Tether Achieves a Record $10 Billion Profit in 2025

Tether (USDT), the world’s largest stablecoin issuer, reported an extraordinary $10 billion profit for 2025, underscoring its position as a dominant force in digital finance. The company’s Q3 earnings alone reached $4.3 billion, highlighting its unmatched profitability and continued leadership among stablecoin providers.

USDT Supply Surges as Demand Grows

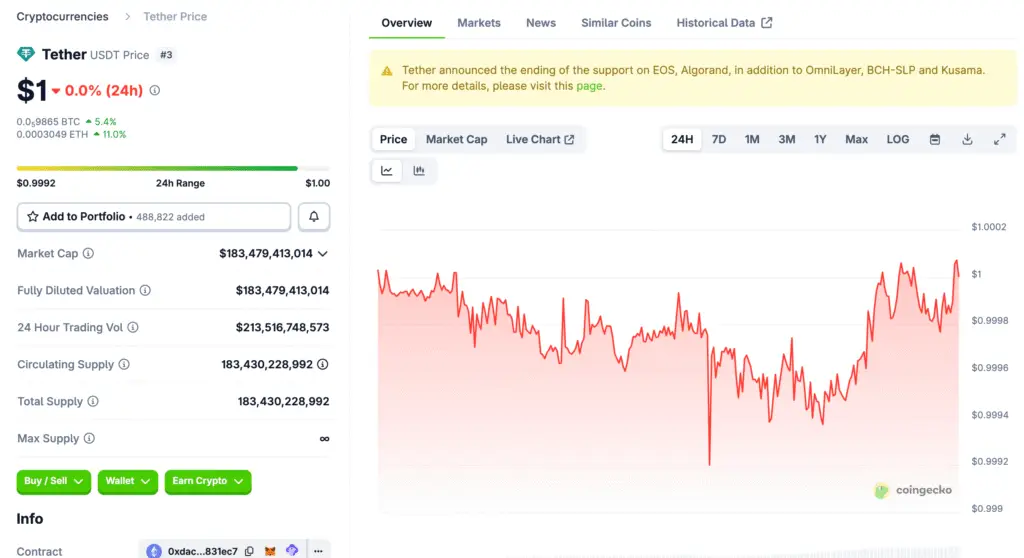

The total supply of USDT has now reached $174 billion, with an additional $17 billion minted between July and September. This growth was fueled by rising adoption across global exchanges, institutional settlements, and retail payment systems. Tether’s market activity surged by nearly 20% in recent weeks, reflecting accelerating transaction volume and liquidity.

Tether Becomes the 17th Largest U.S. Treasury Holder

According to recent disclosures, Tether now holds approximately $135 billion in U.S. Treasury securities—ranking it as the 17th largest holder globally. This milestone places the company ahead of several major national economies and underscores its role as a significant participant in traditional financial markets.

Recommended Article: Tether Posts $10B Profit in 2025, Surpassing Major Global Banks

Stablecoin Market Leadership Strengthened

Tether continues to outperform competing stablecoins, maintaining a commanding lead over its closest rival, USD Coin (USDC). Its transparent reserves, anchored by $6.8 billion in excess capital, provide strong assurance of liquidity and stability. With more than 50 million users worldwide, USDT remains the most widely used stablecoin in circulation.

Regulation and the GENIUS Act Fuel Confidence

Analysts attribute part of Tether’s growth to the introduction of the GENIUS Act, new cryptocurrency legislation designed to enhance stablecoin oversight. The regulatory clarity has boosted investor confidence and expanded institutional participation, further reinforcing Tether’s dominance.

Rapid Minting and Expanding Global Reach

Tether’s expansion shows no sign of slowing. The company continues to mint new coins at record speed while exploring integrations with financial institutions and fintech platforms. Its ability to maintain a near-perfect dollar peg, supported by diversified reserves, has made it a preferred vehicle for digital asset transfers worldwide.

Trade Volume and Market Activity Surge

Recent data shows USDT trade volume rising 20% over the last 24 hours, surpassing $188 billion—more than its total market capitalization. This turnover highlights Tether’s role as the backbone of global crypto liquidity, powering exchanges and on-chain ecosystems across multiple blockchains.

Outlook: Tether’s Growth Signals the Future of Digital Finance

With a $10 billion profit and robust reserves, Tether is redefining what it means to be a stablecoin issuer. Its blend of transparency, profitability, and macro-scale Treasury exposure positions it as a bridge between traditional banking and digital currency. As demand for stable, dollar-backed assets rises, Tether’s influence on the global financial landscape will only continue to expand.