SEC Flags Illegal Bitcoin Investment Operations

The Securities and Exchange Commission (SEC) in Butuan City has issued an urgent public warning about two unregistered investment operations preying on residents across the Caraga region. Officials identified a certain Christabel Arroyo and an entity known as De Guzman Consumer Goods Trading as operators of unauthorized investment solicitations. Both promise unrealistic profits through Bitcoin trading and consumer goods ventures, luring victims through social media. The agency emphasized that neither party holds licenses or registrations under the Securities Regulation Code.

Dubious Promises of Quick Bitcoin Profits

According to SEC investigators, Arroyo actively promotes a so-called Bitcoin mining and trading program through Facebook and Messenger. She allegedly assures investors of earning up to ₱50,000 within 24 hours for a minimum stake of ₱5,000. Victims are encouraged to transfer funds via GCash, reinforcing a veneer of legitimacy through direct payout screenshots. However, the commission verified that Arroyo is not registered as a broker, dealer, or investment solicitor and is therefore operating outside legal parameters.

Unauthorized Solicitation Through Digital Platforms

The SEC warned that Arroyo’s approach uses digital wallets and encrypted messaging to evade oversight. Fraudulent operations like hers often recycle investor funds rather than generating legitimate trading revenue. By distributing small initial returns, they build credibility before abruptly halting payments when new inflows slow. This classic setup matches the hallmarks of a Ponzi scheme designed to collapse once recruitment stagnates.

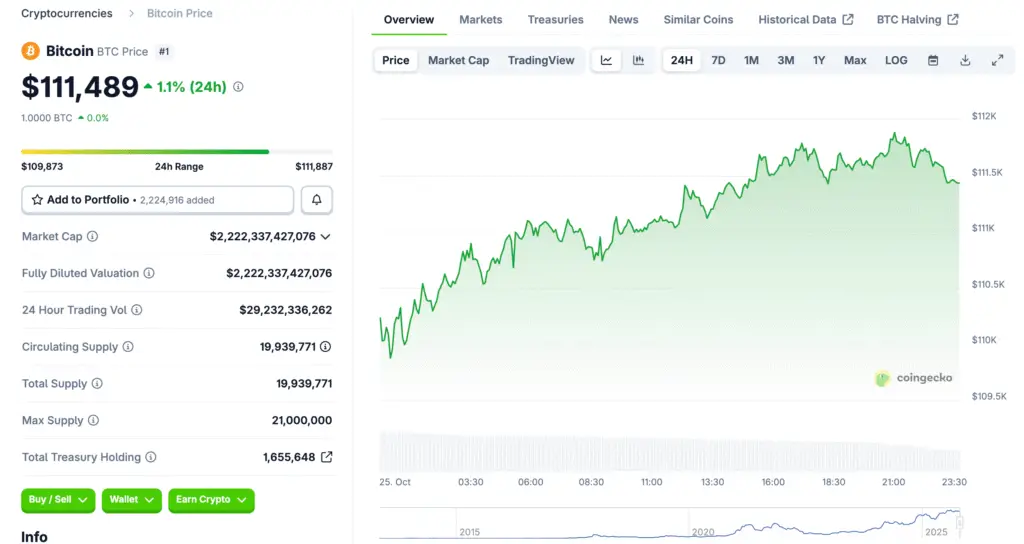

Recommended Article: Bitcoin Price Climbs Above $109,000 Ahead of Key US CPI Report

De Guzman Trading and the Classic Ponzi Setup

The agency also called out De Guzman Consumer Goods Trading for unlicensed investment solicitation. The group allegedly encourages individuals to pool funds under the guise of a goods trading business while offering extraordinary profits. The Enforcement and Investor Protection Department confirmed that the model mimics Ponzi mechanics, using contributions from new investors to pay earlier participants. Such structures inevitably collapse, leaving late joiners with heavy losses once recruitment plateaus.

SEC’s Public Advisory and Enforcement Measures

Through its Caraga advisory, the SEC linked to detailed documentation of both operations. Officials urged the public to report suspicious solicitations through the Enforcement and Investor Protection Department (EIPD) at epd@sec.gov.ph. The Commission reminded citizens that any group or individual collecting funds from the public must be duly registered and authorized under Philippine securities law. Those who continue to act as sales agents, uplines, or endorsers risk being held criminally liable.

Criminal Penalties for Promoters and Influencers

Under Republic Act No. 11765, the Financial Products and Services Consumer Protection Act, investment fraud carries severe repercussions. Violators may face fines reaching ₱5 million, imprisonment of up to 21 years, or both. The SEC warned that penalties apply not only to primary operators but also to those promoting or advertising such schemes. This includes influencers, endorsers, and recruiters who play a role in persuading the public to invest.

Protecting Consumers Through Education and Vigilance

The SEC continues to amplify investor education campaigns in regions vulnerable to online scams. By increasing awareness of common red flags—such as guaranteed daily profits, unverified registration claims, and reliance on referrals—the Commission hopes to prevent financial losses. Officials urge the public to verify any investment offer through the SEC website before sending funds or sharing personal data. Collective vigilance remains the most effective safeguard against evolving digital fraud schemes.

Final Warning: Avoid ‘Too-Good-to-Be-True’ Promises

Authorities reiterated that legitimate investments never promise fixed or rapid returns without risk. The public should remain wary of schemes that rely on recruitment and exaggerated profit claims. As technology enables wider reach for fraudsters, government oversight and community awareness must work hand in hand. The SEC concluded its advisory by reminding citizens that sustainable financial growth is built on transparency, regulation, and patience—not deception.