XRP Breaks Key Levels and Sparks Bullish Market Sentiment

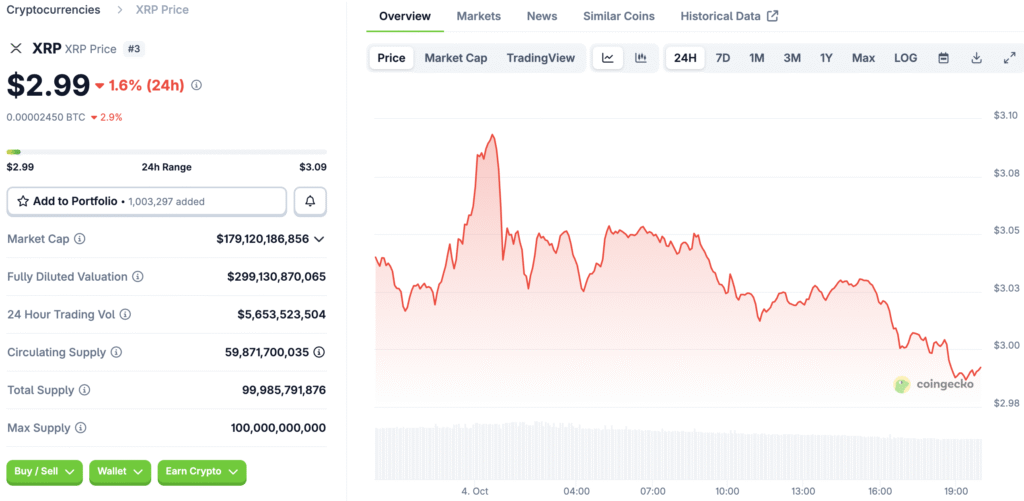

The recent surge of XRP past $2.99 has rekindled optimism in the market, indicating a potential transition from bearish patterns to a period of sustained bullish activity. The significant action validates a descending wedge breakout pattern, creating robust technical support and setting upside targets around $3.50 and $4.30.

Traders view this breakout as a crucial reversal signal, observing the resurgence of optimism within XRP’s trading environment. The rally demonstrates a shift in sentiment among investors who had previously approached XRP’s price movements with caution and skepticism.

Regulatory Developments Strengthen Investor Confidence in XRP

The clarity in regulations has significantly contributed to the momentum of XRP, especially after Ripple’s settlement with the SEC. The decision clarified longstanding ambiguities regarding XRP’s legal standing, opening the door for greater involvement from institutional players.

Enhanced regulations boost market confidence, drawing in liquidity via ETFs, regulated exchanges, and futures listings that create stable trading conditions. Analysts are now incorporating regulatory updates into their technical analysis, recognizing their ability to significantly influence market sentiment and price structures.

Institutional Participation Adds Stability and Deeper Liquidity

The interest from institutions has emerged as a significant stabilizing influence on XRP’s price, distinguishing it from smaller, more erratic cryptocurrencies. The function of XRP as a financial bridge asset fosters authentic transactional demand, facilitated by collaborations with banks and international payment platforms.

Recent CME futures data indicates a notable increase in open interest, highlighting significant inflows from institutional investors pursuing regulated exposure. A recent inflow of $37 million highlighted the increasing confidence in XRP’s strength in light of positive legal and market circumstances.

Recommended Article: XRP Whale Surge Fuels Speculation Of Breakout Beyond $4

XRP Technology Enhances Fintech Payment Infrastructure

The advantages of XRP in terms of speed and cost render it appealing for fintech startups in search of dependable cryptocurrency payment and settlement options. The system boasts a transaction capacity of 1,500 transactions per second, accompanied by minimal fees, facilitating scalable and cost-effective cross-border payments.

The XRP Ledger seamlessly incorporates DeFi elements into its financial framework, enabling fintech companies to create cutting-edge hybrid solutions. Ripple’s advanced custody and tokenization solutions streamline integration, enabling startups to concentrate on expansion without the weight of compliance challenges.

XRP Payroll Integration Attracts Attention from Global SMEs

The steady price movement of XRP, coupled with growing regulatory acceptance, is driving its adoption in payroll systems among small and medium enterprises. The rapidity and fluidity of this system facilitate effortless salary transfers across borders, especially for global teams functioning in various legal frameworks.

Platforms such as Deel and Bitwage are already facilitating XRP payroll, indicating an increasing acceptance of cryptocurrency for compensation in the workplace. These advancements indicate a wider trend in the business landscape, focusing on quicker, more cost-effective, and adaptable payroll solutions that utilize blockchain technology.

Market Comparisons Showcase XRP’s Edge in Institutional Settings

XRP stands out with clear advantages in regulation and utility when compared to smaller tokens like PEPE or meme-driven assets such as Bonk. Support from institutions guarantees more consistent liquidity movements, and advancements in technology enable XRP to efficiently drive practical financial applications.

This blend establishes XRP as a link between speculative cryptocurrency and conventional finance, enhancing its long-term story. As institutions enhance their involvement, XRP could keep surpassing coins driven solely by hype, solidifying its position in the overall market development.

XRP Breakout Aligns With Technicals and Regulations for Market Growth

The recent breakout of XRP is in harmony with technical indicators, regulatory developments, and institutional involvement, all of which collectively pave the way for potential market growth in the upcoming months. Experts are closely monitoring if the price can sustain its momentum towards the targets of $3.50 and $4.30 as liquidity conditions show signs of improvement.

Should stable inflows and clear regulations continue, XRP may firmly establish its leadership role in the forthcoming market cycle. The combination of these elements positions XRP as a highly scrutinized asset as we approach Q4 2025.