Market Opens Week With Broad Declines

The crypto market opened the week with sharp losses, sending top assets to multi-week lows. Bitcoin (BTC) briefly dropped to $111,986, its lowest since September 10. Ethereum (ETH) fell to $4,059, marking its weakest level in over a month, before stabilizing near $4,200.

Traders say the drop highlights renewed uncertainty around macroeconomic pressures and interest rate speculation.

Altcoins Join the Slump

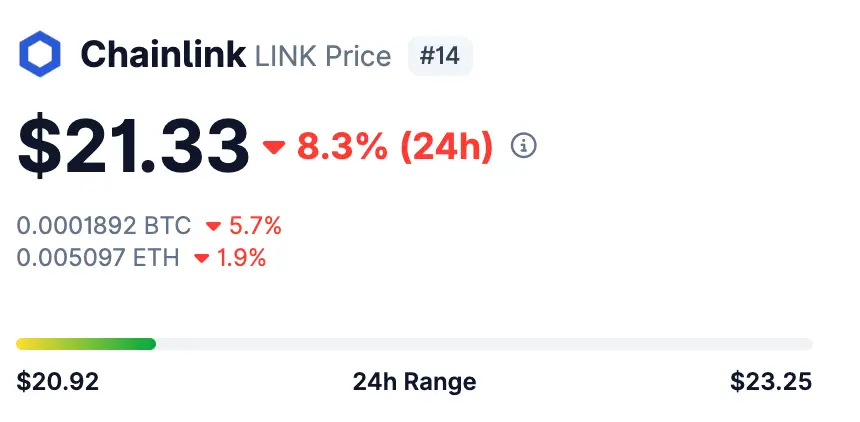

The broader altcoin market was not spared. High-cap tokens including Dogecoin (DOGE), Cardano (ADA), and Chainlink (LINK) recorded steep daily declines of 11.4%, 9.8%, and 8.3%, respectively. Overall, the global crypto market cap sank below $4 trillion, reflecting widespread bearish sentiment.

This synchronized decline shows how quickly investor confidence can evaporate across the altcoin sector.

Mass Liquidations Across the Market

The plunge triggered over $1.7 billion in liquidations, wiping out leveraged positions from more than 406,000 traders. According to Coinglass, longs accounted for $1.62 billion of the total liquidations, showing the scale of the selloff.

Analysts warn that heavy reliance on leverage continues to amplify volatility during market downturns.

Recommended Article: XRP Surpasses Bitcoin on Upbit as ETFs and Futures Fuel Historic Market Shift

Manipulation Allegations Surface

The sudden sweep raised speculation of manipulation. Popular commentator Marty Party alleged that centralized exchanges profited heavily from the crash.

Such accusations are not new, but they add to ongoing concerns about transparency in derivatives markets.

Investor Sentiment and Next Steps

Despite the shakeout, some traders see this as a healthy reset before another leg up. Others remain cautious, warning that continued volatility could pressure even strong assets if macroeconomic headwinds persist.

Sentiment indicators show fear rising across retail circles, but opportunistic buyers may be preparing to re-enter at lower levels.

Outlook for the Market

Despite the steep declines, analysts note that such liquidations are not unusual during heightened volatility. With Bitcoin consolidating near $112K and Ethereum steadying below $4,200, traders are watching closely to see if this flush sets the stage for a rebound—or signals deeper corrections ahead.

Much will depend on macro conditions and whether buyers step in to defend current support levels.