A Quiet Power Shift in the PEPE Ecosystem

The Pepe meme coin ecosystem is currently undergoing a quiet but powerful power shift, driven by a surge in whale accumulation. Over the past month, on-chain data shows that whale holdings of PEPE have increased from 8.76 trillion to 9.22 trillion tokens, a clear indication of strategic buying by large-scale investors. A notable example is a single whale who purchased 178.9 billion PEPE for $2 million in just 24 hours. This particular whale has a history of successful PEPE trades and returned after a five-month hiatus, adding a total of 1.31 trillion tokens at an average cost of $0.00001683.

This persistent accumulation, even in the face of a significant price drawdown, signals a deep-seated belief in a potential rebound. The broader picture is equally compelling, with the top 100 PEPE holders collectively increasing their stakes by 1.50% in a single month. This trend is accompanied by a drop in the supply of PEPE held on exchanges, which indicates that tokens are being moved to cold storage and taken off the market, creating a supply squeeze.

Analyzing the Technical Triangle of Opportunity

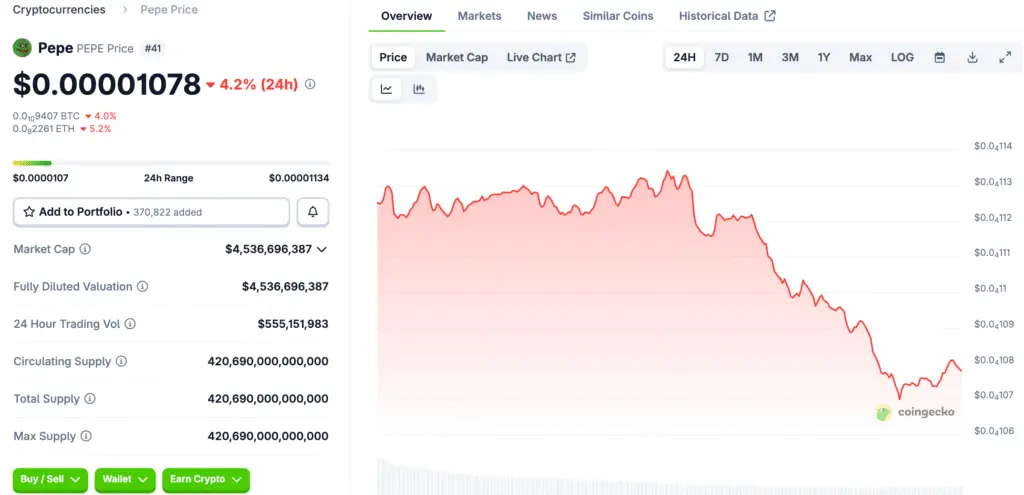

Beyond the on-chain data, the price action for Pepe paints a textbook picture of an accumulation phase. The token has been consolidating within a symmetrical triangle on the daily chart since early May. This pattern is a powerful indicator for traders, suggesting that a major price movement is imminent. The apex of this triangle is near $0.00001366, and a breakout above this level could trigger a significant surge.

While a conservative estimate points to a 65% price jump, the measured move from the triangle’s structure suggests a potential upside of up to 99%, with a target of $0.00002273. The symmetrical triangle represents a period of indecision, where the market is coiling before a decisive move. The convergence of this pattern with strong whale accumulation creates a high-probability setup for a bullish breakout.

Understanding the Broader Meme Coin Market Context

Pepe’s recent price action is best understood within the broader context of the meme coin market. The token has underperformed against the rest of the crypto market, down 30% from its yearly peak. This divergence often precedes sharp rebounds, as capital rotates from high-performing assets into under-the-radar projects that have yet to rally.

While the CoinDesk Memecoin Index has recently fallen, Ethereum’s overall rally toward new all-time highs has drawn attention to its native meme tokens, including Pepe. This market dynamic suggests that while the broader meme coin market may be cooling, there is a selective rotation of capital into projects with strong on-chain fundamentals. Whales are betting on a correction in Pepe’s valuation, as they believe the token is currently undervalued relative to its potential.

Read More: The Rise of a Meme Coin: An Analysis of the Pepe Market

The Strategic Moves of High-Profile Investors

The actions of whales are not random; they are strategic moves based on extensive market analysis. The return of a historically successful whale to accumulate more PEPE tokens is a powerful signal that should not be ignored. It suggests that these sophisticated investors believe the token is at a critical inflection point and that the risk-reward ratio is highly favorable.

This type of high-conviction buying, which is often done quietly and on a massive scale, can create a ripple effect in the market. When retail investors see these large-scale movements, it can ignite a new wave of buying pressure, further propelling the price upward. The fact that the top 100 holders are also increasing their stakes confirms a collective belief among the most influential players in the market.

Why Market Divergence Precedes Sharp Rebounds

The concept of market divergence is a key tenet of technical analysis. When an asset underperforms its peers, it often creates a coiled spring effect. The recent underperformance of Pepe, down 30% from its yearly peak, has created a significant divergence with the rest of the crypto market. This divergence suggests that the token is due for a sharp rebound to catch up with the broader rally.

The convergence of this market behavior with strong on-chain accumulation and a clear technical pattern creates a powerful case for a near-term price surge. For a trader, a divergence like this can be a signal of a high-probability entry point, as it suggests that the token is primed for a move to close the gap with its peers.

A Clear Investment Thesis for Traders

For investors looking to capitalize on this potential opportunity, the investment thesis is clear. The ideal entry point would be a confirmed breakout above the key resistance level of $0.00001250, accompanied by strong trading volume. A stop-loss order placed below the $0.00001050 support level would help to manage risk and protect against a failed breakout.

The primary target for this trade is the triangle projection of $0.00002273, with a more conservative interim target at $0.00001600. It is crucial to wait for volume confirmation to ensure that the breakout is genuine and not a false signal. The confluence of whale accumulation and technical signals creates an asymmetric risk-reward ratio, making this a highly compelling trade setup.

Pepe: A Battleground for Institutional Capital

Pepe is no longer just a speculative meme coin; it has become a battleground for institutional capital and a key player in the dynamic Ethereum ecosystem. The convergence of whale accumulation, technical structure, and market sentiment points to a near-term catalyst that could propel the token to new highs.

The question isn’t whether Pepe can surge but whether traders will be positioned to ride the wave when it arrives. As the market continues to evolve, Pepe’s ability to attract both a strong community and sophisticated institutional interest will be a key factor in its long-term success. The current setup suggests that the token is primed for a significant move that could redefine its role in the meme coin landscape.