ETF Inflows Could Ignite Major Price Momentum for XRP

XRP has captured attention as ETF inflow forecasts ignite optimistic speculation among both institutional and retail investors. Experts indicate that the forthcoming ETF launches may unleash extraordinary demand, with projections suggesting billions in initial inflows.

Steve McClurg from Canary Capital anticipates that more than $10 billion will flow into XRP ETFs in the initial month, which could drive market capitalization beyond $700 billion. This influx of liquidity would greatly enhance buying pressure, paving the way for a substantial rally towards the $12 mark.

Historical Market Trends Signal Potential Volatility Risks

Even with hopeful forecasts, the history of the crypto market calls for careful consideration. ETF approvals frequently initiate a traditional pattern of “buy the rumor, sell the news,” resulting in significant price fluctuations. XRP may undergo considerable fluctuations as traders respond to speculative trends and cycles of profit-taking.

Ongoing price increases depend on a steady influx of net ETF creations. In the absence of consistent inflows, selling after approval may swiftly diminish initial profits. This dynamic reflects earlier market responses seen during Bitcoin ETF launches and Ethereum’s regulatory developments.

Regulatory Developments Could Define XRP’s ETF Trajectory

Regulation continues to play a crucial role in shaping the price forecast for XRP. In the United States, ongoing legal ambiguities persist, posing challenges, as any unfavorable decisions could stifle enthusiasm for ETFs. Negative policy signals may eclipse favorable inflows and hinder progress.

On the other hand, clear regulations in Europe and Asia could drive institutional adoption. Well-defined frameworks would boost confidence among fund managers and expedite the flow of capital into XRP ETFs. An approval from regulators may release significant liquidity from banks, hedge funds, and pension portfolios.

Recommended Article: XRP and Bitcoin Battle for Top Investor Choice

Technical Indicators Suggest Key Breakout Levels to Watch

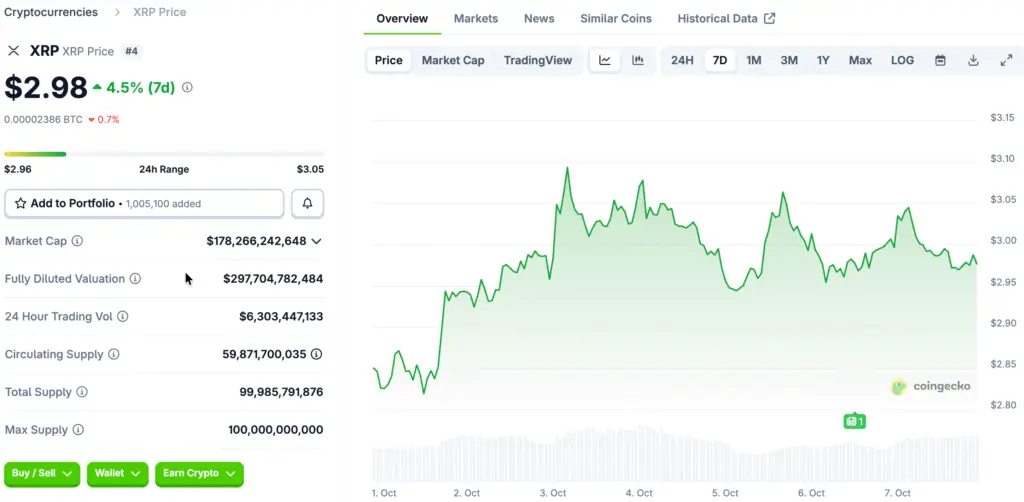

XRP is currently trading around $3.02, showing consolidation within a descending triangle pattern on the four-hour chart. Robust support coincides with the 200-period SMA at $2.94, establishing a vital defense area for bullish traders. Keeping this level is crucial for upholding positive sentiment.

A significant move above $3.10 may lead to increased momentum, with potential targets ranging from $3.25 to $3.55. On the other hand, if support is not maintained, XRP could revisit the $2.70 area. These technical levels will serve as a roadmap for short-term trading strategies amid ETF-induced volatility.

Expert Opinions Split on Long-Term Price Outlook

Market analysts continue to have differing opinions on XRP’s journey towards the bold $12 goal. Optimistic analysts highlight ETF inflows, advancements in regulation, and enhancements in network liquidity as possible drivers for significant growth. There is a belief that the demand from institutions has the potential to quickly alter price dynamics.

Critics, on the other hand, point out the erratic regulatory landscape and the past fluctuations of XRP. They advise against depending exclusively on ETF excitement, encouraging investors to take into account wider macroeconomic elements and changing market sentiment prior to setting ambitious price targets.

Institutional Inflows Could Reshape XRP’s Market Position

ETF products serve as a pivotal link connecting conventional finance with the realm of digital assets. For XRP, notable inflows may improve liquidity, narrow spreads, and contribute to a more stable price movement in the long run. The involvement of institutions would broaden the investor base for XRP and enhance the overall market infrastructure.

This structural evolution could assist XRP in breaking free from purely speculative cycles. Should ETFs continue to draw steady interest, XRP may undergo a prolonged re-rating phase, aligning it with Bitcoin and Ethereum as a fundamental digital asset in institutional investment strategies.

XRP’s $12 Ambition Hinges on Perfect Market Alignment

The potential ascent of XRP to $12 hinges on a careful interplay of several elements: ETF inflows, regulatory clarity, bullish technical formations, and consistent institutional demand. Any disruption could hinder progress, but an ideal convergence might spark one of XRP’s most powerful rallies in years.

Investors should brace themselves for fluctuations and keep a keen eye on ETF advancements. As the crypto market approaches a crucial juncture, XRP finds itself at the crossroads of potential and unpredictability—its path influenced by the dynamics of global finance and advancements in blockchain technology.