Mutuum Finance Presale Success Explained

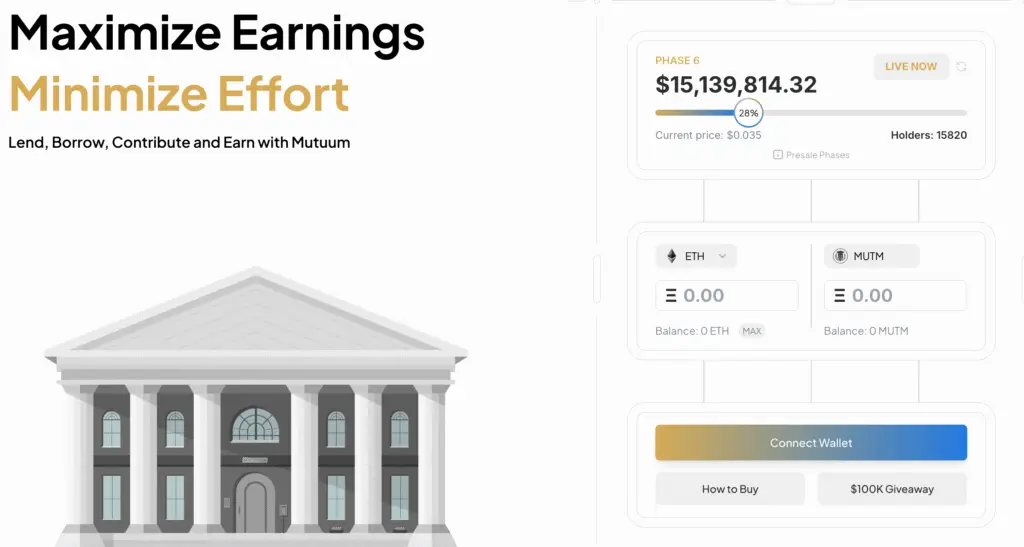

The Mutuum Finance presale has shown significant investor confidence. It is currently in its sixth phase with a price of $0.035 per token. The project has successfully raised over $15 million in capital from thousands of early supporters. Mutuum has now amassed more than 15,720 investors for the project. The price is set to increase to $0.04 in the next presale phase. This represents a 14.29% jump in the token’s value. This early success indicates strong market demand.

The project’s strong presale performance is a key indicator. It showcases how investors are actively seeking new opportunities. They are moving into projects with strong fundamentals. These investors are looking beyond established networks like Cardano. The rapid growth of Mutuum’s investor base is a clear sign. It shows a growing preference for dynamic DeFi platforms.

Cardano’s Market Position in 2025

Cardano continues to hold a stable market presence in 2025. The ADA token is trading at around $0.84, with some minor price fluctuations. Analysts believe its value could rise to $1.20 by the end of the year. This growth is expected due to ongoing network developments. Still, these predictions suggest only moderate growth for Cardano.

The ADA network remains a key player in the crypto space. Its continued presence is a testament to its strong foundation. However, its growth expectations are tempered. Investors seeking substantial returns may look elsewhere. Projects with higher growth potential are now attracting more attention.

The Advantage of Mutuum’s Lending Protocol

Mutuum Finance offers a revolutionary lending protocol. It is a non-custodial decentralized lending platform. This means that asset owners have complete control. Lenders can earn passive income from their holdings. Borrowers can get money by collateralizing various assets. This provides a truly decentralized financial experience.

The system features dynamic interest rate adjustments. These rates are systematically adjusted to ensure sustainability. Mutuum offers both Peer-to-Contract (P2C) and Peer-to-Peer (P2P) lending models. The P2C model is managed by smart contracts. This provides secured yields for lenders. The P2P model eliminates middlemen for more direct transactions.

Recommended Article: Mutuum Finance Presale Touts 10x Growth in 2025

Security and Audits for Investor Trust

Security is a top priority for Mutuum Finance. The project has been fully audited and verified by CertiK. This gives investors a high level of confidence in the platform. The project has a very high trust score from the auditor. This shows its commitment to user security.

Mutuum has also launched an official bug bounty program. It is offering a $50,000 USDT reward pool. The program aims to find and fix vulnerabilities. This demonstrates their dedication to maintaining security. All types of vulnerabilities are considered in this program. This proactive approach builds trust with the investor community.

Mutuum’s Tokenomics and Incentives

Mutuum Finance has implemented strong tokenomics to attract users. They recently announced a huge token giveaway. A total of $100,000 worth of MUTM tokens will be given away. Ten participants will each receive $10,000 in tokens. This incentivizes participation and new investor onboarding.

The project is also developing an overcollateralized stablecoin. This stablecoin will be pegged to the USD. It will be built on the Ethereum blockchain. This adds another layer of utility to the ecosystem. It provides a stable financial tool within the platform. This helps to further enhance the project’s value.

Comparing Future Growth Potential

Investors are now looking for the next big thing in crypto. While Cardano is a stable long-term hold, its explosive growth phase may be over. Many investors are now looking to a more innovative project. They want a project that offers higher potential returns. Mutuum’s current presale price provides a great entry point.

Mutuum Finance is in a prime position for significant growth. The project is still in its early stages. It has a lot of room to appreciate in value. Its unique lending models and strong security are appealing. This makes it a compelling investment opportunity for 2025. It is set to be a major player in the DeFi space.

Choosing Between MUTM and ADA

The choice between Mutuum Finance and Cardano depends on investment goals. For conservative investors, Cardano offers a reliable and steady option. It is a well-established network with a large community. For those seeking higher risk for higher potential rewards, Mutuum is an attractive choice.

Mutuum Finance offers significant upside during the altcoin season. Its low presale price and robust features are appealing. Investors can enter the market early on. This allows them to benefit from potential future gains. The project’s security and dual lending models are very promising.