Volatility Makes Shiba Inu Unfit for Payroll

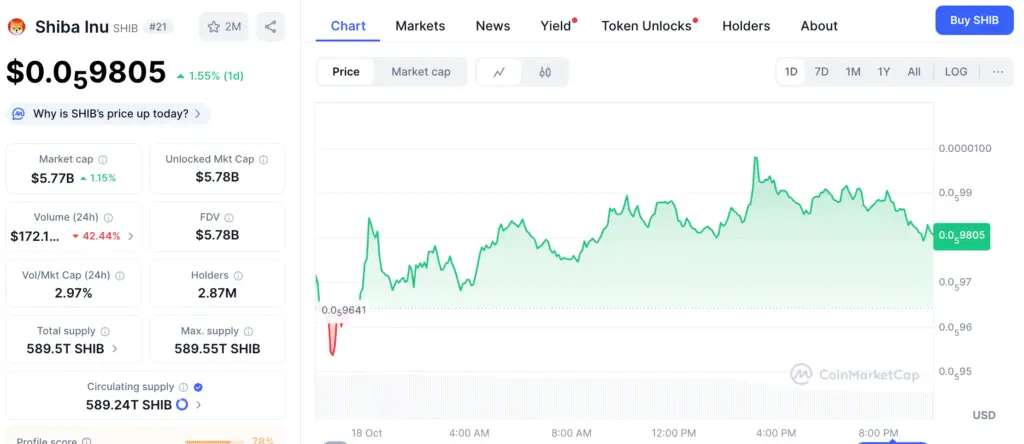

The concept of compensating employees with cryptocurrency has gained traction, yet Shiba Inu (SHIB) continues to pose significant risks for payroll purposes. The significant fluctuations render it impractical for reliable salary allocation, particularly in nascent startups. A sudden decline in the market can drastically impact employees’ earnings in an instant, leading to feelings of frustration and distrust among team members.

For business owners navigating tight budgets, these unexpected shifts can lead to significant financial disarray. Payroll expenses may fluctuate dramatically from month to month, potentially undermining financial stability. Given that startups are already managing narrow margins, depending on SHIB for compensation might evolve into a significant operational risk.

Stablecoins Provide Dependable Options

Conversely, stablecoins such as USDC and USDT offer a viable option for businesses aiming to modernize their payroll systems while steering clear of the volatile price fluctuations associated with cryptocurrencies. These tokens are tied directly to the U.S. dollar, guaranteeing a stable value that enhances security for both employers and employees.

Utilizing stablecoins for salary payments enables startups to harness the efficiency of blockchain while maintaining the reliability of fiat currency value. It also avoids the awkward situation where employees’ wages diminish in value immediately because of fluctuations in the market. For ensuring payroll consistency, stablecoins stand out as the most dependable cryptocurrency choice currently accessible.

Safeguarding International Teams Against Inflation

With the ongoing trend of startups expanding their hiring efforts globally, stablecoins emerge as a potential safeguard against inflationary pressures. Numerous workers in developing regions face challenges due to swiftly depreciating local currencies, leading to stablecoin payments serving as a financial buffer. This strategy guarantees that remote employees are compensated equitably and consistently, irrespective of the economic fluctuations in their area.

This kind of cross-border adaptability enables businesses to reduce conversion costs and sidestep delays associated with international banking. For international teams, stablecoins streamline transactions and enhance morale by providing reliable income streams.

Recommended Article: Shiba Inu Burn Rate Spikes 223% as Investors Turn to Remittix

Regulatory Uncertainty Poses Additional Risks

The framework governing cryptocurrency payroll is intricate and continually changing. Startups that embrace SHIB or other unpredictable tokens may face significant hurdles regarding compliance with anti-money laundering and know-your-customer regulations. Inconsistent classification of crypto assets by authorities in major jurisdictions continues to create ambiguity surrounding tax and reporting obligations.

Furthermore, differing regulations at the state or national level can add complexity to payroll processes. In this complex landscape, the need for legal knowledge and ongoing vigilance is paramount, a challenge that small startups often face without the necessary resources or compliance assistance.

Crypto Payroll Success Depends on Regulation, Security, and Accountability

Crypto payroll brings forth additional dimensions of security accountability. Companies need to establish robust protective measures to secure their assets against cyber threats or fraudulent activities. Implementing multi-signature wallets, utilizing hardware storage, and establishing strong internal controls are crucial strategies for effective risk management.

To ensure adherence to regulations, startups must diligently monitor transaction histories and keep records that are ready for auditing. Disregarding these protocols may lead to consequences such as penalties, damage to reputation, or potentially losing access to exchange accounts should regulators take action. Establishing a robust compliance framework is essential for the long-term viability of crypto payroll processes.

Effective Strategies for Startups Navigating Crypto Payroll

For companies keen on exploring blockchain-based payments, implementing several best practices can help reduce risk. Initially, it is advisable to convert cryptocurrency salaries to traditional currency right upon receipt to mitigate the risks associated with price fluctuations. Secondly, ensure that you utilize trustworthy and authorized platforms for secure payment processing. Third, inform employees about possible risks prior to choosing crypto-based compensation.

Integrating these approaches guarantees clarity and equity for everyone concerned. A well-organized cryptocurrency payroll system that emphasizes security, reliability, and knowledge will consistently surpass speculative options such as SHIB.

Shiba Inu Deemed Unsuitable for Payroll as Stability Takes Priority

Although crypto payroll presents a thrilling advancement, startups ought to steer clear of speculative tokens such as Shiba Inu for employee compensation. The potential downsides significantly overshadow any advantages, especially when financial stability is crucial for development. Stablecoins and tokenized fiat assets are gaining traction as the go-to option for dependable blockchain-based transactions.

As regulations evolve and infrastructure becomes more robust, the future of crypto payroll is poised to focus on stability rather than excitement. In this landscape, the fluctuations and restricted functionality of SHIB render it an impractical option for sustained payroll management, highlighting the necessity for startups to approach the adoption of meme-inspired cryptocurrencies with careful consideration.