Polkadot Community Shows Early Enthusiasm

A big proposal for how to run Polkadot has gotten a lot of attention from the community. Bryan Chen, one of the founders of Acala, recently came up with a plan to launch pUSD, an algorithmic stablecoin backed by DOT that is meant to make Polkadot’s finances more independent. Voting data shows that there is a lot of early support, which means that the ecosystem is very excited.

More than 75% of people who voted in the first rounds of voting have supported the initiative, putting up more than 1.4 million DOT tokens worth about $5.6 million. With only 24 days left to vote, more and more people are showing their support for a native stablecoin solution that makes people less dependent on centralized options.

Proposal Targets External Stablecoin Dependencies

Polkadot currently relies a lot on stablecoins like USDT and USDC, which are both issued by centralized groups. Because of this reliance, liquidity and security benefits go to external platforms instead of Polkadot’s own ecosystem. Chen wants to change that trend by making stablecoin useful within Polkadot itself.

The addition of pUSD would create a financial layer that could run on its own and be fully managed on-chain. This change in strategy could make the ecosystem more stable, stop capital from leaving, and keep the value of transactions moving around in Polkadot’s network.

Polkadot pUSD Stablecoin to Leverage Acala’s Honzon Protocol Design

The proposed pUSD stablecoin would use Acala’s Honzon protocol, which is a system made for decentralized stablecoins and debt positions that are backed by collateral. The only collateral for pUSD would be DOT tokens, which would make sure that it was closely linked to Polkadot’s economic base.

Users could create stablecoins by putting DOT in overcollateralized positions, which would help keep the system stable. A savings module that holders could choose to use would let them lock up their pUSD and earn interest through stability fees. This would encourage people to stay involved and provide liquidity over the long term.

Recommended Article: Meet Gavin Wood: Ethereum and Polkadot Co-Founder Who Coined Web3

Algorithmic Approach Offers Benefits and Risks

Unlike centralized stablecoins, pUSD would keep its dollar peg through smart contracts that create economic incentives. The protocol would not use third-party custodians or intermediaries at all; instead, it would use only on-chain assets and automated processes.

This algorithmic model allows for decentralization and innovation without permission, but it also has a lot of history behind it. The failure of TerraUSD in 2022 showed that poorly designed systems can be weak, which raised concerns that still shape how regulators and the community see things today.

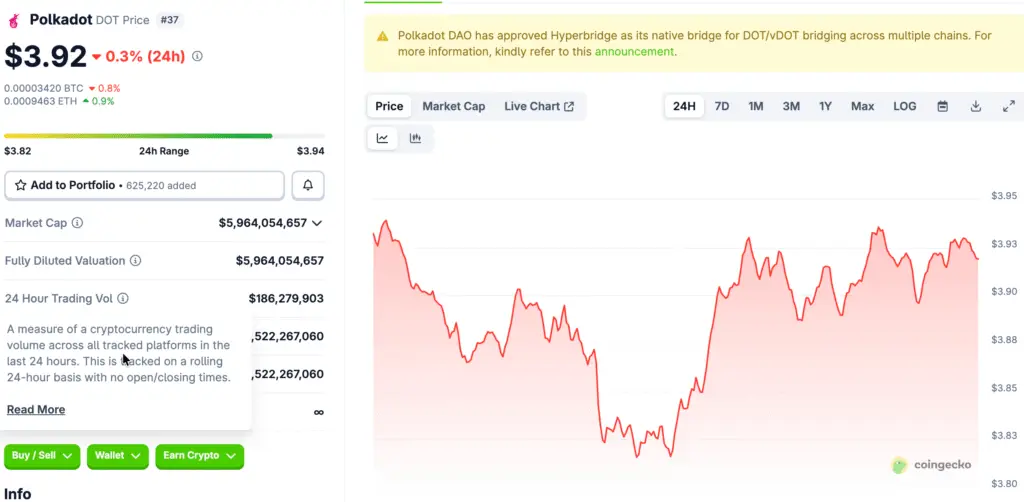

Polkadot Market Mirrors Industry as Stablecoin Flows Drive Ecosystem

Stablecoins are still an important part of the crypto ecosystem because they make trading, lending, and cross-chain activity possible. Polkadot could make more money by creating its own stablecoin. This would improve liquidity and lower the risk of regulatory issues that come with centralized issuers.

The way Polkadot’s market is set up right now is similar to how the rest of the industry is going, where stablecoin flows have a big impact on ecosystem growth. A well-implemented DOT-backed stablecoin could change these dynamics and make Polkadot a more independent financial network.

Regulatory Effects Are Lurking In The Background

Algorithmic stablecoins often work outside of normal regulatory systems, which is why they are sometimes called “dark stablecoins.” Because they are decentralized and don’t need permission, it can be harder to follow sanctions and keep an eye on finances.

Ki Young Ju, the CEO of CryptoQuant, has said before that these kinds of systems may exist outside of normal ways of enforcing the law. This feature makes the system more stable, but it could also make regulators more interested in keeping an eye on algorithmic monetary systems.

Polkadot Stablecoin Proposal Gains Momentum Ahead of Final Approval

There are still weeks left in the voting period, but the proposal’s momentum suggests it will likely be approved. If it works, the next steps will be development and deployment, which could make pUSD a key part of Polkadot’s financial stack.

The project is a big step forward for the network, balancing technological goals with economic goals. In the next few weeks, the community will make decisions that will decide if Polkadot can successfully launch its first major native stablecoin and set a new path for the ecosystem to become self-sufficient.