Sui Network Redefines Blockchain Infrastructure in 2025

The blockchain sector in 2025 is no longer fuelled purely by speculation. Instead, institutional adoption is becoming the defining factor for long-term growth. Within this shift, Sui Network (SUI) has rapidly gained traction by offering a scalable, secure, and developer-friendly platform. With over 1.2 million daily active addresses and more than $2.5 billion in total value locked (TVL), Sui is reshaping how financial institutions and enterprises interact with blockchain technology.

Unlike traditional account-based networks, Sui’s object-centric architecture supports parallel transaction processing and near-instant finality. This distinction allows it to deliver unprecedented throughput of up to 297,000 transactions per second (TPS). In contrast, Ethereum processes just 13 TPS, while Solana averages 4,700 TPS but has faced recurring network stability challenges.

Scalability and Speed as Core Differentiators

Sui’s architecture solves one of the biggest barriers to institutional blockchain adoption: scalability. Its system executes transactions independently, reducing latency to milliseconds and ensuring predictability in gas fees. For financial institutions managing high-volume, time-sensitive operations, these features are not just technological upgrades but strategic necessities.

This performance makes Sui suitable for advanced applications such as real-time gaming, algorithmic trading, and decentralised finance (DeFi). As institutional investors search for networks capable of handling millions of transactions daily, Sui’s infrastructure positions it as a natural choice.

Developer Ecosystem Accelerates Adoption

Another key driver behind Sui’s rise is its strong developer ecosystem. The Move programming language, originally created for the Diem project, provides enhanced flexibility and security. Developers have embraced this framework, resulting in more than 15,000 daily users across gaming dApps and over 89,000 wallet-to-wallet transactions per day.

Major decentralised protocols such as BluefinX and Suilend have also launched on Sui, showcasing the network’s practical applications. BluefinX delivers a low-slippage trading engine, while Suilend has already managed $102 million in Bitcoin-based assets. These use cases demonstrate that Sui is not just a theoretical improvement but a functioning ecosystem capable of hosting real-world financial activity.

Institutional Confidence Backed by Security and Partnerships

Institutional adoption often hinges on security assurances. After the Cetus DEX exploit in 2024, Sui committed $10 million toward audits and bug bounty programmes, reinforcing its resilience. This proactive security stance has reassured investors and positioned Sui as a reliable platform for institutional engagement.

Sui’s partnerships with global technology leaders such as Google Cloud and Alibaba Cloud further strengthen its credibility. These collaborations provide infrastructure for validators, ensuring the network can scale globally while maintaining performance and security standards that meet institutional requirements.

Real-World Use Cases Expand Demand

Sui’s adoption extends far beyond speculative crypto trading. Gaming and social applications on the network have drawn more than 500,000 users within a three-month span. NFT collections like Fuddies and SuiFrens recorded $13.2 million in trading volume in Q1 2025, highlighting the demand for consumer-facing digital assets.

Meanwhile, DeFi protocols such as Typus Perp and Momentum’s CLMM DEX are redefining liquidity provision and derivatives trading on Sui. These projects highlight how the network balances consumer adoption with institutional-grade infrastructure, creating a unique blend of utility and scalability.

Competitive Advantages Over Ethereum and Solana

Ethereum continues to benefit from first-mover status, and Solana is recognised for speed. However, both face structural limitations. Ethereum relies heavily on Layer-2 solutions, which introduce fragmentation and complexity. Solana, while faster than Ethereum, has battled outages and security vulnerabilities.

Sui avoids these pitfalls by leveraging its object-based model. This approach allows seamless parallel transaction execution without relying on external scaling layers. For institutions seeking stable, high-throughput platforms, this architecture provides both technical reliability and operational efficiency.

Why Institutions Are Turning to Sui (SUI)

Institutional investment in Sui has accelerated in 2025, fuelled by strategic partnerships and financial products. The launch of a Sui ETF through 21Shares, custody solutions via Sygnum Bank, and Mill City Ventures’ public treasury allocation all signal growing confidence. Additionally, interoperability through Wormhole bridges connects Sui to more than 20 blockchains, expanding its role as a multi-chain hub.

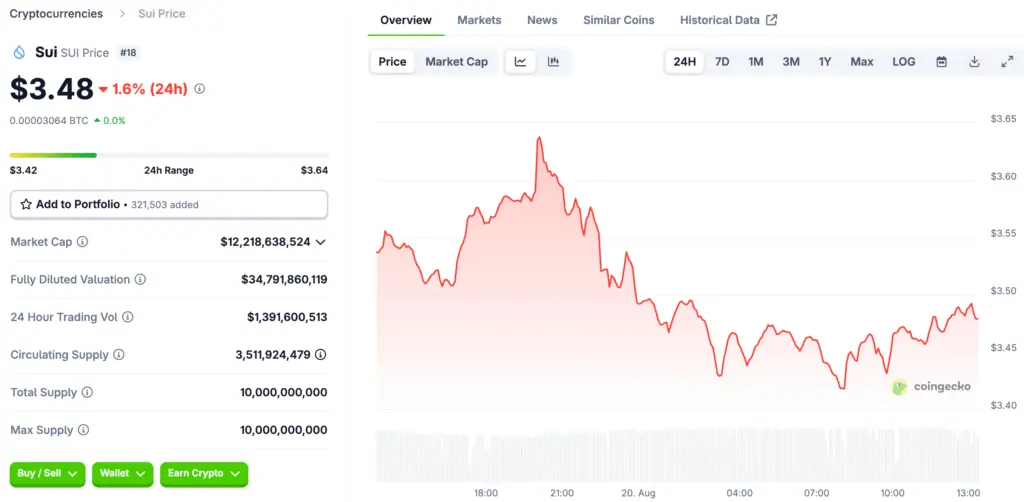

Sui’s tokenomics further reinforce its investment appeal. With a capped supply of 10 billion SUI tokens and a deflationary design, scarcity aligns with adoption. As usage grows, upward pressure on value becomes more likely, making SUI a compelling asset in both speculative and institutional contexts.

SUI as a Strategic Institutional Asset

The rise of Sui Network in 2025 underscores a broader transformation in blockchain, from retail speculation to institutional adoption. With unmatched scalability, proactive security measures, and strong developer momentum, Sui offers institutions a reliable on-ramp into the next generation of blockchain technology.

Its unique blend of high throughput, real-world applications, and deflationary tokenomics make it more than just another blockchain, it positions Sui as a cornerstone of future financial infrastructure.

Read More: SUI Market Resilience: Navigating Volatility for Future Growth