Fed remarks flip the mood and trigger a swift risk reset

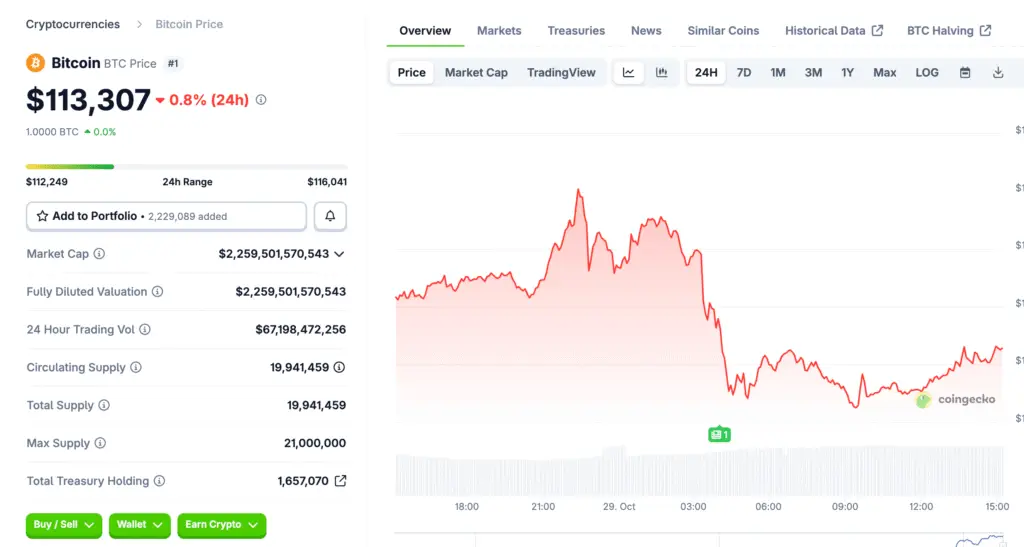

Bitcoin slipped to intraday lows near $110,000 after the Federal Reserve delivered a widely anticipated 25‑basis‑point cut. Traders focused on Chair Jerome Powell’s caution that a December cut is “not a foregone conclusion.” That guidance doused the post‑decision bounce and reinforced a classic “sell the news” dynamic. Instead of chasing upside, short‑term players reduced risk and rotated to the sidelines, pressuring price and sentiment simultaneously.

Prediction markets swing from confidence to caution in hours

On crypto prediction venue dashboards, odds for a near‑term push toward $120,000 faded quickly. Contracts that favored upside earlier in the week compressed toward a near even stance as volatility rose. The abrupt shift reflected traders reassessing the macro path amid mixed signals from rates, liquidity, and growth. As conviction cooled, hedging increased, lifting implied risks of a test toward the six‑figure psychological zone.

Technical gauges show weakening momentum across timeframes

Daily relative strength eased into the mid‑40s while the four‑hour RSI flirted with oversold territory. Average Directional Index readings stayed below the 25 threshold on both the daily and intraday charts. That combination suggests trend uncertainty rather than a strong bearish cascade. However, unless momentum improves, weak hands may continue to dominate short‑term flows and headline‑driven moves.

Recommended Article: France’s $48B Bitcoin Plan Could Reshape EU Crypto Landscape

Moving averages map the battleground for bulls and bears

On the daily view, the 50‑day exponential moving average still sits above the 200‑day, preserving a broader uptrend bias. By contrast, the four‑hour chart flashed a short‑term death cross as the 50‑period slipped beneath the 200‑period. Traders are watching for a quick re‑cross to neutralize the bearish signal and restore confidence. A decisive reclaim of $112,500 with expanding volume would be the first tell that bulls are regaining control.

Key levels define the next swing as liquidity thins into month‑end

Immediate resistance appears near $113,000 and the $114,000–$114,500 supply shelf. Clearing that area reopens $117,000 and a retest of the month’s double‑top near $120,000. On the downside, $111,000–$110,000 is pivotal short‑term support above the 200‑day EMA band at $108,000. A daily close below that band exposes $106,000 and raises risks of a deeper probe toward $100,000.

Macro context explains why a priced‑in cut failed to lift price

Markets respond to surprises, not to outcomes with near‑unanimous odds built in advance. With the cut telegraphed for weeks, incremental buyers were scarce and profit‑taking dominated. Powell’s pushback against prematurely aggressive easing further reduced the impulse for a relief rally. Lower rates can support crypto over time, but transmission into risk assets tends to lag, leaving short‑term positioning in charge.

Flows and positioning hint at longer‑term support despite choppy tape

Spot Bitcoin ETFs recorded fresh net inflows even as price faded intraday. That divergence implies institutions continue to average in, cushioning steeper drawdowns. Derivatives markets, however, show reduced leverage and tighter ranges, consistent with a wait‑and‑see approach. If spot demand persists while futures positioning stays light, volatility may compress before the next directional break.

Trading plan: respect support, wait for confirmation on any recovery

For momentum buyers, patience remains warranted until price reclaims $112,500 and holds above $114,000. For dip accumulators, the 200‑day EMA region around $108,000 is the higher‑probability zone to scale bids. A failure to defend that area increases odds of a swift slide toward $106,000 or even $100,000. Until ADX rises and breadth improves, the path of least resistance tilts lower, even as the long‑term trend stays constructive.