XRP Price Corrects After Hitting Resistance

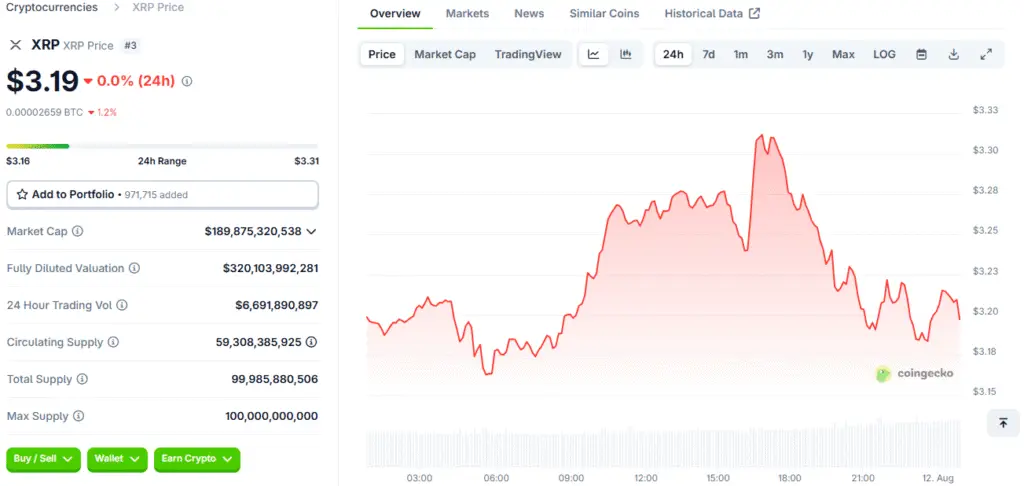

The price of XRP has been trading within a defined intraday range, showing a period of consolidation after a recent rally. The cryptocurrency made a higher high last week but was met with resistance, which triggered a bearish correction. It found and held a key intraday support level near $3.16, a price point that has been tested several times. At the time of writing, the price is again approaching this support level, which is a pivotal point for its short-term intraday movement.

This price action, marked by a TD Sequential sell signal on the three-day chart, indicates the possibility of short-term consolidation or a mild downward movement. However, the token remains above the psychologically important $3.00 support level, with trading volumes remaining elevated and $3.09 serving as a notable resistance point. This price behaviour, where a rally is followed by a correction and a retest of support, is a common pattern in the crypto market.

The SEC’s Regulation D Waiver Explained

The price action is occurring in the wake of a significant legal development: the U.S. Securities and Exchange Commission (SEC) has granted Ripple Labs a waiver from a Regulation D disqualification provision. Regulation D is a rule that allows companies to conduct private offerings of securities without having to go through a full SEC registration process, which can be costly and time-consuming. The waiver, which is tied to a prior injunction in the long-running Ripple vs. SEC lawsuit, effectively permits Ripple to use this exemption for private offerings.

This leniency, which came after the parties settled in May 2025, effectively ends the legal battle and restores a degree of operational freedom to Ripple, allowing it to tap into new funding without the restraint of cumbersome compliance protocols. The court’s 2023 ruling, which differentiates XRP sales on public exchanges from those to institutional investors, remains active and provides a crucial legal foundation for the asset.

The Ripple Settlement and Its Impact on the Market

The settlement between Ripple and the SEC was a pivotal event that has had a profound impact on XRP’s market and its future prospects. Under the terms of the settlement, Ripple agreed to pay a $125 million fine. The company remains under an injunction concerning unregistered securities sales, but the SEC’s waiver of the Regulation D disqualification provision is a massive win, as it allows Ripple to continue its business operations without the threat of ongoing litigation.

This legal resolution has not only restored faith among XRP enthusiasts but has also removed a significant cloud of doubt for institutional investors. The end of the legal battle is expected to usher in an era of renewed fervour among traders and stakeholders, as they can now focus on the fundamental utility of XRP without the distraction of regulatory uncertainty. This new environment is a key factor in the bullish forecasts from analysts and the overall optimistic sentiment surrounding the asset.

Analyst Forecasts for XRP’s Future Price

Following these legal developments, market analysts are forecasting a significant and sustained rally for XRP. Medium-term price forecasts range between $4.50 and $9.00 by 2026-2027, while long-term estimates suggest $8.00 to $15.00 by 2030. These projections are heavily influenced by the new regulatory clarity and the potential for a wave of institutional adoption. DeepSeek AI, for instance, projects that XRP could trade between $3.50 and $5.00 by the end of 2025, assuming a 70% chance of a favourable legal outcome for Ripple.

This outlook also factors in broader market conditions, including Bitcoin’s performance. Analyst Zack Rector is even more bullish, expecting XRP to reach $5 in the near term and possibly $15 by September, representing a significant increase from current levels. Another analyst, James Crypto Space, notes that if XRP follows a pattern similar to the 2017 fractal, it could reach $9 by early September, based on historical trends of rapid price increases after breaking key resistance levels. These diverse forecasts, while speculative, underscore a strong collective belief in XRP’s potential for explosive growth.

XRP’s Newfound Clarity Paves Way for Institutional Adoption

Ripple’s legal victory has set a precedent for other cryptocurrency projects facing regulatory scrutiny, reviving faith in XRP and its assets. The settlement and waiver signal a journey from regulatory uncertainty to a rediscovered faith in the asset. The market’s response was exhilarating, with XRP prices surging by 8.5% immediately after the announcement.

The waiver’s impact is expected to extend beyond XRP, providing a blueprint for other crypto projects on how to engage with regulators, potentially leading to a more stable and predictable market. This newfound clarity can influence the strategic pathways of companies in the cryptocurrency market.

The Importance of Institutional Adoption

The new regulatory clarity provided by the SEC waiver is a crucial step towards attracting a new wave of institutional adoption. Institutional investors, including banks, hedge funds, and asset managers, require a predictable and secure legal environment to operate. The SEC’s waiver provides this, removing a significant cloud of doubt and making XRP a more attractive asset for large-scale investment.

This increased institutional interest is a key factor in the bullish forecasts from analysts and the overall optimistic sentiment surrounding the asset. As institutional capital flows into XRP, it can lead to increased liquidity, price stability, and a broader market presence. This is a crucial step for XRP’s integration into the broader financial ecosystem, as it moves from a speculative asset to a legitimate and widely adopted tool for global finance.

A Bright New Era for Ripple and XRP

The SEC waiver heralds a transformative chapter for Ripple, symbolising a growing acceptance of cryptocurrencies in the robust realm of traditional finance. This defining moment not only bolsters Ripple’s fundraising prowess and operational agility but also shines brightly as a beacon for the entire digital asset ecosystem. As regulatory frameworks continue their evolution, Ripple’s narrative exemplifies an encouraging blend of opportunity and caution, urging stakeholders to remain alert and adaptable.

This newfound lucidity will indubitably influence the strategic pathways of myriad companies entrenched in the bustling cryptocurrency market as they navigate their compliance terrain. A brighter horizon beckons for Ripple and its community, as this monumental shift in regulatory perspective unlocks unparalleled opportunities, propelling XRP to the forefront of financial innovation.

Read More: XRP Ripple SEC Waiver Unleashes New Horizons for Crypto