A crowded catalyst calendar concentrates event risk into days

XRP trades into month‑end with several binary‑feeling headlines on deck. The OCC’s 120‑day review of Ripple’s national bank charter nears its window’s end. Meanwhile, Senate negotiations to reopen the government could unfreeze ETF reviews. Together, these items may define whether consolidation resolves into a breakout or breakdown.

Why an OCC charter matters for Ripple’s Main Street ambitions

A U.S. bank charter would deepen Ripple’s integration with core payment rails. That status can streamline correspondent relationships and broaden liquidity access. For institutions, regulatory clarity often precedes usage at scale across cross‑border flows. While approval is not guaranteed, a green light would validate years of compliance investment.

ETF timelines, shutdown noise, and the read‑through for demand

Multiple spot XRP ETF filings await action amid staffing constraints during the shutdown. Should Congress fund the government, the review docket can accelerate quickly. International precedents and futures milestones have already strengthened the case. A launch would provide a regulated, brokerage‑native path for capital to enter the ecosystem.

Recommended Article: Ripple Report Reveals Timeline for First XRP ETF Launch

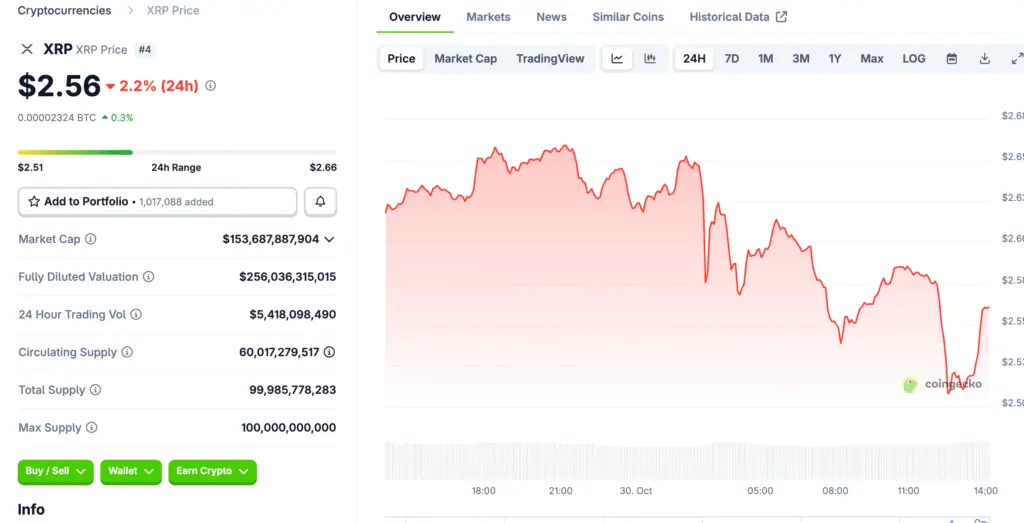

Technicals compress as the triangle tightens into support bands

After several lower‑high failures, price sits below both the 50‑ and 200‑day EMAs. Immediate supports cluster near $2.50, then $2.35 and $2.20 beneath. Resistance layers appear at $2.62, $2.80, and the psychological $3.00 round number. A decisive break with volume will likely determine direction for the next leg.

Scenarios: mapping bearish risks and bullish pathways with levels

A prolonged Senate stalemate, licensing delays, or muted ETF progress favors the downside. Under those outcomes, a slide through $2.35 could put $2.20 and $2.00 in play. Conversely, charter approval and ETF momentum would challenge $2.80 quickly. Clearing $3.00 on strong breadth would raise odds of a run at the prior high near $3.66.

Macro overlays: trade diplomacy and policy tone still sway flows

U.S.–China talks, rate expectations, and dollar strength can amplify or mute crypto moves. A risk‑on impulse typically improves depth and narrows spreads across majors. If macro turns supportive alongside positive XRP‑specific headlines, upside travel speeds up. If macro deteriorates, even bullish catalysts may face choppy follow‑through.

Positioning, liquidity, and what the tape must show to trust a turn

Look for rising volume on up days, shrinking on retracements, and healthier order book depth. Funding normalization and improving market breadth across large caps add confirmation. A reclaim of the 200‑day EMA with acceptance above $2.80 signals buyers in control. Without those tells, range trading likely persists as the market waits for clarity.

Bottom line: respect levels, trade catalysts, and let price lead

XRP sits at an intersection of regulatory milestones and macro cross‑currents. The next decisive move will likely align with concrete outcomes on the charter and ETFs. Traders should predefine invalidations and avoid over‑sizing into binary events. Patience around $2.50 support and discipline near $3.00 resistance remain the prudent stance.