Whale Accumulation Intensifies Speculation Around XRP Breakout Potential

While investors are swiftly amassing XRP, acquiring 250 million tokens in just forty-eight hours, reflecting robust confidence. This kind of intense accumulation often comes before major market shifts, sparking speculation about a potential breakout past important resistance levels.

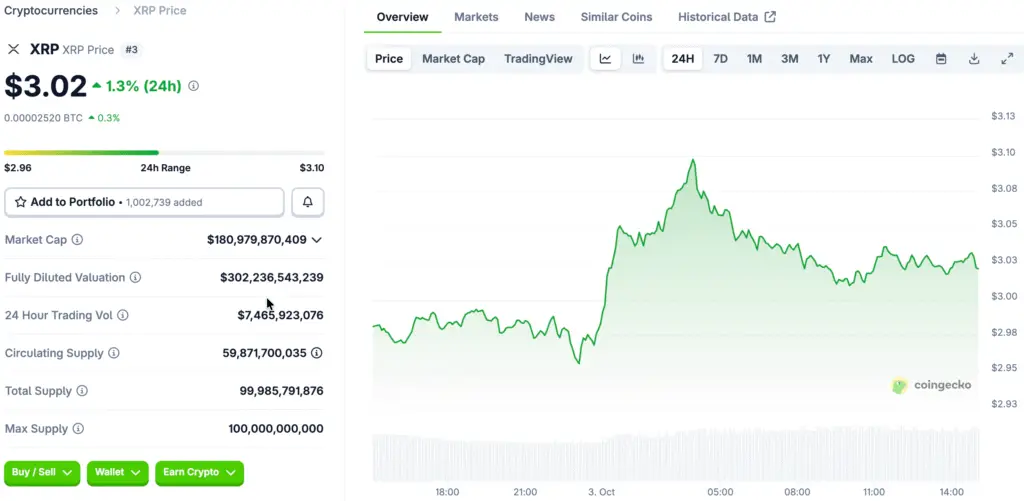

XRP is currently trading at approximately $2.99, with daily trading volumes surpassing $5.5 billion, indicating increased market activity and expectations. The increase in activity heightens volatility, prompting traders to monitor resistance levels for clear bullish or bearish indicators moving forward.

Volatility Rises as Key Resistance Levels Approach Rapidly

The buying activity of large investors tends to heighten short-term volatility, rendering upcoming price movements quite unpredictable for everyday investors. Should XRP surpass the upper resistance level, experts anticipate a significant surge towards the $4.13 mark in the upcoming weeks.

On the other hand, a rejection at resistance may lead to rapid drops towards lower support levels, highlighting the critical nature of timing when making entries. It is recommended for traders to keep an eye on whale wallet movements and volume surges, as these can serve as early signs of major changes in the market.

Technical Patterns Highlight Critical Moment for XRP Traders

Experts are intently observing a descending triangle pattern that is developing on XRP’s price chart, nearing its significant apex point. These patterns usually culminate in significant movements, rendering the forthcoming trading sessions crucial for short-term direction and momentum.

Key resistance levels at $2.95 and $3.05 are crucial for bullish breakout scenarios that may lead to substantial price increases. A confirmed breakout above the falling wedge structure could pave the way for XRP to exceed $5 in this cycle.

Recommended Article: XRP Key Drivers Highlight Powerful Catalysts for Crypto Future

Regulatory Shifts Improve Institutional Confidence in XRP

The recent ruling by the SEC has brought about a notable enhancement in regulatory clarity, confirming that XRP is not classified as a security in secondary market transactions. This decision enhances investor confidence and diminishes legal ambiguities, rendering XRP more appealing for wider financial applications.

At the same time, Europe’s MiCA framework promotes the integration of cryptocurrency, facilitating the adoption of XRP for cross-border payments among small businesses. The recent advancements boost XRP’s attractiveness to institutions, likely leading to considerable investments from companies looking for effective blockchain solutions.

Adoption Momentum Builds Among Global Payment Ecosystems

Enhanced regulations are driving adoption as companies investigate XRP’s capabilities for more efficient global transactions. Adhering to KYC and AML standards establishes XRP as a credible financial asset, moving beyond the realm of just a speculative cryptocurrency.

Payment service providers and SMEs are increasingly recognizing XRP as a bridge asset that can lower costs and enhance transaction efficiency. The increasing acceptance supports a positive outlook for the long term, strengthening technical indicators that suggest potential breakout opportunities in the near future.

Market Sentiment Reflects Bullish Expectations Despite Volatility

Optimistic feelings are prevailing in today’s market conversations, bolstered by significant accumulation from large investors, positive chart patterns, and clearer regulations. Investors are looking forward to the possibility that these combined factors may drive XRP to break through significant resistance levels in the forthcoming trading cycles.

Nonetheless, it is essential to exercise caution since volatility has the potential to swiftly alter trends, especially near significant resistance and support levels. Short-term corrections can still occur even in a generally positive market outlook, highlighting the importance of maintaining disciplined risk management strategies.

Future Outlook Positions XRP at a Crucial Turning Point

XRP is currently at a crucial crossroads, where the actions of large investors, technical indicators, and regulatory developments come together to influence its future price movements. The optimistic outlook relies on ongoing accumulation by large investors, successful price breakouts, and sustained interest from institutions in the months ahead.

Should the momentum persist in a favorable direction, XRP may regain its position as a leader among the leading digital assets by overcoming previous resistance levels. On the other hand, a lack of sustained momentum might hinder bullish trends, highlighting the importance of the coming weeks for XRP holders.