic factors, exchange flows, and regulatory updates offers a strategic edge in managing unpredictable environments. In unpredictable sectors such as PEPE, safeguarding capital is just as essential as generating profits.