Bitcoin Bounces Back Following Market Turbulence

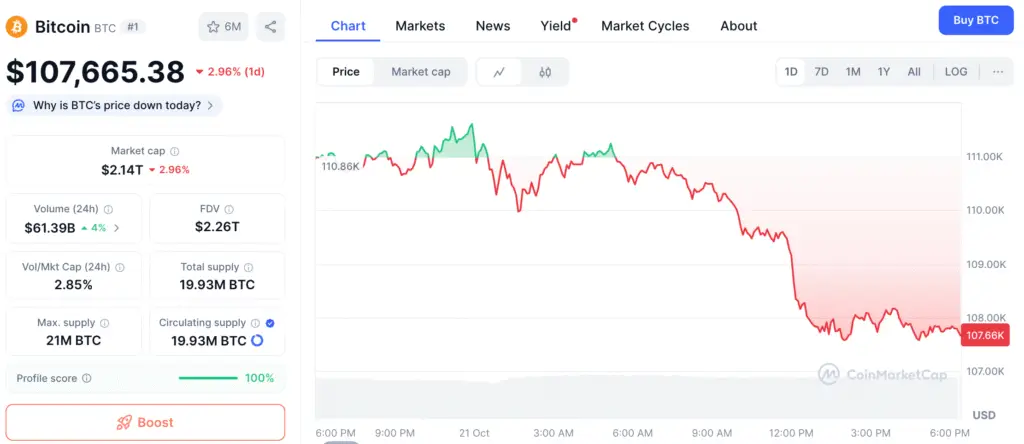

Bitcoin has surged back above $110,000 after a period of significant volatility. Investors are regaining confidence as the cryptocurrency shows resilience amid global uncertainty. Fresh buying activity has lifted Bitcoin above critical short-term levels, signaling a shift in trader sentiment. Experts believe that a new accumulation phase may be forming as prices stabilize across leading exchanges.

The latest rebound comes as investors move beyond the $19 billion liquidation wave that rattled leveraged positions. The recovery also aligns with eased trade tensions between the United States and China, following conciliatory remarks from President Donald Trump. Amid continued macroeconomic challenges, Bitcoin’s structure suggests potential for renewed momentum heading into late October.

Technical Indicators Validate Revitalized Energy

Charts indicate that Bitcoin is trading well above the lower boundary of its three-month consolidation range. The 200-day moving average now acts as a crucial support level, strengthening the medium-term bullish trend. Price action remains anchored near this area, reflecting growing conviction among buyers.

The Relative Strength Index has rebounded from oversold territory, hinting at rising momentum across multiple timeframes. However, it remains below the neutral threshold, meaning further gains will require confirmation through trading volume. Analysts are watching these signals closely to assess whether the rebound marks a lasting recovery or a temporary reaction.

Essential Support Levels That Could Safeguard the Upside

Immediate support for Bitcoin is located near the $100,000 psychological mark, which coincides with trading activity from previous market cycles. This level has often sparked major recoveries during past downturns, making it crucial for sustaining optimism among traders.

A deeper correction could test secondary support around $93,000, aligning with last year’s consolidation floor. Many long-term investors see this region as a strategic accumulation zone, supported by increased buying pressure. Sustaining strength within these areas will be vital to preserving the market’s structural integrity.

Recommended Article: Bitcoin Price Tests $112K as Traders Watch Key Breakout Zone

Potential Barriers That May Limit Bitcoin’s Surge

Traders are now focused on the $117,000 resistance level, which aligns with the 50-day moving average. This area has repeatedly served as both a barrier and a consolidation point across different cycles, making it a key short-term target.

A confirmed breakout above $117,000 could clear the way for a move toward $123,000, representing the upper edge of the recent range. This zone corresponds to the peaks reached in July, August, and October, reinforcing its technical significance. Surpassing it would validate a bullish reversal pattern and potentially spark an extended rally.

Bitcoin Builds Foundation for Potential Surge Toward Previous Highs

Analysts note that Bitcoin’s current setup mirrors consolidation phases that preceded earlier bull markets. Periods of low volatility near key supports have historically foreshadowed strong upside moves. If this trend continues, Bitcoin could aim for a climb toward prior highs before the year ends.

Even so, external influences such as central bank policy shifts and new regulatory measures could affect short-term direction. Traders are encouraged to maintain discipline and patience while managing risk in the evolving environment.

Institutional Involvement Keeps Growing

Institutional appetite for Bitcoin remains firm despite short-term dips. Wallet data shows that long-term holders continue to accumulate, undeterred by recent price swings. This steady inflow of capital reinforces confidence in Bitcoin’s long-term fundamentals.

On-chain analytics also reveal consistent outflows from exchanges into cold storage, showing a clear move toward holding over short-term trading. This accumulation trend typically signals growing conviction among large investors and often precedes renewed upward movement.

Analysis of Bitcoin’s Prospects as We Approach Late 2025

Bitcoin’s performance in the fourth quarter of 2025 will likely depend on broader economic stability and global liquidity conditions. Analysts expect more consolidation before a potential surge toward $123,000, driven by renewed buying strength. The crypto market could also benefit from improved sentiment as trade relations stabilize and policy clarity increases.

Overall, Bitcoin’s setup remains constructive, with firm support near $100,000 and rising resistance above $117,000. If the recovery maintains its pace, a breakout beyond the upper range could push the price toward $130,000, reinforcing Bitcoin’s dominant position in the digital asset landscape.