Ethereum Experiences Brief Setback Following Tariff Surprise

The recent implementation of tariffs by former U.S. President Donald Trump has caused Ethereum’s momentum to falter, leading to a resurgence of volatility in global markets. ETH was experiencing consistent upward momentum until the tariff escalation prompted a wave of profit-taking among traders.

At present, Ethereum is trading under $3,900, having transformed its previous support level into resistance, suggesting a potential short-term bearish trend. Experts anticipate a decline to around $3,000, which may act as a solid accumulation area prior to the onset of the next significant bullish movement.

Support Levels Shape Ethereum’s Short-Term Perspective

The $3,000 region continues to be a crucial technical point for Ethereum enthusiasts, as it signifies a historically robust support level. Market analysts highlight that a consistent rise above $4,800 could trigger a rapid surge toward $10,000 in the upcoming market cycle.

Even with the recent slowdown, there is a persistent rise in institutional interest, especially from funds seeking to build long-term positions in decentralized finance and Layer-1 networks. The prevailing opinion indicates that Ethereum’s recent correction could present strategic opportunities for investors who exercise discipline.

Mutuum Finance Presale Sees Increased Activity in Q4

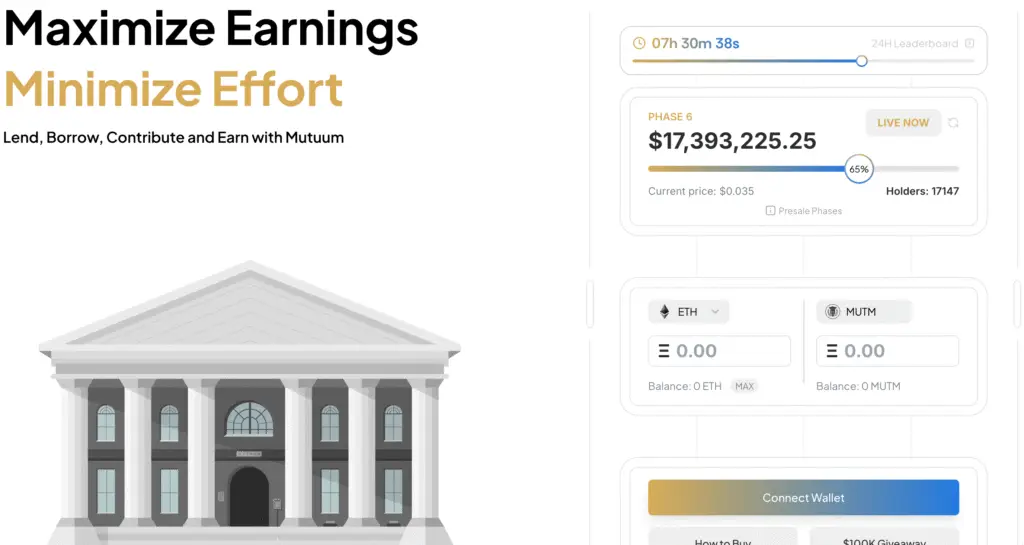

As Ethereum stabilizes, Mutuum Finance (MUTM) is swiftly emerging as one of the most talked-about DeFi projects of 2025. The presale for Phase 6 of the project has exceeded $17.3 million in funding, drawing in over 17,000 investors from around the globe.

This increase highlights the market’s trust in Mutuum Finance’s ability to bring forth innovation and sustainability within decentralized finance. The ecosystem presents a clear and flexible framework aimed at enduring price fluctuations while ensuring steady liquidity and stability.

Recommended Article: Ethereum Price Holds Strong as Mutuum Finance Presale Surges Globally

Risk Management Features Reinforce Investor Confidence

Mutuum Finance incorporates a smart Loan-to-Value (LTV) mechanism along with an automated liquidation system designed to safeguard against volatility. These features respond dynamically to market shocks, guaranteeing platform resilience even amidst unpredictable price fluctuations.

The platform utilizes reserve multipliers that vary between 10% and 35%, adjusted based on the levels of collateral risk. This multi-faceted strategy enhances safety for participants and fosters lasting confidence among investors.

Measures for Safety Enhance the Mutuum Ecosystem

Security stands as a fundamental element of Mutuum Finance’s framework. The initiative introduced a Bug Bounty Program with a budget of 50,000 USDT, encompassing four classification tiers: critical, major, minor, and low.

This initiative promotes testing led by the community and fosters transparency, all while strengthening the platform’s overall resilience. Mutuum’s open architecture and security-by-design principles reflect its commitment to creating a stable, secure, and scalable DeFi environment.

Borrowing and Lending Protocol Launches in Q4 2025

Mutuum Finance is preparing to launch its Version 1 lending and borrowing protocol on the Sepolia Testnet in the fourth quarter of 2025. The upcoming update will bring essential DeFi functionalities, such as liquidity pools, mtTokens, debt tokens, and an automated liquidator bot.

On the first day, users will have the ability to lend, borrow, and use assets like ETH and USDT as collateral. The system is designed to deliver a streamlined, unrestricted experience that serves both institutional investors and regular crypto users looking for passive income options.

Mutuum Finance Set to Emerge as a Major Force in DeFi

With Ethereum finding stability amidst short-term challenges, the ascent of Mutuum Finance highlights the increasing trend towards innovative and risk-managed decentralized finance protocols. The project has successfully completed over 65% of its Phase 6 presale, showcasing robust support and a growing confidence among investors.

The integration of sophisticated risk mechanisms, thorough audits, and a flexible architecture sets Mutuum Finance apart as a strong contender for the upcoming significant DeFi breakthrough. Early adopters see this as a crucial chance to get involved before listings drive its market valuation even higher.