Memecoins Struggle Amidst Market Turmoil

The recent downturn in the cryptocurrency market this October has caused significant upheaval, erasing almost $19 billion in leveraged positions in a matter of hours. Among the most severely affected are memecoins, with Pepe (PEPE) at the forefront of the downturn. The token’s price plummeted by almost 80%, wiping out months of speculative profits and unsettling investor confidence.

In various online forums, traders are voicing their doubts regarding whether this downturn signifies a short-lived adjustment or the onset of a lengthy downward trend. The atmosphere around memecoins is tenuous, as investors express doubts about the long-term viability of valuations fueled by hype.

Pepe Price Action Reflects Technical Breakdown

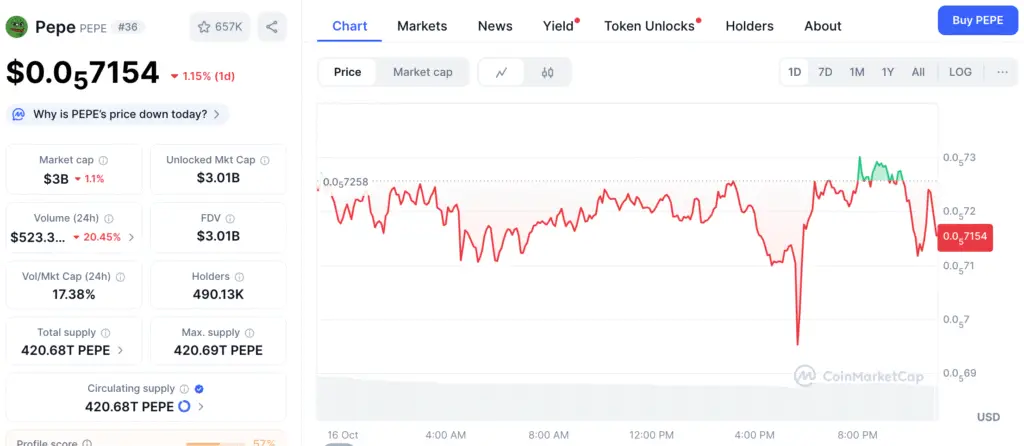

Pepe’s technical framework reveals a warning about diminishing bullish momentum and a decline in confidence. After a significant 35% decline and a short-lived rebound, the coin faced an additional 77% plunge, bringing its value down to approximately $0.00000725.

The token currently trades significantly beneath its 50-day moving average at $0.00000969, a benchmark considered crucial for validating any potential trend reversal. Experts caution that not recovering this level may extend downward pressure throughout the wider memecoin market.

Analysts Identify Key Inflection Point for Pepe

Technical expert Davie Satoshi characterizes Pepe’s situation as a pivotal “inflection point.” He presents two possible trajectories: an optimistic outlook resulting in a swift recovery or a pessimistic trend that exacerbates market declines.

The future is heavily influenced by the availability of funds in the market and the mindset of investors. To regain its strength, Pepe must draw in consistent inflows while maintaining stability amidst the overall decline in confidence across altcoins.

Recommended Article: PEPE Price Weakens as Market Jitters Erode Whale Confidence

Whale Movements Intensify Selling Pressure

Recent fluctuations have been heightened by significant movements from major stakeholders, who have transferred considerable amounts to exchanges in the last week. The recent wave of profit-taking activities has led to a reduction in liquidity, increasing market volatility and prompting further sell-offs.

As Pepe’s market capitalization stands at approximately $2.85 billion, even slight movements from large investors can lead to significant fluctuations in price. The trend highlights the significant impact of concentrated ownership in the memecoin landscape.

Broader Memecoin Sentiment Mirrors Pepe’s Struggles

Pepe frequently serves as an indicator of the speculative interest in smaller-cap assets. The persistent fragility has reverberated throughout the memecoin landscape, stifling excitement for alternative tokens and constricting overall liquidity.

Market analysts indicate that a prolonged recovery in Pepe might spark renewed enthusiasm throughout the sector. For the time being, a careful outlook prevails, with traders adopting a protective stance in the face of ongoing price fluctuations.

Historical Trends Provide Insights into Rebound

Even in the face of the current downturn, history indicates that recoveries in the memecoin market can happen swiftly when sentiment changes. In past instances, significant declines frequently came before rapid recoveries fueled by revitalized community involvement and viral energy.

Pepe’s community continues to engage vigorously on social platforms, indicating that the project maintains its cultural significance. This involvement may lay the groundwork for potential recoveries should broader economic conditions enhance.

Charting the Course Ahead for Pepe

As Q4 progresses, Pepe’s tenacity will be pivotal in shaping the trajectory of the memecoin arena. A rebound past the $0.00000969 mark may bolster confidence and pave the way for ongoing liquidity inflows.

On the other hand, ongoing weakness could prolong the consolidation phase and reduce speculative interest. For investors, the ability to adjust and a keen understanding of technology are crucial assets in maneuvering through this unpredictable yet vibrant segment of the crypto market.