Ripple Strengthens Institutional Presence With New Innovations

Ripple is enhancing its influence in international financial systems by incorporating artificial intelligence into its XRP Ledger, which optimizes fraud detection and transparency while supporting compliance. This strategic move is attracting institutional investors seeking reliable blockchain solutions, resulting in increased confidence from major financial institutions worldwide.

Following Ripple’s legal victory over the SEC, market optimism has surged regarding its regulatory position, bolstered by initiatives for ETF approvals and a federal trust bank charter. These developments have kept XRP trading above $2.81, with analysts predicting a potential increase to $3.10 as trading momentum builds.

Institutional Interest Reinforces Ripple’s Global Position

Ripple’s advancement into AI-driven transaction monitoring is in harmony with its overarching objective of bridging blockchain systems and traditional finance. Investors view this integration as a strategic move aimed at enhancing long-term scalability and ensuring institutional reliability across various markets. Ripple’s dedication to innovation enhances its significance as regulated adoption grows worldwide.

Observers of the market suggest that XRP’s stable technical groundwork reflects ongoing investor trust, even during times of short-term fluctuations. Traders emphasize XRP’s ability to maintain elevated support levels even amidst recent volatility. This stance reinforces Ripple’s standing as one of the most resilient networks in the changing PayFi environment.

Remittix Emerges as PayFi Solution for Global Consumers

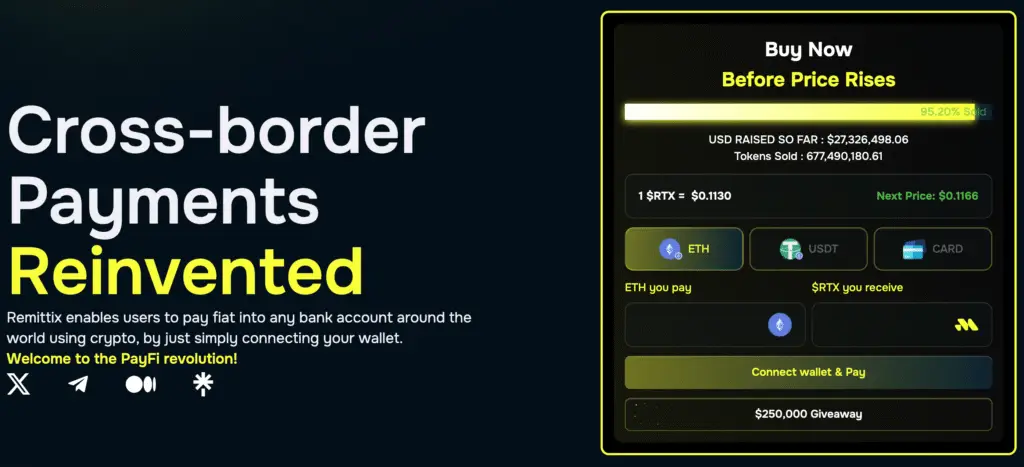

As Ripple focuses on attracting corporate clients, Remittix establishes itself as a PayFi bridge that facilitates direct transactions for everyday users. This initiative facilitates effortless transfers from cryptocurrency to bank accounts in over 30 nations, combining the rapidity of blockchain technology with practical accessibility in the real world. The emphasis on global inclusivity sets it apart as a practical platform for decentralized finance.

Remittix’s wallet beta enables immediate cross-border transfers, establishing a benchmark for innovative DeFi payment solutions of the future. The project’s verified team holds the top position on CertiK’s Pre-Launch leaderboard, indicating outstanding credibility and transparency. The strategy combines cutting-edge ideas with real-world application, guaranteeing enduring stability as its network grows swiftly across the globe.

Recommended Article: Remittix, Shiba Inu, and AVAX Drive PayFi Growth Globally

Key Features Drive Investor Confidence in Remittix

Remittix has garnered considerable interest from investors due to its robust fundamentals and a variety of reward mechanisms. The tokenomics feature deflationary models aimed at stabilizing supply and rewarding dedicated holders for their ongoing involvement. This framework bolsters the platform’s enduring viability and fosters the potential for natural price appreciation.

The daily 15% USDT referral reward program during the presale enhances engagement and fortifies community involvement. The confirmed listings on BitMart and LBank indicate a strong preparedness for extensive liquidity as trading is set to commence. These advancements bolster Remittix’s reputation as a PayFi ecosystem that is both community-focused and secure for investors.

Rapid Growth Mirrors Ripple’s Early Expansion Trajectory

Over 677 million tokens have been sold at $0.1130 each, generating over $27.2 million in presale funding, which experts attribute to Ripple’s early momentum and increased institutional partnerships. The market recognizes Remittix’s scalable architecture and user-friendly transaction framework, distinguishing it from speculative tokens.

Initial backers view this as a positive indicator for market development and growth potential driven by demand. Remittix’s combination of practical applications and transparent verification enhances its operational readiness to engage with mainstream PayFi networks.

Long-Term Outlook Suggests Competitive Advantage by 2030

Analysts project that Remittix could surpass Ripple in community growth by offering financial access solutions tailored to user needs. Its PayFi infrastructure facilitates inclusivity for unbanked individuals and improves global remittance efficiency. This approach aligns with the evolving global landscape that underscores the need for accessible and compliant tools in decentralized finance.

The project’s deflationary supply model, coupled with ongoing global adoption, leads to expectations of considerable value appreciation by 2030. Such developments may enable Remittix to emerge as a leading altcoin, delivering real-world benefits and representing a new wave in decentralized finance with its blend of practical and scalable features.

Investors Anticipate Life-Changing Opportunities Ahead

Remittix’s rapid progress marks a pivotal change in the cryptocurrency sector, reflecting the rise of inclusive PayFi platforms that integrate both digital and traditional finance. This development mirrors Ripple’s achievements and extends its advantages to users globally, highlighting the increasing demand for accessible international financial systems.

As the presale approaches its end, community enthusiasm is rising for forthcoming exchange listings and global integrations. Investors recognize that projects showcasing tangible real-world adoption often outperform speculative trends over time. Remittix prioritizes usability and transparency, positioning itself as a potential leader in transforming financial connectivity.