What’s Driving Floki Price Today?

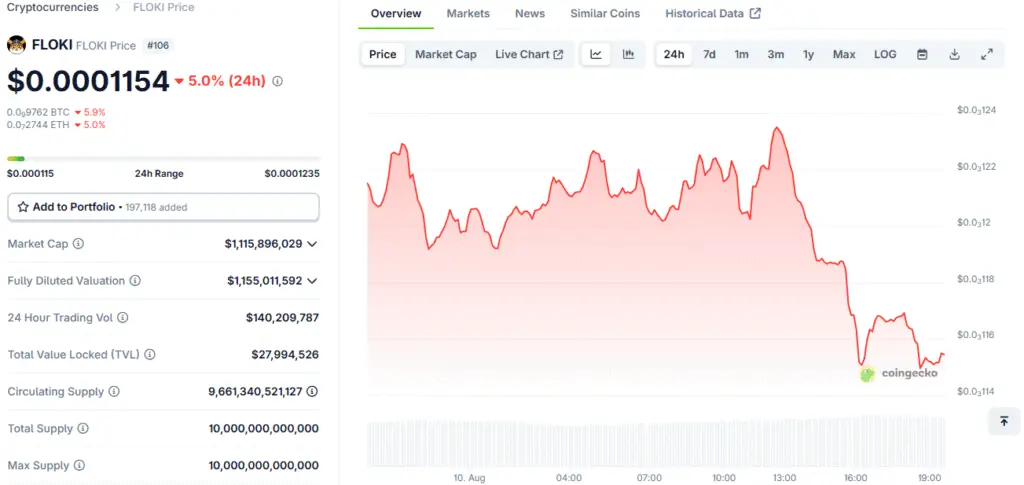

The FLOKI price is currently navigating a period of bearish momentum, with a recent decline of 3.90% over the last 24 hours. This price action appears to be driven primarily by technical factors and broader market sentiment, as no significant fundamental news has emerged in the past week to directly impact the token. This absence of major announcements or partnerships has made FLOKI’s price vulnerable to technical selling pressure.

The lack of fundamental drivers means that chart patterns and momentum indicators carry more weight in current trading decisions, making a detailed technical analysis particularly relevant for understanding near-term price movements. Market participants are now focused on key support levels, as the next few days will be critical in determining whether the pullback continues or finds a floor.

Mixed Signals Create Trading Uncertainty

The FLOKI MACD histogram shows bearish momentum, suggesting short-term selling pressure. This contradicts the longer-term bullish trend, creating uncertainty for traders. The FLOKI RSI is neutral at 52.83, suggesting neither overbought nor oversold conditions. The stochastic indicators suggest FLOKI may be approaching oversold levels, but not yet.

The Floki Bollinger Bands position at 0.4704 indicates the price is trading below the middle band, confirming the current bearish bias and suggesting further downside movement towards support levels. This complex technical analysis presents a challenging environment for traders.

Key Support and Resistance Levels to Watch

Current FLOKI support levels will be critical in determining whether this pullback continues or finds a floor. The immediate support zone represents the first line of defence for bulls attempting to halt the decline. Should the FLOKI price break below this immediate support, the next key area to monitor is a strong support level that has historically provided significant buying interest and could attract value-seeking traders. On the upside, FLOKI resistance levels remain well-defined.

An immediate resistance zone will need to be reclaimed before bulls can target a stronger resistance area above. The FLOKI/USDT trading pair’s current position relative to these levels suggests limited upside potential until momentum indicators improve. Traders should watch for volume confirmation at these critical FLOKI support levels, as a significant volume spike at a key support level could signal a potential reversal.

Risk-Reward Analysis for Traders

Based on Binance spot market data, FLOKI presents a mixed risk-reward scenario that varies significantly by trading timeframe and risk tolerance. Conservative traders may want to wait for clearer signals, particularly an improvement in the bearish MACD momentum or a successful retest of strong support levels. The current technical setup does not favour immediate long positions given the conflicting signals. Aggressive traders, however, might view the neutral FLOKI RSI as an opportunity, especially if volume increases near support zones.

However, the bearish MACD momentum suggests any bounce could be short-lived without fundamental catalysts. Day traders should focus on the daily trading range and watch for volume spikes at key levels. The $32.5 million in 24-hour volume provides adequate liquidity for most trading strategies, though volatility remains elevated. Risk management becomes paramount in this environment, and using stop-loss orders below strong support levels could help limit downside while allowing for participation in any potential reversal.

A Critical Juncture for FLOKI’s Trajectory

FLOKI’s price is facing near-term headwinds as bearish MACD momentum conflicts with the longer-term bullish trend. The next 24-48 hours will likely hinge on whether key support levels can hold under current selling pressure. Traders should monitor the FLOKI RSI for any move below 50, which could signal accelerated selling. Conversely, a bounce from current support with improving momentum indicators could provide attractive entry opportunities for the resumption of the broader uptrend.

The lack of fundamental news keeps the focus squarely on technical levels, making support and resistance zones particularly important for FLOKI/USDT trading decisions in the immediate term. For investors who believe in the long-term potential of FLOKI, this period of consolidation may offer a unique opportunity, but it is important to exercise caution and conduct your own research before making any commitments.

Read More: FLOKI Robinhood Listing Sparks Rally Past $1 Billion Mark