Solana Price Outlook Strengthens With Network Upgrades

Solana’s price is currently around $229, showing a resurgence of optimism fueled by recent technological advancements and speculation surrounding ETFs. Experts anticipate robust bullish momentum with the increasing adoption of DeFi, although short-term corrections might happen if the market becomes overextended.

Enhancements like Alpenglow and Firedancer are designed to improve network throughput and stability, effectively tackling earlier congestion issues. This advancement in technology places Solana in a strong position relative to Ethereum, increasing its attractiveness for both developers and institutional investors.

ETF Speculation Adds Fuel to Solana’s Bullish Narrative

The potential for SEC approval of spot Solana ETFs from October 6 to 10 has invigorated market sentiment across major exchanges worldwide. Possible ETF listings are viewed as a driving force for enhanced liquidity and institutional investments, which may boost Solana’s price movement.

Historically, speculation around ETFs has led to significant rallies in the crypto markets, reflecting the explosive growth driven by ETFs that Bitcoin experienced in the past. Should approval be granted, Solana may embark on a significant price discovery journey, pushing its gains well past the existing resistance levels near $230.

Distinct Benefits Maintain Attention on Solana for Investors

Solana stands out with its impressive throughput capabilities, minimal transaction fees, and ongoing efforts to expand its ecosystem. The upgrades to its infrastructure are designed to enhance reliability, addressing previous concerns about network instability during peak activity times.

In contrast to Ethereum, Solana’s efficiency attracts new projects looking for scalable solutions in the realms of DeFi, NFTs, and global tokenization initiatives. The benefits outlined bolster Solana’s prospects for sustained growth, establishing it as a prominent blockchain network in the midst of the current bullish trend.

Recommended Article: Pi Network Faces Collapse Fears as Remittix Gains Trust

Remittix Stands Out as a Leading Candidate for Long-Term Growth

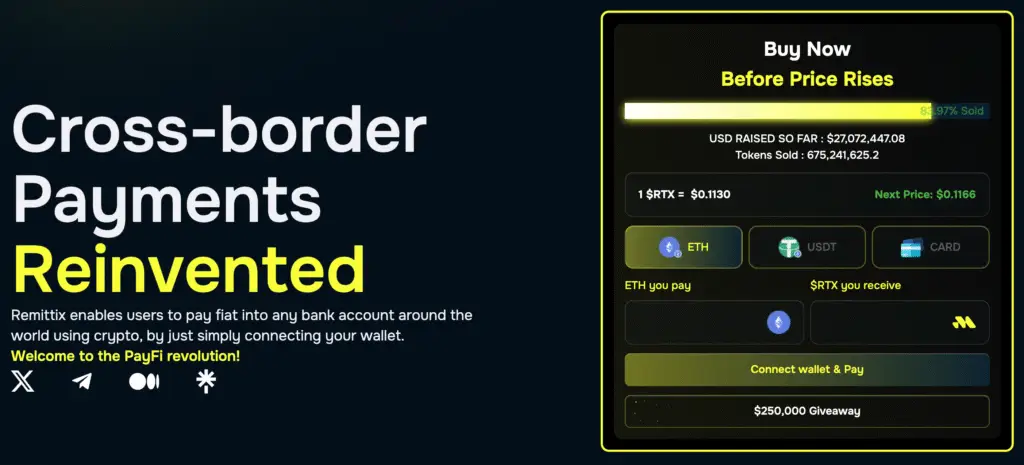

As Solana experiences a surge, Remittix (RTX) is garnering notable interest as a viable crypto-to-fiat solution, boasting global utility features. The project holds the top verification on CertiK, features a live beta wallet, and enables swift crypto-to-bank transfers across more than 30 countries.

Remittix has successfully secured over $27 million by selling more than 674 million tokens at a presale price of $0.1130 each. The impressive presale results and robust infrastructure underscore RTX’s rising status as a prominent player in the DeFi growth landscape.

Unique Utility and Deflationary Tokenomics Drive Remittix Appeal

Remittix connects digital assets with traditional banking systems, facilitating smooth cross-border crypto-to-fiat transactions for users around the world every day. The project’s leading CertiK ranking highlights its strong focus on security, transparency, and a level of trustworthiness that appeals to institutional investors.

The deflationary model of RTX tokens guarantees a diminishing supply as time progresses, providing advantages for long-term holders through the possibility of price growth. Through strategic mass adoption initiatives and forthcoming centralized exchange listings, Remittix is setting the stage for rapid global expansion with impressive effectiveness.

Market Outlook: Solana and Remittix Shine in Uptober

The price forecast for Solana in October is anticipated to fall between $187 and $229, influenced by the expansion of DeFi, advancements in network capabilities, and the results of pending ETF approvals. In the meantime, Remittix is steadily gaining momentum as a sustainable investment option, supported by practical payment applications and an expanding community backing.

Each asset showcases compelling stories within distinct areas of the crypto market—one emphasizing infrastructure, while the other highlights practical adoption. As Uptober unfolds, it’s expected that investor focus will sharpen on these projects, leading to heightened engagement and possible upward momentum.

Opportunities for Strategic Investment to Foster Long-Term Growth

For those looking to diversify their investments, Solana presents an intriguing infrastructure opportunity, whereas Remittix showcases potential for growth driven by utility. Integrating these assets into a well-structured portfolio could harness potential gains from market drivers in both technological advancements and practical application areas.

The convergence of ETF developments, network upgrades, and global adoption trends makes Q4 an ideal time for strategic positioning. Vigilant observation of resistance levels, regulatory results, and adoption metrics will be essential for optimizing long-term investment success.

Solana and Remittix Emerge as Key Q4 Contenders Amid Uptober Momentum

Solana’s ongoing network development and ETF potential position it as a strong contender for lasting bullish momentum in the months ahead. At the same time, Remittix’s distinctive value offering and increasing financial usefulness position it as a notable player among new altcoins.

These assets highlight the variety of opportunities present in the crypto ecosystem, striking a balance between infrastructure development and payment innovation. As Uptober progresses, investors seeking long-term gains should monitor both closely, as they may influence market leadership trends in Q4.