Market Struggles to Sustain Momentum After Brief Price Spike

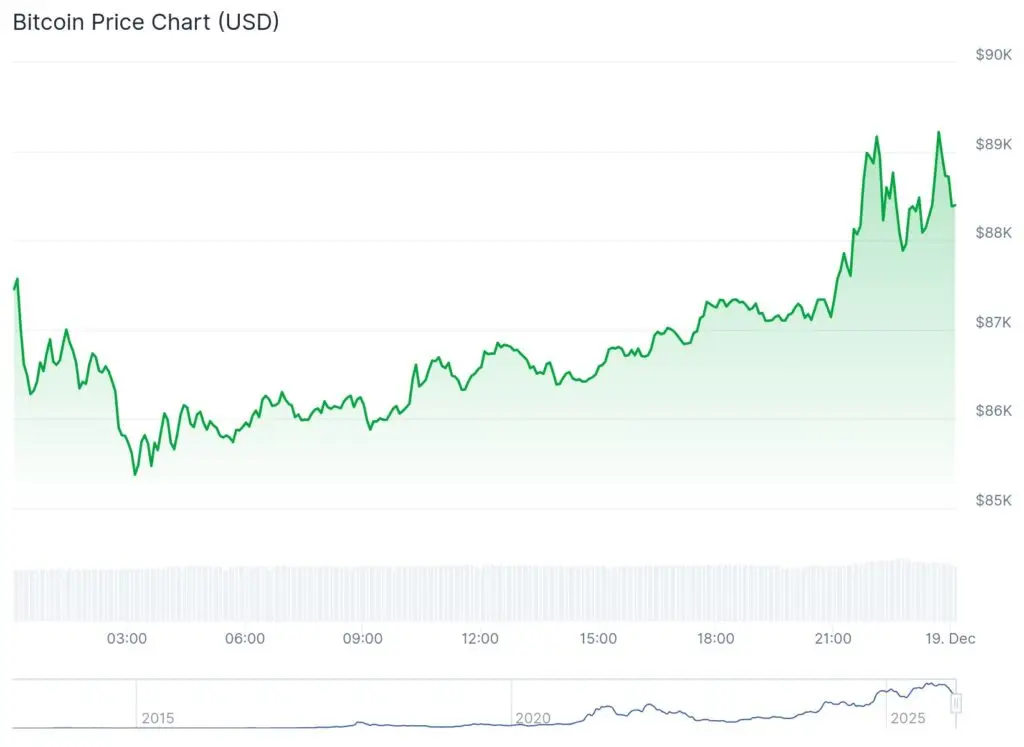

Bitcoin entered the week with cautious optimism after a short-lived rally briefly pushed prices above $90,000. The move initially sparked hopes of a seasonal recovery, but enthusiasm faded quickly as selling pressure returned and erased the gains within minutes. The rapid reversal underscored the market’s fragile condition, particularly as liquidity thins heading into the year-end holiday period.

Traders observed that Bitcoin’s inability to hold higher levels reflected deeper structural issues rather than a lack of short-term catalysts. While derivatives-driven buying created momentary upward pressure, the absence of consistent spot demand left the rally exposed. As a result, prices slipped back toward the mid-$80,000 range, where Bitcoin has struggled to establish a clear directional trend.

Spot Demand Remains Weak Despite Derivatives Activity

On-chain and market data suggest that recent price action has been driven largely by leveraged trading rather than organic accumulation. Metrics tracking cumulative volume delta indicate that buying pressure came primarily from derivatives markets, where traders increased exposure through perpetual contracts and futures. This activity created bursts of upward momentum but failed to generate sustained follow-through.

In contrast, spot market participation remained subdued. As prices climbed, spot sellers stepped in aggressively, absorbing demand and reversing the rally. This imbalance between leveraged buying and spot selling has become a recurring pattern, leaving Bitcoin vulnerable to sharp pullbacks whenever speculative interest fades.

The lack of long-term conviction among spot buyers reflects broader uncertainty about macroeconomic conditions, monetary policy, and near-term catalysts. Without renewed spot inflows, rallies are increasingly dependent on short-term trading strategies that amplify volatility rather than stabilize prices.

Dense Supply Zones Limit Upside Potential

One of the most significant obstacles facing Bitcoin is the concentration of supply held by investors currently at a loss. Analysis shows a dense band of coins acquired at higher price levels, particularly between $93,000 and $120,000. These holders are more likely to sell into rallies as prices approach their breakeven points, creating persistent resistance.

This supply overhang effectively caps upside momentum, as each attempt to move higher encounters waves of distribution. Analysts note that Bitcoin must reclaim key technical levels, including the short-term holder breakeven zone near $101,500, before a more durable recovery becomes possible.

Until then, any upward movement is likely to remain constrained, with price action characterized by sharp advances followed by equally swift reversals. The market’s inability to clear these supply walls highlights the importance of broader participation and improved sentiment.

Recommendede Article: MicroStrategy Faces Scrutiny After Costly Bitcoin Buy in 2025

Holiday Liquidity Adds to Market Fragility

Seasonal factors are compounding Bitcoin’s challenges. The holiday period typically brings reduced trading volumes, which can exaggerate price movements in both directions. In low-liquidity environments, relatively modest orders can trigger outsized swings, increasing the risk of false breakouts and abrupt sell-offs.

This dynamic was evident during the recent spike, when a burst of buying quickly lifted prices before liquidity dried up and sellers regained control. As traders scale back activity during the holidays, Bitcoin may remain vulnerable to similar episodes, with volatility driven more by market structure than fundamentals.

Macroeconomic Risks Continue to Influence Crypto Markets

Beyond internal market dynamics, external macroeconomic factors are also shaping Bitcoin’s outlook. Recent interest rate actions by the Bank of Japan have raised concerns about global liquidity conditions, particularly as shifts in traditional markets often ripple into digital assets. Historically, tightening cycles and currency adjustments have weighed on risk assets, including cryptocurrencies.

Additionally, upcoming economic data releases, such as inflation reports, could influence expectations around monetary policy. Any signs of easing inflation may provide temporary relief, but sustained upside would likely require clearer signals of broader economic stability.

Outlook Remains Cautious Into Year-End

As Bitcoin trades sideways near $86,000, the market appears stuck in a holding pattern. Support levels have so far prevented a deeper breakdown, but resistance remains firmly in place. Analysts caution that without a meaningful resurgence in spot demand, the probability of a strong year-end rally remains limited.

While short-term relief rallies are possible, particularly in response to favorable macro data, the broader picture suggests continued consolidation. For now, Bitcoin’s price ceiling remains intact, shaped by supply pressures, cautious sentiment, and thin liquidity during the holiday season.