XRP’s Price Surge Sparks Renewed Attention

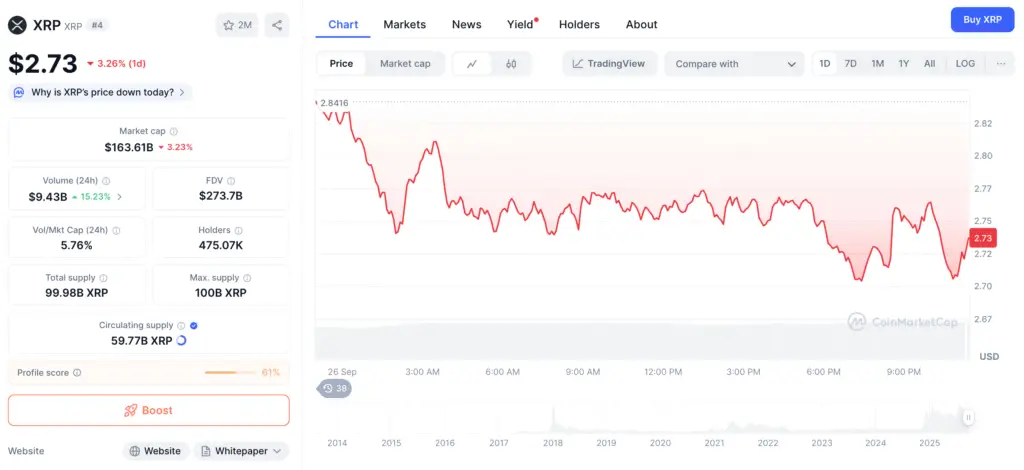

After years trading below $1, XRP has staged a stunning comeback. Over the past year, the token surged 385% as of September 23, outpacing Bitcoin, Ethereum, and other top ten cryptocurrencies.

Despite this rally, growth momentum has recently slowed, leaving investors questioning whether XRP can sustain long-term value. Much of the renewed interest has been tied to the election of President Donald Trump and Ripple’s legal victory over the U.S. Securities and Exchange Commission (SEC).

RippleNet: The Network Behind XRP

Ripple, the blockchain payments company behind XRP, developed RippleNet as an alternative to the SWIFT system for cross-border payments. Using RippleNet, international transfers can settle in three to five seconds, often at a fraction of traditional costs.

At the heart of this system lies XRP, which powers RippleNet’s on-demand liquidity (ODL). With XRP as a bridge currency, banks can avoid maintaining pre-funded accounts in multiple currencies, streamlining global transfers.

Limited Adoption by Major Financial Institutions

The challenge for XRP is that adoption among large banks remains limited. While over 300 financial institutions reportedly use RippleNet, few rely on XRP itself. Many major banks can still execute transfers without ODL, reducing the necessity of XRP for their operations.

This means RippleNet could expand globally without significant demand for XRP. For investors, the key risk is that Ripple’s business success doesn’t always translate into utility for the token.

Recommended Article: XRP Positioned as the Future of Payroll in a Digital Economy

What Drove XRP’s Growth in 2025

XRP’s sharp price gains in the past year were largely fueled by external factors. First, the resolution of Ripple’s long-standing SEC battle removed a cloud of uncertainty. Second, Trump’s pro-crypto stance reignited market optimism and attracted new buyers into XRP.

However, both of these drivers are sentiment-based rather than adoption-based. Without deeper integration into global financial flows, XRP’s growth story could stall.

Institutional Adoption Will Be the Deciding Factor

For XRP to secure its future, increased institutional adoption is critical. If more banks and payment providers adopt ODL for real settlement needs, XRP could see sustained demand. Broader integration into cross-border remittances and payroll systems could also strengthen its case.

Conversely, if RippleNet expands without XRP usage, the token risks becoming a speculative asset detached from Ripple’s enterprise success.

Risks and Considerations for Investors

Investors should weigh several risks when considering XRP:

- Adoption Gap: Limited use of XRP despite RippleNet’s growth.

- Competition: Stablecoins and central bank digital currencies (CBDCs) may serve similar payment functions.

- Regulatory Shifts: While Ripple’s SEC victory was positive, future policy changes could alter its trajectory.

- Speculative Volatility: Much of XRP’s rally has been sentiment-driven, leaving it vulnerable to sharp corrections.

Final Thoughts: Can XRP Deliver on Its Promise?

XRP has proven its resilience, staging one of the strongest rallies of 2025. Yet its long-term success depends less on speculation and more on whether Ripple can push meaningful XRP adoption among global financial institutions.

For now, XRP represents both promise and uncertainty. Investors should monitor adoption metrics closely, as these will determine whether XRP can evolve from a speculative asset into a cornerstone of international finance.