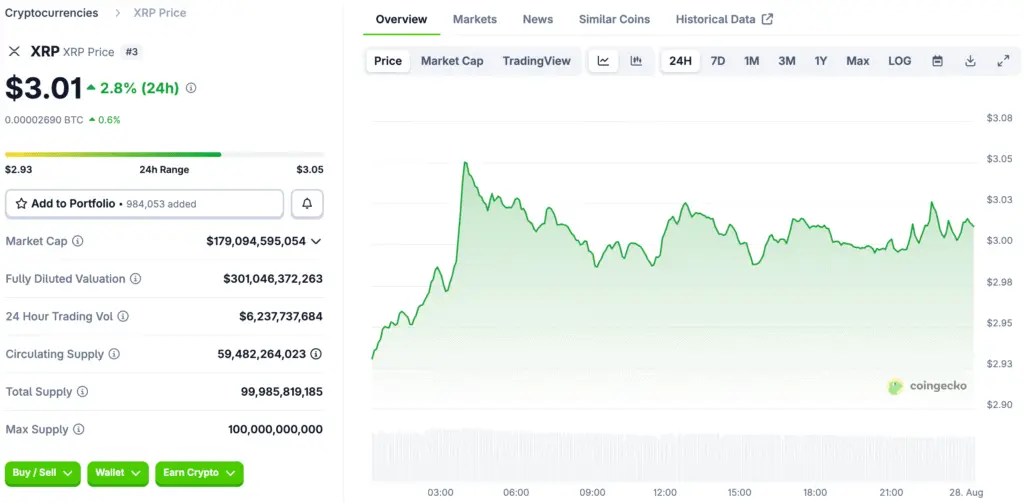

XRP Leads the Charge in a Broad Market Rebound

After a period of steep decline, the cryptocurrency market has shown a strong and decisive rebound, with XRP leading the charge. The altcoin sector, in particular, has rallied sharply as traders took advantage of lower prices to re-enter the market. Over a 24-hour period, XRP surged by an impressive 6%, outpacing other major cryptocurrencies and topping the list of market gainers.

The recovery was broad, with Solana and Dogecoin each climbing by about 4.5%, and Ethereum adding a solid 5% over the same period. This synchronized upward movement suggests a renewed sense of confidence among investors. The quick recovery from the recent sell-off indicates that the market is in a healthy accumulation phase, where dips are seen as buying opportunities rather than signs of a market breakdown.

The Role of Rising CME Crypto Futures Open Interest

The recent market rebound is not just a result of retail investor activity; it is also being fueled by a significant increase in institutional participation. A major indicator of this growing interest is the performance of the CME Group’s crypto futures suite. The CME announced a major milestone: its crypto futures surpassed $30 billion in notional open interest for the first time. This figure is a powerful testament to the increasing engagement of large-scale financial players in the cryptocurrency derivatives market.

The futures market is often seen as a barometer for institutional demand, and reaching such a significant milestone suggests that big money is becoming more comfortable with crypto as a legitimate asset class. This institutional flow provides a new layer of stability and liquidity to the market, which can help to temper the kind of dramatic volatility often seen in the past.

XRP’s Record-Breaking Performance in Futures

Within the broader CME futures data, XRP’s performance stands out. Both Solana and XRP futures each crossed the $1 billion mark in open interest, but XRP’s achievement was particularly noteworthy. The XRP contract became the fastest to reach the $1 billion level, doing so in just over three months. This record-breaking performance is a clear signal of the immense interest and demand for XRP among institutional investors.

This milestone is also being seen by analysts as a compelling argument for the potential of a spot XRP ETF. Experts believe that the futures market data provides strong evidence of a robust and mature ecosystem for XRP, which could make a spot ETF a highly attractive and successful product for both institutional and retail investors.

The Broader Altcoin Rally and Bitcoin’s Position

While XRP led the rally, the upward movement was a collective effort across the altcoin market. Solana and Dogecoin showed strong gains, and Ethereum added a solid 5% to its value. This broad-based rally suggests that investor appetite for higher-risk assets is returning. In contrast, Bitcoin, while still gaining, lagged behind the altcoins, adding only about 1% and crossing back over the $111,000 mark.

This is a common dynamic in bull markets, where Bitcoin tends to stabilize after a major run-up, and capital then flows into altcoins, which are often seen as having greater upside potential. This altcoin season is a healthy sign for the overall market, indicating that confidence is not just limited to the top cryptocurrency but is spreading throughout the entire ecosystem.

Analyzing Market Sentiment and Potential Risks

Despite the recent rally, some analysts are warning that market sentiment may be running too hot. Blockchain analytics firm Santiment has cautioned that optimism around a potential Federal Reserve rate cut in September has reached levels that often precede corrections. The firm’s report noted a significant spike in online chatter about the Fed’s decision, suggesting that traders may be getting ahead of themselves.

This kind of social data provides a valuable counterpoint to the on-chain metrics. While the market’s technicals and institutional inflows are strong, a swift correction could occur if expectations for monetary easing fail to materialize. This highlights the importance of staying informed and not getting carried away by short-term euphoria.

The PCE Inflation Data as a Key Market Indicator

Looking ahead, traders are now keenly focused on Friday’s release of the Personal Consumption Expenditures (PCE) Price Index. The PCE is a key inflation gauge that the Federal Reserve watches closely when making its decisions on interest rates. The data from this report will be a crucial signal for the Fed’s next move, and any deviation from market expectations could have a significant impact on crypto prices.

If the PCE data shows that inflation is cooling, it could reinforce the bullish sentiment and increase the likelihood of a rate cut. Conversely, a hotter-than-expected PCE report could lead to a sudden market correction as investors recalibrate their expectations for a September rate cut.

XRP Leads a Crypto Rally

The recent crypto rally, led by XRP, is a strong indicator of renewed market confidence. This rebound is not a fleeting trend but is being fueled by a significant and verifiable increase in institutional participation, as evidenced by the record-breaking open interest in CME crypto futures. XRP’s exceptional performance in the futures market, in particular, suggests that it is becoming a favorite among institutional investors, with many now anticipating the launch of a spot ETF.

While caution is warranted due to overheated market sentiment and the uncertainty surrounding the upcoming PCE inflation data, the overall outlook remains positive. The collective actions of both institutional and retail investors point to a market that is healthy, resilient, and poised for future growth.

Read More: XRP Price Rally After Historic Court Victory