Coinbase’s XRP Holdings: A 57.4% Reduction and Strategic Reallocation

In a significant move that has captured the attention of the crypto world, Coinbase has announced a major reduction in its XRP holdings, slashing its reserves by a substantial 57.4%. This decision is not a sign of the company pulling out of the XRP market entirely, but rather a strategic reallocation of assets. Coinbase is moving its XRP from its own cold wallets to liquidity partners, primarily Ripple-linked firms like Bitstamp and BitGo.

This action highlights a careful and deliberate asset management shift. While some might view this as a negative development, it is a calculated move that could have positive implications for the wider XRP ecosystem, particularly for smaller fintech startups that rely on the token for cross-border payments and payroll services. This strategic adjustment is a key indicator of how major players are adapting to the evolving regulatory landscape.

XRP Reallocation A Major Benefit for Asian Fintech Startups

The reallocation of XRP from Coinbase to Ripple’s On-Demand Liquidity (ODL) partners could be a major benefit for small fintech startups, particularly those in Asia. For these companies, XRP is a crucial tool for cross-border payments and payroll, as it offers a low-cost and high-speed alternative to traditional banking systems. The move could enhance liquidity access and boost trading volume on platforms that specialise in providing XRP liquidity.

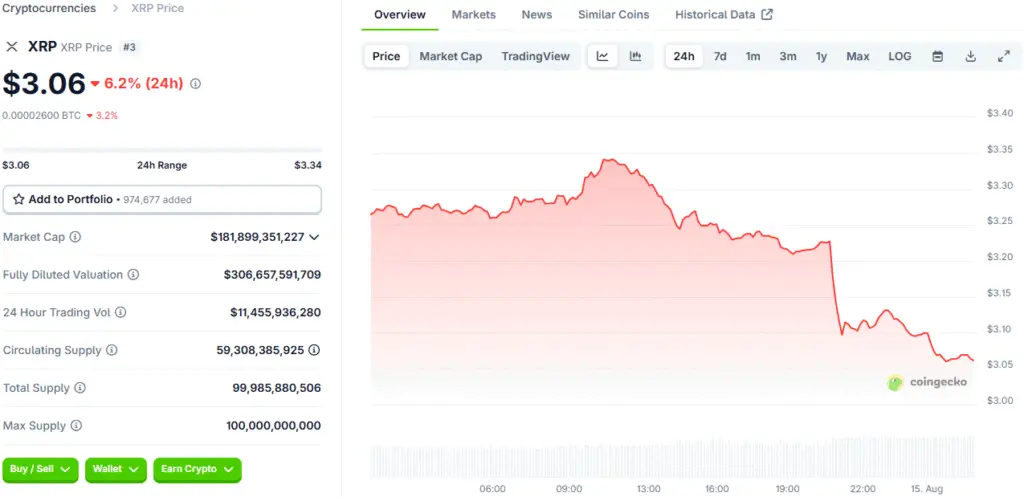

This is a critical development for startups that need efficient payment solutions to remain competitive in a fast-paced global market. The recent bump in XRP trading volume, following the news, suggests that market makers and institutional investors are still actively engaged, indicating that Coinbase’s strategic move is reorganising, not diminishing, liquidity for the token.

The Push for Regulatory Compliance

Coinbase’s decision is a clear signal of its commitment to regulatory compliance. By taking a proactive approach to its asset management, the company is aiming to align with new regulatory guidelines and build greater investor confidence. The move is a step towards a more stable and regulated market, which is crucial for the long-term health and growth of the crypto industry.

The company is also stepping up its Know Your Customer (KYC) and Anti-Money Laundering (AML) game to reduce fraud and illicit activities. While these changes are essential for building trust, they may also come with a new set of challenges. Stricter regulations often lead to higher compliance costs for smaller startups, which could stifle innovation and create new barriers to entry for up-and-coming players in the market.

The Rise of Crypto Payroll Solutions

The crypto market is witnessing a shift in institutional trading patterns, with more investors allocating a significant portion of their portfolios to digital assets. This growing confidence is also giving a boost to the adoption of crypto payroll solutions for businesses. As companies recognise the benefits of using cryptocurrencies for payroll, including faster transaction times and lower fees, the trend is gaining momentum.

Stablecoins, in particular, are becoming an attractive option for payroll due to their transactional efficiency and reduced volatility. This new era of institutional and corporate adoption is creating a powerful new use case for cryptocurrencies, moving them beyond a simple investment and into the realm of practical financial tools for businesses of all sizes.

Best Practices for Treasury Management

In this new and evolving landscape, it is essential for crypto-friendly SMEs, particularly those in Europe and Asia, to adopt best practices for treasury management. This includes aligning with new regulations, such as the EU’s MiCA framework, to ensure legal compliance and gain access to a pan-European licencing system. It also means leveraging advanced treasury management tools to use capital more efficiently.

Businesses can benefit from platforms that offer deep liquidity and algorithmic execution, allowing them to trade over 260 crypto assets. Furthermore, stablecoin payment rails and staking rewards can be used to optimise treasury management and generate additional yield on crypto holdings. These tools are crucial for businesses that want to remain competitive and leverage the full potential of the crypto market in a secure and efficient way.

Coinbase’s Move Could Benefit Asian Fintech Startups

In conclusion, Coinbase’s decision to reduce its XRP holdings is a complex one. It’s not about pulling out of the market entirely, but rather a strategic shift in how liquidity is provided. This reallocation could actually benefit fintech startups in Asia, supporting their cross-border payment and payroll solutions with improved liquidity access. As the crypto landscape continues to be shaped by new regulations, businesses will need to adapt their strategies to leverage the benefits of crypto payroll solutions.

The future of crypto payments is bright, with the potential for greater efficiency, transparency, and cost-effectiveness in managing payroll and financial operations. This move by Coinbase is a key indicator of a maturing market, where a strategic and compliant approach to asset management is becoming the new standard.

Read More: Vivopower and Crypto.com Partner to Grow XRP Treasury