SUI Price Reversal Gains Strength After Weeks of Pressure

SUI is back in the limelight as its price trends upward, rebounding from a significant 20% weekly decline. The token is currently valued at approximately $2.82, showing resilience amid broader market volatility. Experts note that this recovery reflects rising market confidence, driven by improved liquidity and renewed investor engagement within the Sui ecosystem.

The recovery is supported by a 19% surge in stablecoin market capitalization, now at $1.1 billion. This growth signals enhanced on-chain liquidity—often an early sign of price stabilization and potential reversal. The rebound aligns with rising transaction activity and expanding developer participation, strengthening Sui’s outlook heading into Q4 2025.

Stablecoin Expansion Signals Network Confidence

Stablecoins form the liquidity backbone of any Layer-1 network, and Sui’s 19% expansion highlights growing trust in its ecosystem. The inflow of capital suggests that stakeholders are positioning for sustained network growth, aligning with higher trading volumes across decentralized exchanges built on Sui.

The total value locked (TVL) within Sui’s ecosystem has reached a new all-time high, underscoring continued developer and liquidity provider confidence. This momentum reinforces that Sui’s core fundamentals remain strong despite temporary volatility in the wider cryptocurrency market.

SUI Battles Resistance at Key EMAs as Bulls Target Breakout Above $3.16

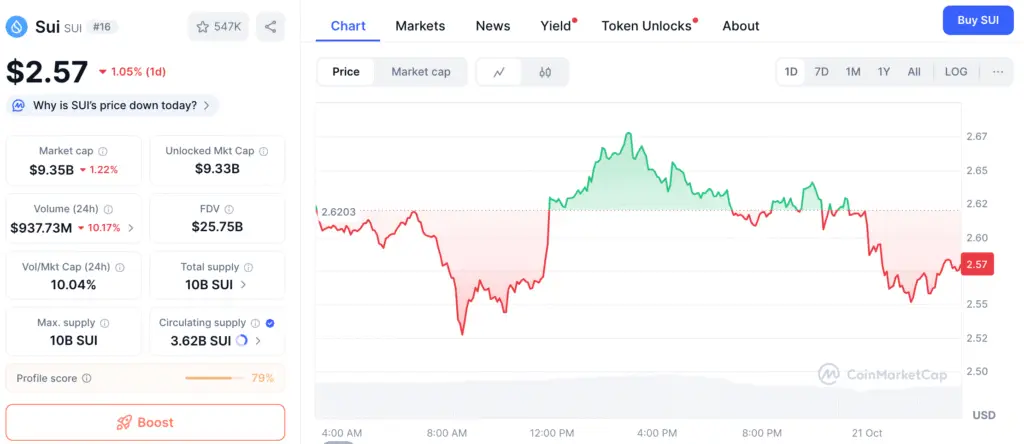

SUI faces short-term resistance at its 10-day and 20-day exponential moving averages (EMAs), located at $3.00 and $3.16, respectively. A decisive daily close above these levels could confirm a breakout and push prices toward the $3.50–$3.80 zone.

However, failure to reclaim $3.00 may trigger a pullback toward the $2.60–$2.80 range. Momentum indicators such as the RSI and MACD now display early signs of recovery, implying that selling pressure is easing and accumulation phases could already be forming.

Recommended Article: Sui Bulls Target $4.40 as Price Holds Above $3.07 Support

DeFi and Developer Activity Boost Sui’s Ecosystem Growth

Sui’s price rebound is supported by real network expansion. The number of active smart contracts continues to rise, accompanied by a surge in developer activity across DeFi, gaming, and NFT sectors.

Projects built using Sui’s Move-based smart contracts—a language designed for security and efficiency—are attracting attention from developers seeking scalable and low-latency frameworks. This steady participation reinforces token demand and provides a strong base for future ecosystem growth.

Institutional and Retail Confidence Strengthen Sui’s Market Position

Investor sentiment toward SUI has strengthened considerably. Institutional players are exploring opportunities in staking and liquidity provision, while retail traders remain optimistic about the network’s scalability.

The combination of technical recovery, growing liquidity, and active development positions SUI as a solid mid-cap contender. Expanding collaborations with DeFi protocols and cross-chain bridges may further enhance liquidity and attract capital from investors seeking efficient Layer-1 infrastructure.

SUI’s Distinct Advantage Over Layer-1 Competitors

While Layer-1 rivals such as Solana and Avalanche continue to dominate headlines, Sui stands apart through its advanced architecture. Its use of parallel execution and the Move programming language offers a clear advantage in managing large transaction volumes with speed and reliability.

These design efficiencies reduce transaction costs, accelerate confirmation times, and ensure scalability—key factors for both developers and enterprise users. As the blockchain industry evolves, platforms that combine performance and security, like Sui, are increasingly favored.

SUI Price Poised for Upside if Bulls Maintain Key $2.70 Support Zone

If SUI sustains support above $2.70 and breaks through $3.16, analysts expect a more extended recovery phase. Rising liquidity and expanding ecosystem activity suggest the foundation for a steady uptrend as October concludes.

Experts predict that continued network growth and increased stablecoin usage could attract additional capital inflows in the coming weeks. For traders and long-term holders alike, maintaining key support levels will determine whether this rebound transforms into a lasting rally as November approaches.