Pepe Price Drop Reflects Weak Market Sentiment

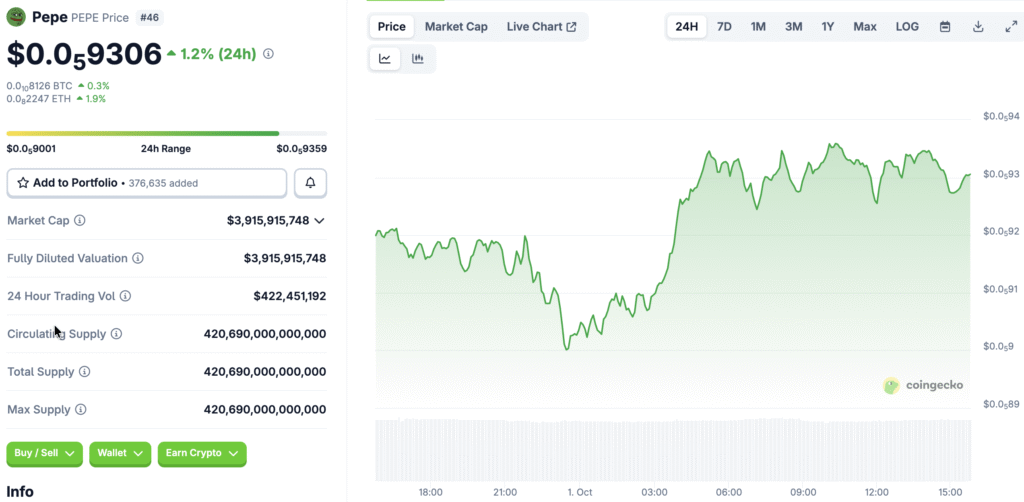

Pepe’s price fell two point six percent over twenty-four hours, signaling increased selling pressure and overall weakness. The memecoin traded near $0.00009150, underperforming other cryptocurrencies during the same period as traders reduced risk exposure.

Market data highlighted failed rally attempts and heavy intraday sell-offs that erased early gains repeatedly across major exchanges. Investors remain cautious, closely observing liquidity trends and technical levels that influence broader cryptocurrency sentiment during downturns.

Resistance Levels Limit Upward Momentum Opportunities

The session began around ninety-three millionths before peaking near ninety-five millionths and reversing lower shortly thereafter. Sellers consistently emerged near resistance zones, capping bullish momentum despite temporary spikes in trading volumes throughout sessions.

These ceilings continue to pose significant challenges to sustainable recoveries, frustrating traders seeking stronger continuation signals from intraday rallies. Market participants now watch whether renewed buying interest can trigger decisive resistance breakouts to shift short-term directional narratives upward.

Support Zones Draw Focus During Price Consolidation

Initial support appeared near ninety-two millionths during early sessions, temporarily preventing further declines before weakening later in trading. Gradual erosion of this support increased downside vulnerability, encouraging bearish traders to position for extended declines below critical levels.

Analysts emphasize maintaining support stability as crucial to avoid slipping toward deeper consolidation ranges with accelerating bearish momentum. Extended weakness beneath support could trigger liquidations among leveraged traders, intensifying volatility within Pepe’s speculative derivatives markets.

Recommended Article: Remittix, Cardano & Pepe: The Best Altcoins to Buy Now for Maximum Returns

Derivatives Activity Hints At Upcoming Volatility Breakouts

Open interest climbed toward $560 million alongside total daily trading volumes exceeding $1.2 billion during recent sessions. Elevated derivatives positioning indicates heightened speculative activity, often preceding significant volatility expansions in thin liquidity environments.

Monitoring open interest trends combined with price actions offers insights into potential breakout or breakdown trajectories forming imminently. Traders increasingly hedge or leverage positions ahead of expected directional moves, shaping Pepe’s near-term volatility profile aggressively.

Volume Spikes Indicate Hesitation From Buyers And Sellers

Intraday volume spikes accompanied several attempted resistance breakouts, but lacked follow-through conviction as reversals occurred quickly. Repeated failures to sustain momentum underscored hesitant market participation, leaving consolidation attempts exposed to external sentiment shifts.

Declining volume toward session close suggested indecision rather than strong directional commitment among participants watching macroeconomic cues. Without decisive buyer engagement, recovery efforts appear fragile, leaving Pepe vulnerable to sentiment-driven shocks impacting broader markets.

Accumulation Signs Appear But Bears Still Dominate Trends

Early trading showed higher lows forming, hinting at accumulation structures typically preceding bullish reversals during uncertain conditions. However, sellers retained control near resistance levels, blocking pattern confirmations required for sustained upward momentum generation.

Bullish outlooks require stronger volume inflows to push decisively through resistance near ninety-five millionths with conviction. Until that occurs, prevailing technical structures favor sideways pressure under bearish dominance, limiting upside opportunities significantly.

Breakout Above Resistance Could Revive Bullish Sentiment

Analysts closely monitor Pepe’s ability to defend support near ninety-one millionths while testing resistance zones above. Prolonged weakness below these supports risks cascading liquidations amplifying volatility across Pepe’s speculative ecosystem significantly.

Conversely, decisive resistance breakouts supported by volume confirmations could spark short-term bullish reversals and renewed optimism. Pepe remains delicately balanced between potential recovery scenarios and intensified selling pressures shaping near-term trajectory dramatically.