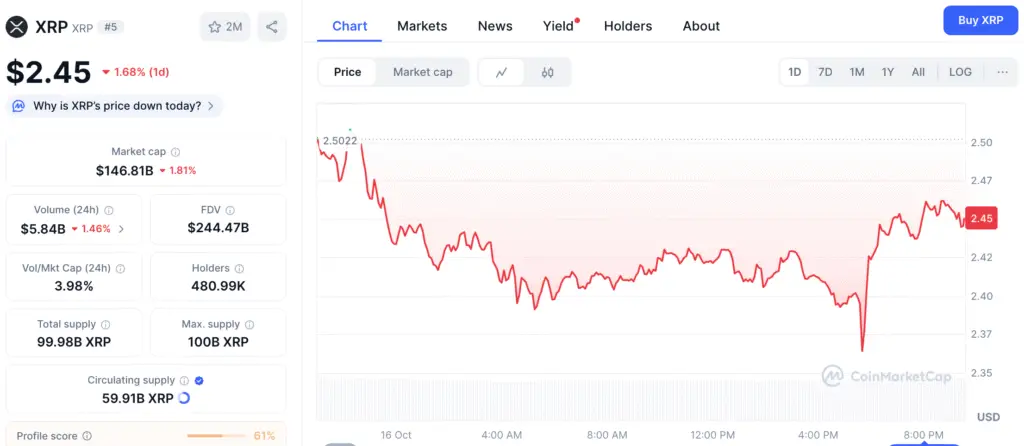

XRP Faces Technical Bear Market Following Significant Drop

Ripple’s XRP has entered a technical bear market after experiencing a significant 35% drop from its annual peak. The decline of the token corresponds with a wider downturn in the cryptocurrency market that has significantly impacted Bitcoin, Solana, and various other prominent altcoins. The unexpected decline has unsettled investors, prompting discussions on whether to seize the opportunity to buy at a lower price or to minimize losses ahead of a potential further downturn.

On Friday, XRP experienced a brief decline, hitting a low of $1.7768, the lowest level recorded since November 2024. The token has experienced a slight rebound as savvy buyers have stepped into the market, but the prevailing sentiment remains bearish, casting a shadow over the technical outlook.

Technical Structure Confirms Bearish Continuation

The daily chart reveals a troubling scenario. XRP made a feeble attempt to recover following Friday’s decline but encountered resistance at the 200-day EMA around $2.6292. Experts view this as a temporary rebound, a fleeting uptick that frequently signals more significant declines ahead.

Additionally, the break-and-retest pattern near $2.6530 indicates a possible continuation of the downward trend. The price action observed near this resistance indicates that sellers are firmly in charge, restricting any upward movement unless a clear breakout takes place.

XRP Chart Warns of Death Cross as EMAs Signal Potential Market Downturn

A new cautionary indicator is appearing on the XRP chart. The 50-day and 200-day EMAs are nearing a death cross, a pattern that has historically signaled prolonged downturns. Once validated, this crossover frequently draws in momentum traders anticipating additional price decline.

Analyzing the wave structure reveals that XRP has negated the impulse phase of the Elliott Wave, indicating a potential for a more pronounced corrective phase. Should the current trend continue, experts anticipate a revisit to $1.7768, approximately 26% lower than the present figures.

Recommended Article: XRP Price Falls 20% as Whale Inflows Flood Binance Exchange

Resistance at $2.65 Defines the Bullish Threshold

To bolster the optimistic outlook, XRP needs to firmly establish itself above the $2.65 resistance level. A consistent hold above this level could indicate a resurgence in momentum and may pave the way for a rebound toward the $3.00 area.

Until that breakout takes place, the technical indicators lean towards the sellers. The interplay of declining volume, negative crossovers, and diminishing highs suggests that the potential for downside risk continues to prevail in the short term.

XRP Gains Attention as ETF Endorsement Could Spark Institutional Inflows

Even in the face of negative indicators, XRP possesses multiple potential drivers that may spark a recovery. The initial point of focus is the expected endorsement of XRP ETFs, which has the potential to significantly enhance institutional engagement and market fluidity.

Experts observe that these approvals could come after the conclusion of the U.S. government shutdown, although there are differing opinions suggesting that the optimism may already be reflected in current valuations. Increased ETF inflows may restore XRP’s long-term credibility with investors, akin to the way Bitcoin ETFs revolutionized institutional engagement in early 2025.

Ripple USD (RLUSD) Stablecoin Nears $1 Billion Market Cap

A significant factor contributing to optimism is the swift expansion of Ripple USD (RLUSD), the stablecoin associated with Ripple. As its market capitalization nears $1 billion, RLUSD is rapidly establishing itself as one of the most swiftly growing stablecoins within the ecosystem.

This development enhances the Ripple network’s on-chain functionality and liquidity characteristics, generating beneficial ripple effects for XRP by boosting actual transaction demand throughout its payment system.

XRP Outlook Tied to Bitcoin Recovery as Market Awaits Liquidity Rotation

Ultimately, the possibility of Bitcoin’s resurgence is a pivotal element influencing XRP’s future prospects. In the past, alternative cryptocurrencies tended to bounce back following a period of stabilization in Bitcoin, as investor confidence and liquidity gradually flowed back into riskier assets. If Bitcoin manages to regain higher levels, it may lead to increased capital inflows into major tokens like XRP and Solana, potentially enhancing a wider market recovery.

XRP traders are exercising caution during this period. In the current landscape, short-term trends seem to lean towards the bears, while those with a longer investment horizon view this period as an opportunity to gather assets ahead of upcoming ETF developments and broader economic recovery signals that could reinstate a bullish outlook.