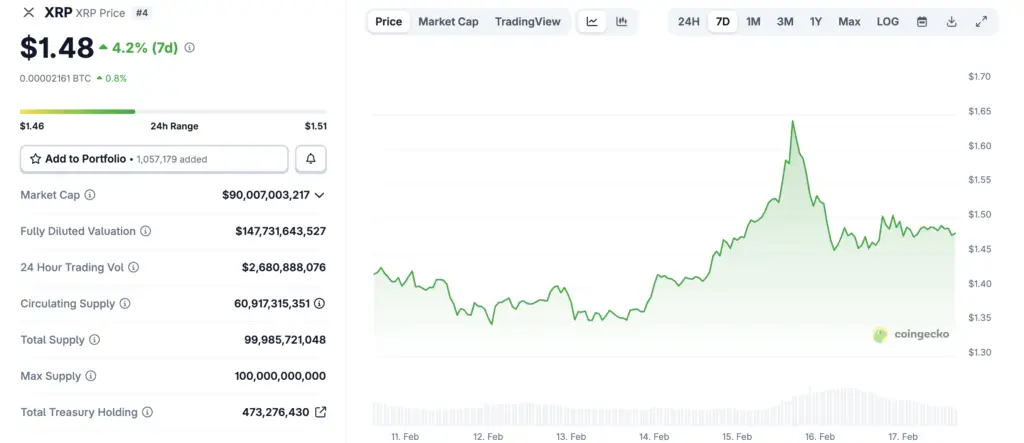

XRP Outperforms Bitcoin and Ethereum After Market Crash

XRP has emerged as one of the strongest performers in the cryptocurrency market following the recent downturn, climbing roughly 38% from its local bottom. While major assets like Bitcoin and Ethereum have posted modest recoveries, the payments-focused token has demonstrated notably stronger buying momentum.

The divergence highlights shifting investor behavior within digital asset markets. Rather than spreading capital evenly across large-cap cryptocurrencies, traders appear increasingly selective, targeting assets they believe offer asymmetric recovery potential.

Binance Withdrawals Trigger Supply Shock

Data from blockchain analytics platform CryptoQuant shows that more than 192 million XRP tokens were withdrawn from Binance over a brief period. Exchange reserves fell about 7%, pushing holdings to their lowest level in over a year.

Such movements often indicate that investors are transferring assets into private wallets for long-term storage rather than leaving them on trading platforms. Reduced exchange supply can tighten liquidity, creating conditions that support price appreciation when demand rises.

Accumulation Patterns Reinforce Bullish Sentiment

Historically, declining exchange balances have been associated with accumulation phases. When fewer tokens are readily available for sale, upward price pressure can build as buyers compete for limited supply.

Analysts note that the recent stabilization in reserves suggests the initial wave of buying may have subsided, yet the overall supply remains constrained. This structural shift could continue influencing price dynamics in the near term.

Recommended Article: Bitcoin Ransom Mystery Grips America as FBI Hunts Kidnappers in…

Lessons From XRP’s Previous Rally

Market participants have observed similar patterns before. In late 2024, XRP surged dramatically—from roughly $0.60 to above $2—during a sustained period of exchange outflows.

That rally demonstrated how supply-side factors can amplify bullish momentum. While past performance does not guarantee future results, historical parallels often shape trader expectations and strategy.

Recovery Reflects Changing Investor Preferences

The performance gap between XRP and larger cryptocurrencies may signal evolving perceptions about utility-driven tokens. XRP’s role in cross-border payments has long positioned it as a practical financial instrument rather than purely speculative collateral.

As institutional interest grows in blockchain-based settlement solutions, assets tied to real-world applications could attract renewed attention. Investors frequently rotate toward narratives that promise measurable adoption.

Market Crash Viewed as Buying Opportunity

Many traders appear to interpret the recent correction as a chance to accumulate discounted assets. This behavior contrasts with panic-driven selling typical of deeper bear markets, suggesting confidence has not fully eroded.

Short-term volatility often resets positioning, allowing stronger hands to consolidate holdings. When markets stabilize, these investors may provide the foundation for sustained recoveries.

Exchange Metrics Remain Critical Indicators

On-chain analytics have become indispensable tools for evaluating crypto market structure. Metrics such as reserve levels, wallet flows, and transaction volumes offer insight beyond traditional price charts.

Institutional desks increasingly integrate this data into trading strategies, reflecting the sector’s growing sophistication. Monitoring exchange balances in particular helps identify whether rallies are supported by genuine demand.

Broader Crypto Market Still Sets the Tone

Despite XRP’s impressive rebound, the wider market environment continues to matter. Bitcoin remains the primary liquidity driver, meaning its trajectory often influences capital flows across altcoins.

If macro conditions stabilize and Bitcoin regains upward momentum, secondary assets like XRP could benefit from renewed risk appetite. Conversely, prolonged weakness might cap gains regardless of individual strength.

Investor Psychology Plays a Central Role

Crypto markets are heavily influenced by sentiment cycles. Strong rebounds can attract momentum traders, reinforcing upward moves, while sudden reversals may trigger rapid profit-taking.

Understanding these behavioral dynamics is essential for interpreting price action. The current rally suggests optimism is returning—but cautiously.

Outlook Hinges on Sustained Demand

Whether XRP can extend its recovery will depend largely on continued accumulation and broader market stability. A persistent reduction in exchange supply could act as a structural tailwind if demand holds.

For now, the token’s outperformance underscores a key theme shaping modern crypto markets: capital is becoming more strategic. As investors refine their approach, assets demonstrating both liquidity and perceived utility may increasingly lead the next phase of digital finance.