Dogecoin Price Recovers After Market-Wide Correction

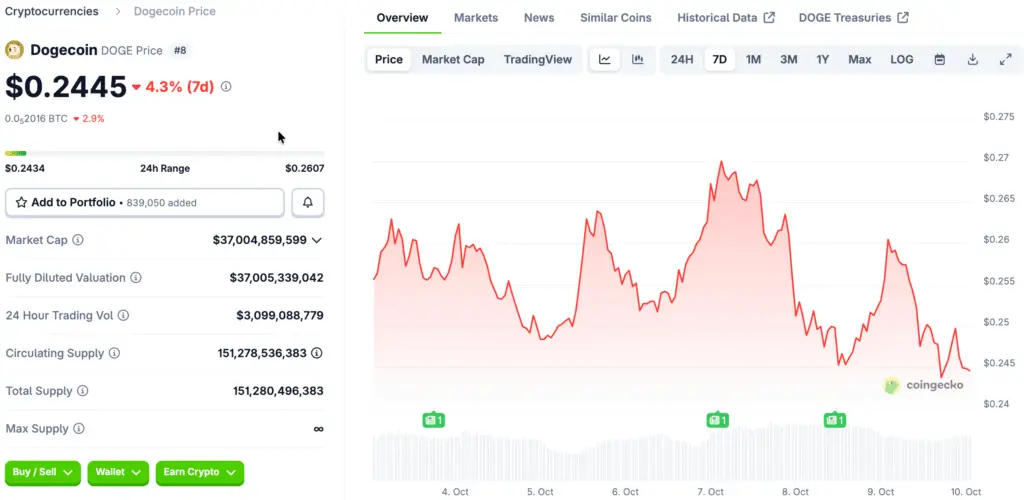

After erratic market swings that first wiped out its early October gains, Dogecoin saw a modest recovery this week. Echoing the larger crypto slump seen across altcoins, the meme token’s 7% spike was swiftly followed by a comparable decrease.

However, Dogecoin’s price recovered by 1.08% in the most recent 24-hour period, reaching $0.2490, or around IDR 4,122. Amid a cooling mood, traders changed their holdings, causing trading activity to vary between IDR 4,059 and IDR 4,324.

Whale Activity Highlights Growing Accumulation Trend

Dogecoin wallets with between 10 million and 100 million tokens have a discernible accumulation tendency, according to on-chain statistics. Within a week, the combined holdings of these mid-sized investors grew from 24.20 billion DOGE to 24.33 billion DOGE.

Growing institutional engagement and market optimism are reflected in this accumulation of almost 130 million DOGE, or about $32 million. Historically, possible short-term stability and subsequent momentum returns are frequently preceded by consistent whale purchasing.

Dogecoin Exchange Balances Surge to 17.7% Signaling Caution Among Traders and Whales

Even while whale activity is promising, growing DOGE exchange balances show traders are being cautious. According to Glassnode statistics, 17.7% of the whole supply is presently on exchanges, which is close to multi-year highs.

Given that major declines were preceded by prior exchange balance maxima, this level is noteworthy. Remaining downside risk was indicated by similar readings in April 2024 and December 2024, which resulted in 55% and 65% drops, respectively.

Recommended Article: Dogecoin Price Rally To $10 Is ‘All Math’, But Paydax (PDP) Rally From $0.015 To $80 Will Be Smooth; Analyst

Price Charts Indicate Correction Fatigue Emerging

Dogecoin is trading above ascending support in a rising wedge formation on four-hour technical charts. Buyers are defending $0.246 as a temporary floor, as confirmed by recent price swings around that level.

A possible short-term comeback is supported by a concealed positive divergence between the Relative Strength Index and price activity. As buyers subtly recover dominance inside the present consolidation range, this divergence suggests that selling pressure is waning.

Dogecoin Price Outlook Defined by Key Support Levels

The $0.246 range is anticipated by analysts to serve as a crucial pivot for anticipating future changes in momentum. Before the next resistance barrier, holding this support may cause the price to rise toward $0.257, $0.270, and perhaps $0.278.

However, if support is not maintained below $0.246, downside exposure may be exposed to $0.234 or perhaps $0.226. In that scenario, short-term session volatility may be increased by profit-taking from large exchange balances.

Market Sentiment Balances Between Confidence and Caution

At the moment, the Dogecoin market exhibits a precarious equilibrium between profit-driven retail players and whales who are hoarding. Whale holdings indicate long-term conviction, but short-term risk remains high due to a heightened exchange supply.

Investor sentiment is still split, with cautious traders watching for profit exits and confident investors anticipating steady gain. Extreme directional swings are constrained by this dynamic interaction, which also determines the market’s present equilibrium phase.

Dogecoin’s Prospects Are Still Cautiously Positive

Despite recent volatility, Dogecoin’s structural resilience endures, as accumulation tendencies balance out short-term negative technical patterns. Historical resiliency combined with consistent whale purchase points to a reasonable chance of recovery in the future.

However, reduced exchange balances and a general improvement in cryptocurrency mood are necessary for long-term growth. Dogecoin may regain equilibrium and get ready for a fresh upward trajectory if whales continue to gain momentum as retail flows resume.