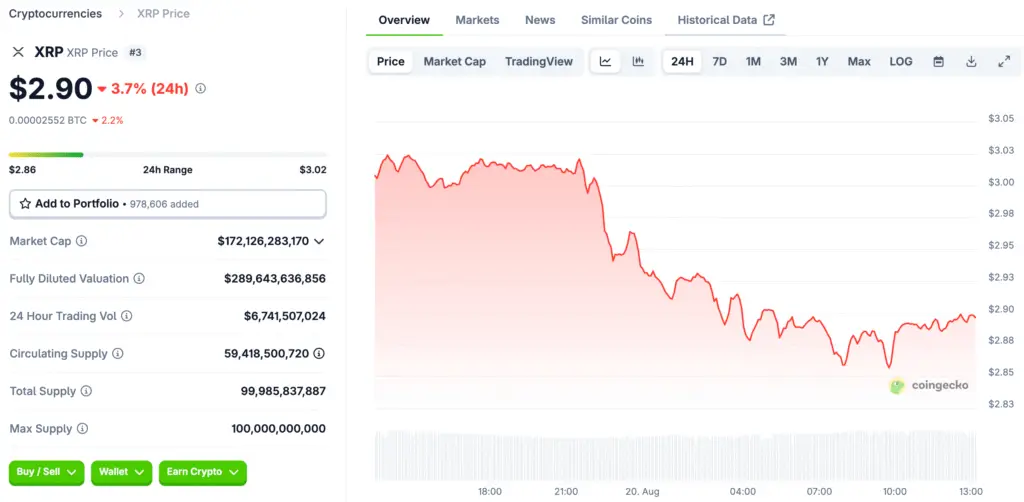

XRP Consolidates Around $3 Amid Market Uncertainty

XRP, Ripple’s native token, is holding close to $3.01 after repeatedly testing the critical support zone of $2.95–$3.00. Earlier in July, the asset surged to $3.65, only to retreat as selling pressure intensified. Since then, XRP has traded in a tight band between $2.90 and $3.20, with analysts identifying this as a pivotal range for the next major move.

A breakout above $3.20 could invite renewed bullish momentum, but failure to hold $2.95 risks a pullback toward $2.72. This consolidation reflects the broader crypto market’s cautious stance as investors weigh regulatory decisions and macroeconomic signals.

Institutional Adoption Strengthens Ripple’s Global Reach

Despite near-term stagnation, Ripple’s On-Demand Liquidity (ODL) network continues to gain traction among major financial institutions. By eliminating the need for costly nostro accounts, ODL allows faster and cheaper cross-border payments using XRP. Global partners such as Santander, SBI Holdings, and MoneyGram are already exploring or integrating the system.

Importantly, regulators in the U.S., U.K., and EU have clarified that secondary XRP trading is not a securities transaction. This clarity has opened doors for institutional desks that were once hesitant, making the upcoming ETF decision even more critical for wider adoption.

Ripple ETF Decision Could Unlock Billions in Liquidity

One of the strongest catalysts on the horizon for XRP is the pending decision on a spot ETF. Several issuers, including Greyscale and 21Shares, have filed applications, with the U.S. SEC expected to deliver its verdict in October. Approval would represent a significant milestone, potentially attracting inflows from both retail investors and institutional funds.

Analysts estimate that even a modest allocation from retirement accounts, such as 401(k) plans, could translate into billions in new liquidity. Following the recent approval of Solana’s ETF, optimism is growing that Ripple’s case may receive similar treatment, setting the stage for a major market shift.

Technical Landscape Shows Heavy Resistance Ahead

From a technical standpoint, XRP faces dense resistance zones. The 20-day EMA at $3.05 and the 50-day EMA at $3.10 form the first barriers, while the 100- and 200-day EMAs cluster near $3.11–$3.14. This creates a supply wall that XRP must clear before advancing higher.

Indicators such as the RSI remain stuck in neutral territory, hovering in the mid-40s, while the Supertrend has flipped bearish near $3.12. Exchange flows add to the cautious picture: on August 19 alone, net outflows of $3.45 million suggested selling pressure may continue. Unless bulls regain control, XRP risks sliding toward lower demand levels.

Futures Market Data Signals Fragile Sentiment

Derivatives trading adds another layer of complexity. Futures open interest for XRP is currently around $7.82 billion, marking a slight decline in the last 24 hours. Options open interest has fallen 13%, although daily volumes spiked 140%, indicating heightened hedging activity rather than outright bullish bets.

Over $6 million in long liquidations within a single day shows how speculative traders are being punished for anticipating sharp breakouts. While retail accounts remain overwhelmingly long, institutional desks appear more balanced, signalling caution and preparing for volatility instead of chasing aggressive upside targets.

Macro and Regulatory Forces Weigh on XRP’s Next Move

Beyond charts and derivatives, broader macroeconomic conditions continue to shape XRP’s outlook. A stronger-than-expected U.S. Producer Price Index (PPI) report in August dampened expectations for near-term Federal Reserve rate cuts, sparking a crypto-wide selloff. Although Ripple’s fundamentals are less sensitive to monetary policy compared to Bitcoin or Ethereum, XRP still moves in tandem with overall risk sentiment.

Meanwhile, the SEC’s decision to delay Ripple’s ETF ruling until October has put a temporary cap on investor enthusiasm. Still, political momentum for crypto remains strong, with U.S. leaders openly discussing retirement account access to digital assets.

XRP’s Asymmetric Potential for Investors

Analyst projections for XRP vary sharply. In the short term, a breakout above $3.20 could pave the way toward $3.49 in September, while a breakdown below $2.95 may lead to $2.60 or even $2.00. In the medium term, bullish forecasts envision $4.80–$5.50 by late 2025, particularly if ETF approval coincides with expanding ODL usage.

Long-term projections are even more ambitious, with some models speculating on $10 targets by 2030 and ultra-long-term scenarios pointing toward $160+ by 2040. While such extreme forecasts require uninterrupted growth, they highlight the asymmetric potential that XRP represents for investors seeking exposure to digital payments infrastructure.

Read More: Is XRP at a Crossroads? The Fight for $3