Bitcoin Retreats After Federal Reserve Rate Cut Rally

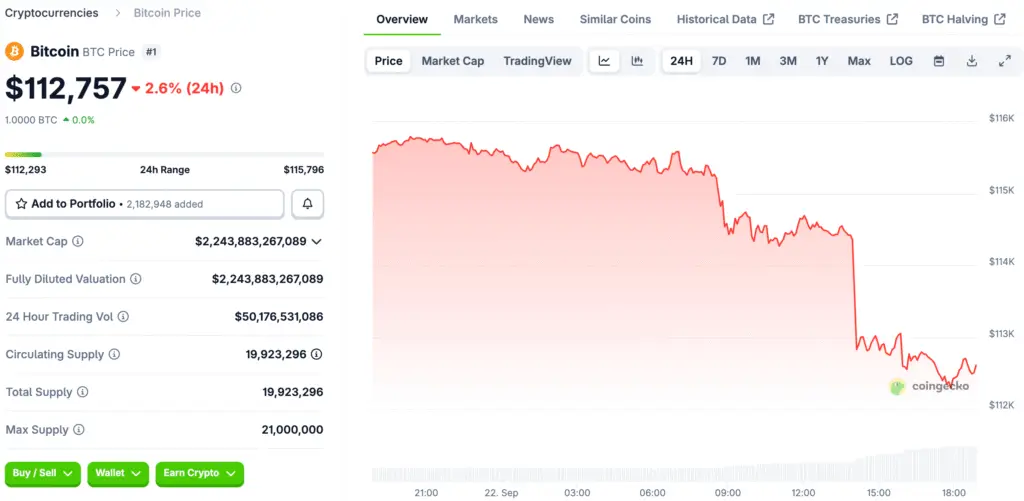

After the Federal Reserve cut interest rates for the first time in 2025, Bitcoin quickly rose to $118,000. The news made people feel good about the crypto markets at first, and Bitcoin hit a monthly high before the momentum faded quickly, leaving investors unsure about the trend.

After failing to make more gains, Bitcoin fell back to about $115,500 by Friday, September 19. Traders wondered if the drop meant there were bigger problems, but analysts said it was more likely a sign of consolidation than structural weakness in the current market cycle. Committed holders were not willing to sell their positions.

Ethereum and Altcoins Follow Downward Trend

Ethereum fell 3.3% to $4,307, showing that altcoins are getting weaker. Solana fell 3.24% and XRP fell 2.5%. Investors noticed that even though the economy was doing well, most cryptocurrencies didn’t keep going up after recent rallies, so traders were careful to cut back on their exposure. Analysts said that altcoins are still at risk when Bitcoin hesitates near important levels.

Other tokens, including smaller-cap assets, were also volatile as traders changed their minds about how much risk they were willing to take on in light of changing economic conditions. This broader weakness was a sign of waning interest, as many traders prepared for possible consolidation phases before stronger bullish continuation. As volume went down, participants stressed the need for catalysts other than changes in Federal Reserve policy.

FOMC Rate Cut Sparks Short-Lived Optimism

The Federal Open Market Committee cut rates by 25 basis points, causing Bitcoin to briefly reach $118,000. However, the market’s initial relief faded as analysts noted insufficient buying power. Short-term traders took profits at resistance levels, causing caution despite the overall economy’s good performance.

Federal Reserve head Jerome Powell called the rate cut a “risk management” decision, indicating a cautious approach to future monetary easing. Market participants believe the rate cut will slow down, reducing the likelihood of significant cuts. Traders are now waiting for more data, causing uncertainty and lower confidence in all cryptocurrencies.

Recommended Article: Bitcoin Faces Looming Death Spiral As Market Crash Fears Intensify Ahead of $25 Trillion Gold Challenge

Analysts Warn of Potential Cycle Pause

Crypto experts suggest that the recent drop in value may signal a break in the bull cycle. Analyst Rachael Lucas at BTC Markets believes investors are cautiously optimistic and holding onto their coins, while short-term traders are becoming more impatient.

Long-term holders’ conviction is strong, as on-chain indicators show wallets linked to them are not selling much. To continue moving towards new highs, Bitcoin needs to break above $124,000, and unless that happens, the market will likely remain sideways with nervous optimism dominating.

Long-Term Holders Maintain Confidence in Market

Even though prices fell over the weekend, long-term investors don’t seem to be worried and are still buying Bitcoin at lower prices. Analysts said that historical trends show that long-term holders rarely give up during shallow retracements, which makes them more resilient. This behavior backs up bullish stories by showing that corrections give investors who think adoption will continue a chance to buy more.

Reports showed that major institutional wallets were also inactive, which suggests that larger players in the ecosystem are very sure of themselves. Analysts stressed that institutional support keeps things stable and limits the potential for losses during weaker periods. As more people start using Bitcoin, the basic demand factors stay the same, which makes people more hopeful about its future.

Potential Catalysts Could Trigger Renewed Bullish Rally

Analysts predict that the market could recover with new opportunities like the allowing of Bitcoin ETFs in new locations, big companies or governments using Bitcoin as part of their reserve strategies, and positive regulatory news. These events could boost bullish confidence and push Bitcoin to new all-time highs.

Additionally, increased demand for decentralized assets like Bitcoin during global uncertainty could drive up demand, especially if fiat currencies lose value. Macroeconomic instability can benefit decentralized assets like Bitcoin by making cautious traders more willing to take risks.

Crypto Traders Show Nervous Optimism as Bitcoin Stays in Range

According to analysts who keep an eye on price action and on-chain data, the general mood in the crypto market is “nervous optimism.” Traders are still hopeful but careful, waiting for stronger breakouts before putting more money into risky positions. This careful attitude shows that the person is aware of both the chances and the dangers in the current situation.

Even though the market is still volatile, sentiment suggests that it is consolidating before trying to move up again. Experts say that nervous optimism shows that investors are being patient while they wait for more information about the economy. Bitcoin is still stuck in a range for now, but people are hopeful that bigger events will lead to more growth.