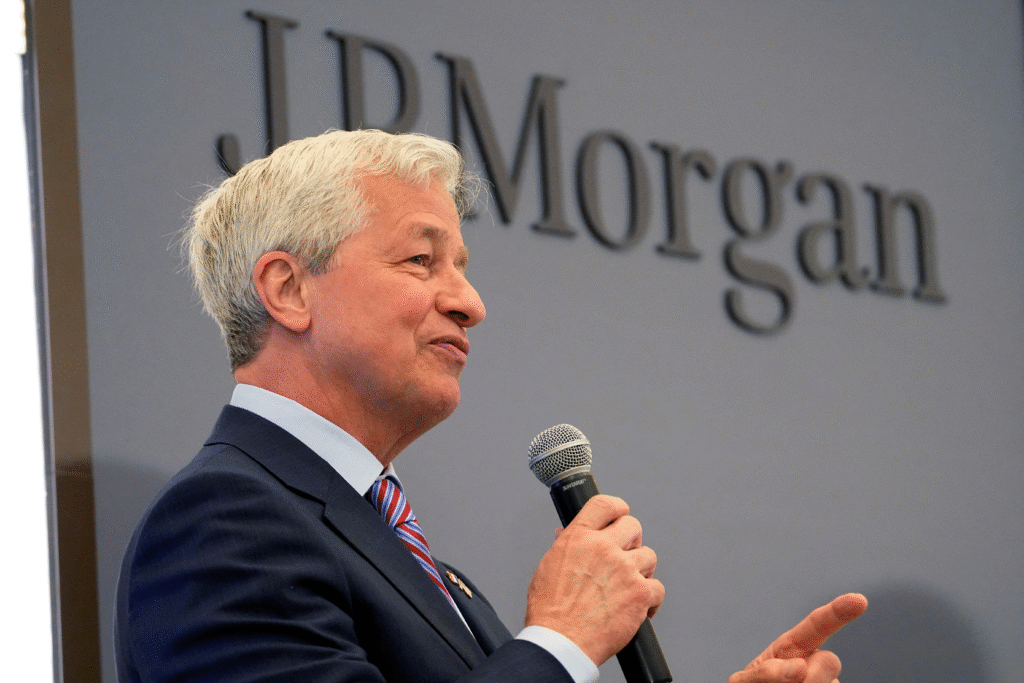

Jamie Dimon Expresses Concern Over Market Stability

JP Morgan CEO Jamie Dimon cautioned about an increased likelihood of a notable decline in the US stock market in the near future. In an interview with BBC reporters, he expressed that he was “far more worried than others” regarding potential corrections in the upcoming 6 to 24 months.

Dimon highlighted that various uncertainties, including fiscal spending, geopolitical tensions, and global militarization, have led to unpredictable circumstances. He pointed out that investors may be overlooking present risks, highlighting that the level of market confidence seems to exceed what the fundamentals would support.

Source: Reuters

Inflation Risks Remain Despite Federal Reserve Independence

The head of JP Morgan expressed that although inflation has eased, he still feels “a little worried” about potential long-term price pressures. Dimon expressed confidence that the Federal Reserve would uphold its independence, even in the face of public criticism from former US President Donald Trump.

He supported Fed Chair Jerome Powell, emphasizing the importance of central bank independence for maintaining economic stability. Dimon emphasized that despite facing political challenges, the integrity of the US financial system remained secure.

Global Standing of the US Faces Reliability Questions

Dimon recognized that America has become a “little less reliable” partner on the global stage compared to earlier decades. This was linked to changes in foreign policy and fiscal priorities that have disturbed established allies and economic partners.

He acknowledged that specific actions taken by the US played a significant role in prompting Europe to tackle its underinvestment in NATO defense and enhance its economic competitiveness. He proposed that these obstacles might ultimately foster enhanced global collaboration through mutual responsibility.

Recommended Article: 8 Foreigners Arrested for Illegal Gold Trade in Bono

AI Valuations Compared to Dotcom-Era Bubble Risks

In a conversation about the swift advancement of technology, Dimon highlighted that artificial intelligence is a significant factor contributing to the recent increases in the stock market. He cautioned that AI valuations seem to be inflated, reflecting worries expressed by the Bank of England regarding possible adjustments.

Dimon likened the current excitement around AI to the dot-com boom of the late 1990s, noting that many investors did not see returns even though the industry as a whole thrived. He forecasted that “a portion of the funds allocated to AI may likely be squandered” because of unrealistic expectations.

Security Risks Highlight Growing Geopolitical Tensions

Dimon emphasized his position on national preparedness, stating that the world has turned into “a much more dangerous place.” He recommended focusing on defense readiness rather than engaging in speculative ventures like cryptocurrency investments.

He wittily suggested that countries ought to “stockpile bullets, guns, and bombs” instead of digital assets to guarantee security in the face of rising global turmoil. This illustrates his overarching belief that security is fundamental to sustaining long-term economic and market stability.

Investment Expansion Signals Confidence in the UK Market

While in Bournemouth, Dimon revealed plans for a £350 million expansion of JP Morgan’s local campus, along with a commitment of £3.5 million in philanthropic funding. UK Chancellor Rachel Reeves expressed her approval of the decision, describing it as “fantastic news” for the economic growth and job prospects in Dorset.

Dimon conveyed a positive outlook regarding Britain’s initiatives to lessen regulation and enhance innovation, praising Reeves for her adept fiscal management. His relaxed demeanor and lively engagement with the team at a town hall event highlighted his standing as an approachable corporate leader.

Dimon Confident in JP Morgan Stability Despite Inflation and Global Market Volatility

Despite his concerns about the market, Dimon conveyed a sense of assurance that US institutions possess the resilience to navigate volatility, thanks to effective leadership and careful policy-making. He asserted that staying alert is essential, as interconnected risks from inflation to global conflict have the potential to transform investment strategies.

Despite ongoing speculation regarding Dimon’s possible political aspirations, he has firmly rejected the notion, emphasizing that his priority lies in maintaining the strength of JP Morgan. With a chuckle, he remarked that if the presidency were presented to him, he would gladly accept it, confident in his ability to perform well in the role.