TRON Remains Resilient Amid Market Fluctuations

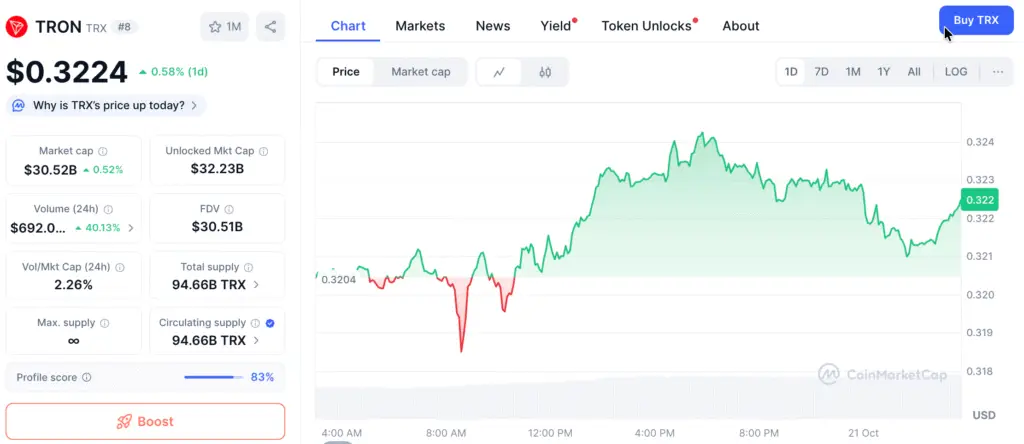

As 2025 unfolds, TRON (TRX) continues to stand out among major blockchain networks. Currently trading around $0.306, the token has seen modest fluctuations, recording a daily decline of 3.2%. Despite this, TRON remains resilient compared to many altcoins struggling amid ongoing macroeconomic uncertainty.

The network’s consistent performance, strong community loyalty, and growing role in stablecoin settlements have cemented its position as one of the most active and dependable blockchains globally. Over the past three months, TRON has averaged more than 2.6 million daily transactions, highlighting the strength of its ecosystem and the efficiency of its on-chain infrastructure.

TRX Targets Significant Resistance at $0.37 Ahead of Bullish Validation

TRON has repeatedly tested resistance near $0.37—a key threshold that traders are closely monitoring. A confirmed breakout above this level could pave the way toward the $0.45–$0.50 range in early 2025, aligning with analysts’ expectations for a medium-term rally.

If accumulation continues, TRX could gather enough momentum to approach $1 by late 2025. However, maintaining support above $0.28 remains essential. A sustained drop below this level may prolong consolidation and delay the next leg of bullish movement.

DeFi Expansion and Stablecoin Growth Drive TRON’s Utility

TRON’s growth is driven by its leadership in stablecoin activity, particularly through Tether (USDT) transactions on its network. Its expanding use in remittances, peer-to-peer payments, and DeFi applications continues to provide a strong demand base, ensuring steady fee revenue and token circulation.

The ecosystem’s DeFi footprint remains impressive, with a Total Value Locked (TVL) exceeding $8 billion. Key platforms such as JustLend and SunSwap contribute to TRON’s status as a leading DeFi hub—one of the few networks maintaining stable TVL levels even during market corrections.

Recommended Article: TRON Price Consolidates Near $0.31 as Bulls Defend Key Support

Institutional Interest and Blockchain Adoption Strengthen TRON’s Case

Institutional perspectives on TRON have grown increasingly positive, driven by its cost-effective transaction model and rapid settlement speeds. The network’s efficiency continues to attract fintech enterprises across Asia and Latin America, where cross-border remittance volumes are expanding rapidly.

Founder Justin Sun’s ongoing partnerships with regional exchanges and payment providers have elevated TRON’s visibility. The project’s focus on cross-border efficiency and real-world payment integration positions it as a practical bridge between blockchain technology and traditional finance.

The Path to $1: Essential Steps for TRON’s Success in 2025

Reaching the $1 milestone will require a convergence of factors—chief among them deeper institutional involvement, increased DeFi liquidity, and consistent burn initiatives to limit token supply. TRON’s ongoing transaction-fee burn mechanism has already removed millions of TRX from circulation, gradually enhancing scarcity and long-term value.

Market strategists believe that continued growth and DeFi adoption could lift TRX into the $0.70–$1.00 range by Q4 2025, provided Bitcoin’s stability and favorable liquidity conditions persist. Progress will also depend on TRON’s ability to launch new financial instruments and expand its institutional integrations.

TRON and Its Layer-1 Rivals: Evaluating Its Market Position

Amid competition from Layer-1 giants such as Ethereum, Solana, and BNB Chain, TRON’s transaction efficiency and affordability remain its key differentiators. While other blockchains face congestion and high fees, TRON’s energy-bandwidth model provides sustainable scalability ideal for gaming, stablecoin settlements, and high-volume remittance applications.

Furthermore, the network’s continued growth in tokenized assets and Web3 payments reinforces its long-term potential. With more than 200 million wallet addresses and an expanding global user base, TRON now rivals top-tier chains in adoption and transaction throughput.

TRON Set for Continued Expansion Through 2026

TRON’s road to $1 is supported by strong fundamentals, increasing DeFi participation, and consistent network expansion. While resistance remains at $0.37, a breakout above this level could trigger a renewed uptrend as we enter early 2025.

As blockchain adoption accelerates worldwide, TRON’s blend of speed, efficiency, and stablecoin utility sets it apart as a long-term contender. Heading into the next market cycle, TRX stands as a reliable Layer-1 asset for both retail and institutional investors alike.