ASTER Market Shaken by Abrupt Drop in Confidence

The removal of Aster from the prominent analytics platform DeFiLlama has unsettled investor confidence and sparked significant uncertainty. Concerns have been raised by analysts regarding the possibility of inflated trading data on decentralized exchanges leading to this event.

The market response has been swift, as ASTER’s token price stabilizes close to essential support following significant investor pullbacks. On-chain indicators show a clear change in sentiment among major holders and institutional players.

Data Integrity Concerns Raised by DeFiLlama for Aster

On October 5, 0xngmi, the founder of DeFiLlama, noted that the reported volumes of Aster reflected the patterns observed in Binance’s perpetual market data. This observation ignited a discussion about whether Aster’s previous trading spike was a natural occurrence or the result of artificial manipulation.

The discovery led DeFiLlama to take Aster off its listings, referencing concerns about integrity. This choice sparked increased doubt among traders and led to greater fluctuations in Aster’s native token during the subsequent sessions.

Major Investors Swiftly Reduce Their Stake in ASTER

Whale wallets with holdings over $1 million in ASTER have decreased their balances by 12% following the delisting event. This significant decrease serves as a clear indication that substantial investors are withdrawing due to diminishing confidence.

Coordinated selling pressure from large investors often signals prolonged price declines. Experts observe that this trend may indicate a more significant retracement phase if purchasing support continues to be weak around the current levels.

Recommended Article: Aster Price Loses Ground Over Hyperliquid (HYPE) as PDP Aims for a 1000x Uptober

Smart Money Exits Amplify Bearish Market Pressure

Nansen data reveals that “smart money” traders have reduced their exposure to ASTER by about 37% following the delisting. The participants consist of seasoned investors and funds whose actions frequently indicate shifts in informed sentiment.

The combined decrease from this group intensifies the downward trend throughout the asset. This highlights the view that experienced investors are taking a cautious stance, while the mood among retail investors continues to be unstable.

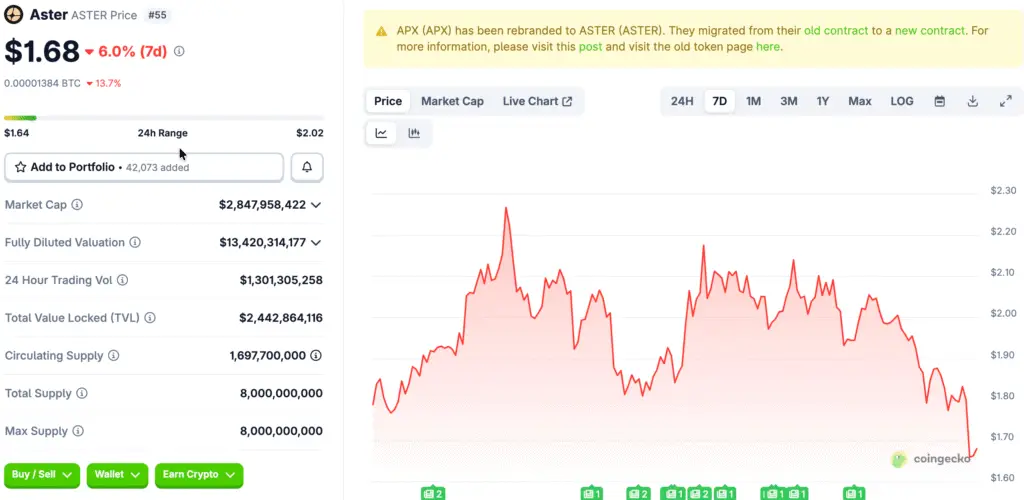

ASTER Trades Near $2.03 Support Amid Heavy Selling

Currently, ASTER is trading near the $2.03 support level, maintaining a position within a tightening range of volatility. Maintaining this level will be essential to avoid increased downward pressure that might exacerbate the correction.

If bearish volume increases, the token may face a decline towards the next significant support level at $1.71. On the other hand, regaining upward momentum might enable prices to revisit the $2.43 resistance level.

Restoring Trust Becomes Aster’s Immediate Priority

Aster needs to tackle issues related to data transparency and rebuild trust within decentralized finance ecosystems to stabilize sentiment. Effective communication from developers, along with independent verification, has the potential to alleviate investor concerns.

Clarity regarding disclosed trading metrics will be crucial for restoring trust. In the absence of it, Aster encounters ongoing doubt that could obstruct liquidity inflows and postpone significant recovery.

Aster Faces Pressure as Whale Exits Extend Downtrend With Key Support at $2.03 Zone

Experts in technical analysis warn that the recent departures of large investors and savvy market players could extend the downward trend into October. The potential for recovery in ASTER is constrained within the current trading range until new inflows materialize.

Should bullish demand return and resistance levels surpass $2.43 decisively, a more robust rebound may ensue. Currently, investors are observing if $2.03 will serve as the last line of defense before a more significant market decline towards $1.71.