Understanding the Pepe Meme Coin

The cryptocurrency market is a dynamic and unpredictable space, and few assets embody this better than Pepe ($PEPE). Inspired by the “Pepe the Frog” internet meme, this coin emerged as a new player in the meme coin arena. While it openly states its lack of intrinsic value and formal utility, its community-driven nature and viral popularity have propelled it to a multi-billion dollar market capitalisation. For investors, understanding the unique factors that influence this token is crucial for making informed decisions.

What is Pepe Coin and Its Origins?

Pepe coin is an Ethereum-based cryptocurrency that was launched in 2023. Unlike many crypto projects, it lacks a formal team, a strategic roadmap, or any practical use case. Its creators have been explicit in their focus on the coin’s purely meme-based nature, aiming to achieve widespread adoption and social media trending through the power of its virality. This lighthearted approach is a key part of its appeal, attracting a segment of the crypto community that is drawn to speculative, high-risk assets.

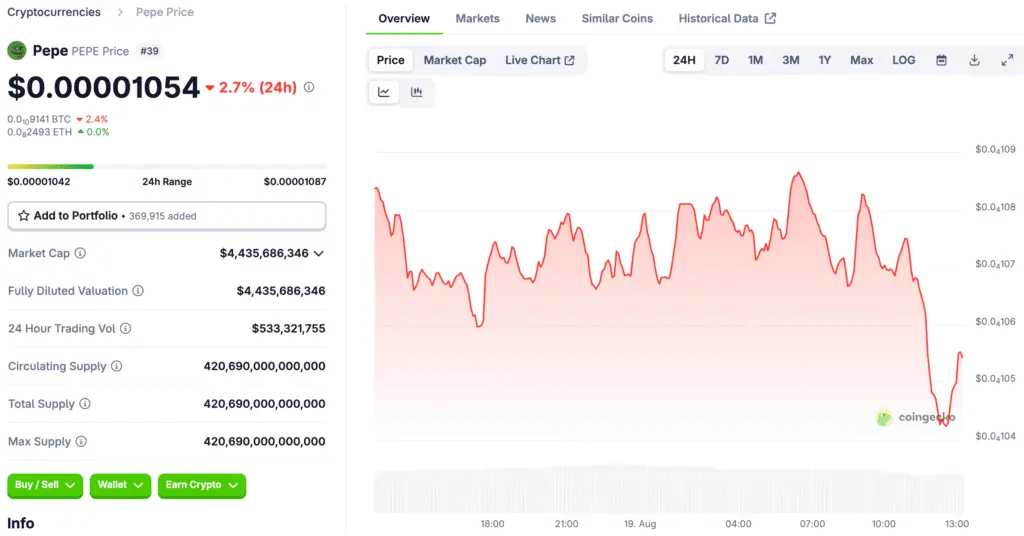

A Snapshot of Recent Price Performance

Pepe’s price has been highly volatile, as is typical for a meme coin. The token has seen significant swings, from its all-time high of approximately $0.000028 to its current trading range around $0.000011. This represents a substantial decline from its peak, a common trend after a major bull run. Despite this, its current market cap remains in the billions, and its trading volume is consistently high. This indicates a robust and active market, with significant buying and selling activity.

Key Factors Influencing the Pepe Market

Several factors are at play when it comes to Pepe’s market performance. The first and most significant is market sentiment. During periods of general bullishness in the broader crypto market, investors often seek out higher-risk, high-reward assets like meme coins. A positive outlook towards Bitcoin and Ethereum can create a “risk-on” environment that directly benefits Pepe. Conversely, a bearish or risk-averse mood can lead to sell-offs.

Another critical factor is social media sentiment. Pepe’s value is intrinsically tied to its online popularity. Mentions and engagement on platforms like X (formerly Twitter) and Reddit can directly influence its price. This is a double-edged sword: a viral post can send the price soaring, but a shift in public interest can lead to a rapid decline.

Read More: Meme Coin Mania The Rise of PEPE and SHIB

The Role of Community and Speculation

The Pepe community is the lifeblood of the project. Its strength is not derived from utility but from collective belief and shared humour. The community’s engagement in creating and sharing memes, as well as its efforts to drive adoption, are the primary drivers of demand.

The project’s roadmap, as outlined by its creators, focuses on community-centric milestones like trending on social media, launching a digital newsletter, and creating token-gated groups. These goals, while not traditional, are crucial for sustaining the speculative interest that gives the token its value.

Analysing the Supply and Trading Dynamics

Pepe has a fixed total supply of 420.69 trillion tokens. A large portion of this supply, 93.1%, was allocated to the liquidity pool with the LP tokens burned, which is a measure intended to prevent creators from removing liquidity. The remaining 6.9% is held in a multi-sig wallet for future exchange listings and liquidity.

Trading activity is a key indicator, with daily volumes in the hundreds of millions. The balance between buyers and sellers is a constant tug-of-war, and technical analysis often focuses on identifying trends and patterns within this trading data.

How Community Enthusiasm Drives Pepe Coin

The future of Pepe coin is heavily dependent on the continued enthusiasm of its community and the overall health of the crypto market. While it faces competition from other emerging meme coins that offer a layer of utility or gameplay, Pepe’s established brand recognition gives it an advantage.

The ability to be listed on Tier 1 exchanges is another crucial milestone that could boost its legitimacy and accessibility, potentially driving further price appreciation. However, investors should remain aware of the high-risk nature of this asset and its complete reliance on market sentiment and speculative interest.