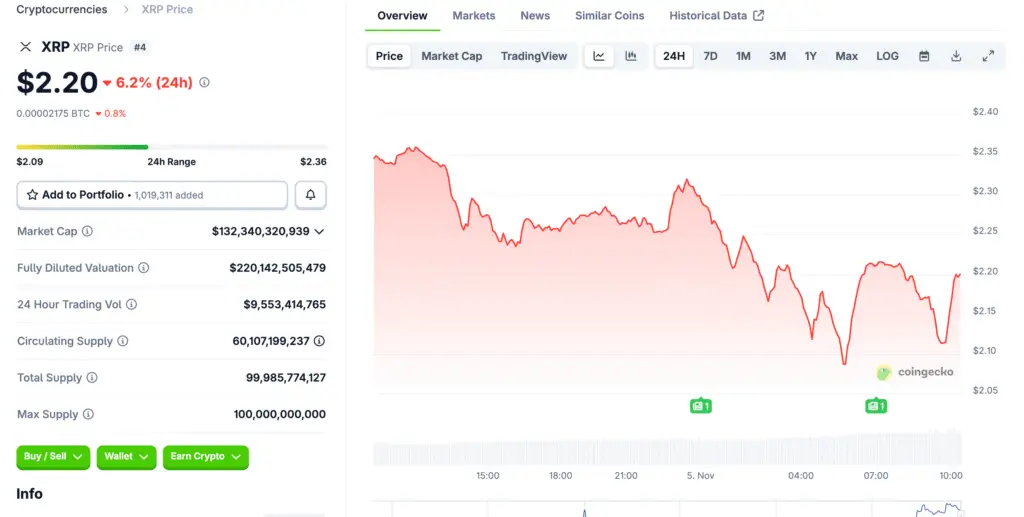

XRP Struggles Under Prolonged Bearish Pressure

XRP continues to face downward pressure, extending its recent losing streak amid a sluggish broader crypto market. The altcoin has dropped nearly 10% in the past few days, leaving traders cautious about short-term prospects. Despite this weakness, market data suggest renewed participation from new investors.

Unrealized Profits Hit 12-Month Lows

Glassnode data reveal that unrealized profits among XRP holders have plunged to their lowest level in a year. This indicates that most investors now hold the asset at or below their cost basis. Historically, such conditions often lead to panic selling as confidence erodes during volatile market periods.

New Investors Step In Despite Weak Sentiment

Amid widespread caution, an influx of new addresses accumulating XRP has emerged. Lower prices appear to be attracting opportunistic buyers seeking discounted entry points. These inflows may help absorb selling pressure and stabilize price action in the short term.

Recommended Article: Ripple Swell 2025 Poised To Redefine XRP’s Market Future

Network Activity Suggests Renewed Interest

At their peak, over 12,000 new wallets began accumulating XRP, injecting fresh liquidity into the ecosystem. This expansion signals potential investor confidence in XRP’s long-term viability. Analysts suggest that continued growth in active addresses could precede a recovery phase.

Technical Indicators Highlight Key Support Zone

XRP is currently trading around $2.26, hovering near its critical support level at $2.27. A successful defense of this area could enable sideways trading and short-term rebounds toward $2.35 or $2.45. Failure to hold support, however, may push prices lower to $2.13.

Historical Trends Indicate Rebound Potential

Periods of minimal profitability followed by new wallet creation have historically led to bullish reversals. If the pattern holds, XRP could see stabilization before a gradual climb through November. Long-term investors may interpret current conditions as an early accumulation window.

Market Sentiment Remains Mixed

Traders remain divided over XRP’s near-term direction. Some anticipate further losses amid broader weakness, while others believe the asset is forming a base for recovery. The interplay between selling pressure and new investor demand will likely dictate short-term momentum.

Outlook: Recovery Hopes Build Amid Fresh Accumulation

Despite a challenging environment, XRP’s growing network activity offers a glimmer of optimism. If support levels hold and new participants continue entering the market, a rebound could unfold later this month. Analysts emphasize that while volatility persists, XRP’s long-term fundamentals remain intact.