The Ripple SEC Waiver: A Groundbreaking Inflection Point

The recent SEC waiver granted to Ripple marks a groundbreaking inflection point in the digital currency arena, signalling a new era of opportunity for the company and its native token, XRP. With the regulatory shackles now loosened, Ripple is ideally positioned to unleash its potential for capital allocation like never before, catalysing a cascade of innovation within the cryptocurrency spectrum.

This isn’t merely a financial boost for Ripple; it stands to redefine compliance benchmarks industry-wide, restoring faith among XRP enthusiasts and stakeholders. This significant event transcends Ripple’s individual sphere, as its outcome could provide vital insights that will shape the broader implications for everyone invested in the crypto domain. For a market that has been defined by ambiguity and a lack of clear rules, this waiver represents a monumental step towards a more predictable and legally sound future.

Legal Nuances of Ripple’s SEC Waiver

In light of this waiver, former SEC attorney Marc Fagel has illuminated its legal bearings, providing crucial context for its significance. Fagel pointed out that although Ripple had faced severe criticisms for breaching securities regulations, the new waiver considerably lightens those once-strict operational burdens. This leniency empowers Ripple to tap into funding without the restraint of cumbersome compliance protocols that previously hindered growth, effectively exorcising a significant cloud of doubt that had long hung over the company.

By facilitating private fundraising initiatives under Regulation D, the waiver rejuvenates Ripple’s fundraising avenues, potentially sparking a resurgence of ambitious growth projects and strategic investments. This is a crucial distinction, as it allows Ripple to attract institutional capital with a clear legal framework, moving beyond the uncertainty that had previously defined its operations in the United States.

The Expansion Landscape: New Fundraising Frontiers

The SEC’s relaxed regulations have made Ripple more attractive to institutional investors, who are keen to support innovative projects despite regulatory risks. The re-establishment of Regulation D exemptions has increased confidence among XRP investors and fortified the company’s path towards innovative product development and strategic mergers and acquisitions.

This new era of fundraising could lead to a rapid expansion of Ripple’s ecosystem, with new partnerships, product launches, and technological advancements. Funding these projects with institutional capital provides a more stable and powerful engine for growth than relying solely on organic market movements.

Read More: XRP Ripple Acquires Rail to Dominate Stablecoin Payments

Market-wide Repercussions and Investor Confidence

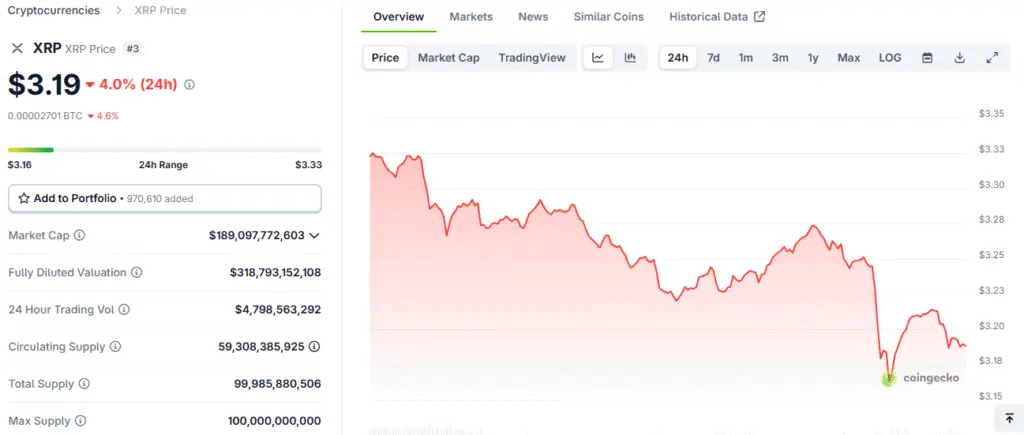

Ripple’s monumental legal triumph transcends its individual sphere, sending positive shockwaves throughout the cryptocurrency market and heralding an era steeped in compliance and operational flexibility. For a plethora of investors, the waiver signals a journey from uncertainty to a newfound faith in XRP and its affiliated assets. The market’s instantaneous response was nothing short of exhilarating, as XRP prices surged by 8.5% almost immediately after the announcement.

This dramatic price movement showcases a revived fervour among traders and stakeholders alike, who have been waiting for a positive catalyst to validate their long-term belief in the asset. The waiver’s impact is expected to extend beyond just XRP, as it sets a precedent that other crypto projects can follow. By demonstrating a successful model of constructive engagement with regulators, Ripple is providing a blueprint for the entire digital asset ecosystem, which could lead to a more stable and predictable market for everyone.

Navigating Compliance in a Changing Crypto Framework

As the SEC waiver ushers in notable progress for Ripple, it simultaneously raises pivotal questions concerning the future of regulatory compliance in the crypto environment. Emerging Web3 ventures might now perceive financial regulation as a navigable pathway rather than an insurmountable barrier. This newfound clarity could encourage more innovative projects to seek a compliant path from the outset, fostering a more responsible and mature industry.

However, there is a word of caution for these ventures: an overreliance on established compliance models could introduce risks that might jeopardise the decentralised ethos revered by many blockchain proponents. The challenge for the industry will be to find a balance between regulatory compliance and the core principles of decentralisation, ensuring that innovation is not stifled by an overly rigid framework. This is a delicate and complex path, and Ripple’s journey serves as a powerful case study for how to navigate it effectively.

Ripple’s Path and Its Influence on Other Cryptocurrencies

As Ripple skilfully manoeuvres through this invigorated operational landscape, its approach may become a blueprint for others wrestling with regulatory entanglements. This waiver may serve as a landmark case, shaping the strategic manoeuvres of other companies striving for similar regulatory resolutions. With legal boundaries shifting, Ripple stands at the forefront of redefining the compliance landscape, demonstrating the prospects of engaging constructively with regulatory frameworks rather than being in a state of constant conflict.

This could lead to a new era of collaboration between regulators and innovators, fostering a more positive and productive relationship. The legal clarity provided by the waiver will undoubtedly influence the strategic pathways of myriad companies entrenched in the bustling cryptocurrency market as they navigate their own compliance terrain. This newfound lucidity is expected to unlock unparalleled opportunities, propelling XRP to the forefront of financial innovation and positioning Ripple as a leader in the next phase of the digital asset economy.

A Bright New Era for Ripple and XRP

The SEC waiver heralds a transformative chapter for Ripple, symbolising a growing acceptance of cryptocurrencies in the robust realm of traditional finance. This defining moment not only bolsters Ripple’s fundraising prowess and operational agility but also shines brightly as a beacon for the entire digital asset ecosystem. As regulatory frameworks continue their evolution, Ripple’s narrative exemplifies an encouraging blend of opportunity and caution, urging stakeholders to remain alert and adaptable.

This newfound lucidity will indubitably influence the strategic pathways of myriad companies entrenched in the bustling cryptocurrency market as they navigate their compliance terrain. A brighter horizon beckons for Ripple and its community, as this monumental shift in regulatory perspective unlocks unparalleled opportunities, propelling XRP to the forefront of financial innovation.