Ripple’s $3 Million Bet on Doppler

Ripple has made headlines once again by investing $3 million into Doppler Finance, a protocol built to unlock XRP Ledger’s untapped liquidity. The seed round, announced August 7, 2025, was led by Reforge VC with participation from DCG and Hashkey Capital.

Ripple aims to mobilise the $200 billion in idle XRP by building institutional-grade yield opportunities. Already, Doppler’s RLUSD Vault has attracted $50 million in total value locked (TVL), signalling strong traction in Ripple’s ecosystem.

Market Reaction and XRP Outlook

XRP responded positively to the news, climbing 9% to around $3.28 and breaking a key resistance level. Whale accumulation exceeding $1 billion has fuelled bullish sentiment, and analysts suggest that a successful break above $3.64 could open the door to a $4.50 target.

However, risks remain, with macro headwinds like U.S. tariffs threatening to suppress momentum. For many retail investors, these slower institutional plays are less attractive than more direct, high-upside opportunities.

Why Traders Are Turning to Mutuum Finance (MUTM)

While Ripple’s Doppler investment signals long-term ecosystem building, traders looking for immediate upside are shifting their focus to Mutuum Finance (MUTM). Unlike institutional-focused projects, Mutuum is designed for both lenders and borrowers in the retail market.

Its hybrid model combines peer-to-contract (P2C) lending, where assets like ETH and USDT are deposited into pools for yield, and peer-to-peer (P2P) lending, where terms are set directly between lender and borrower. This dual system makes Mutuum accessible, flexible, and potentially more rewarding for early investors.

The Power of Presale Momentum

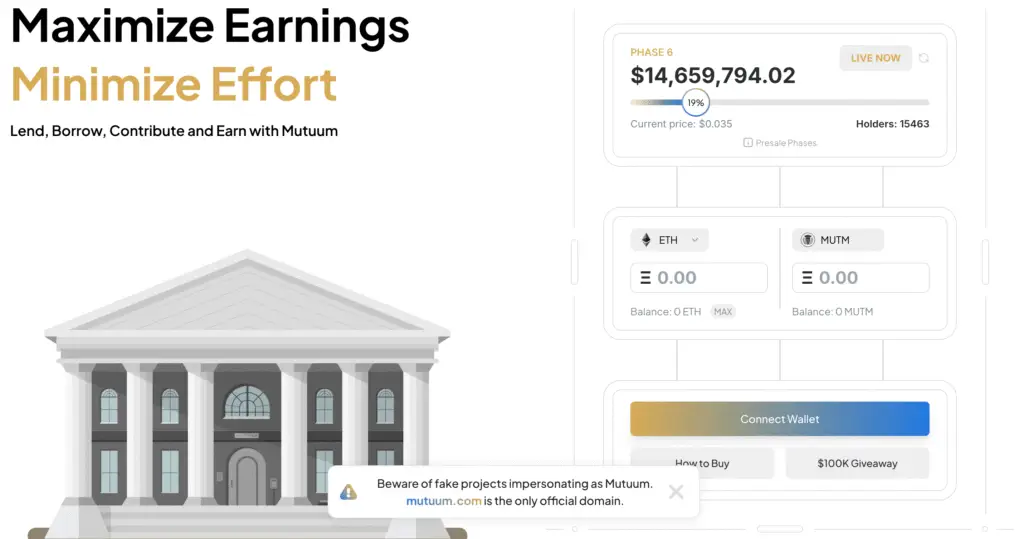

Mutuum Finance is in Phase 6 of its presale, offering tokens at $0.035 each. More than $14.63 million has already been raised from over 15,450 holders, with 22% of the Phase 6 allocation sold. Demand has created strong momentum, as the next phase will raise the price to $0.04. For traders, this creates a sense of urgency to secure MUTM before prices climb further, with presale phases already demonstrating substantial returns for early adopters.

Read More: Mutuum Finance Presale Touts 10x Growth in 2025

Sustainable Tokenomics Backed by Real Revenue

One of Mutuum Finance’s biggest draws is its staking and buyback-driven tokenomics. Holders can stake their mtTokens to earn MUTM rewards funded directly from platform revenue. As lending and borrowing activity increases, revenue is used for open-market token buybacks, aligning rewards with actual usage.

In addition, the project is launching its own stablecoin pegged to $1, backed by ETH collateral and automatically burnt upon loan repayment, ensuring scarcity and stability. This model provides a level of sustainability often missing in DeFi token designs.

Security, Trust, and Community Engagement

Security has been a priority for Mutuum Finance, with a CertiK audit scoring a 95 on Token Scan and 78 on Skynet. To further build confidence, a $50,000 bug bounty programme invites ethical hackers to uncover vulnerabilities, while a $100,000 community giveaway is boosting engagement and expanding the holder base. These steps have strengthened trust in the protocol as it heads toward its mainnet launch.

Long-Term Vision and Investment Potential

Mutuum Finance has a roadmap spanning four phases: introduction, building, finalisation, and delivery. With audits, presale, and awareness campaigns already complete, the project is moving toward smart contract development, exchange listings, and eventual multi-chain expansion.

Early investors are already seeing significant paper gains. For example, a $10,000 allocation in Phase 1 at $0.01 per token is now worth $30,000 at Phase 6 pricing, with expectations of $60,000 once the listing hits $0.06.

Why Mutuum Finance Stands Out in DeFi

While Ripple’s $3 million Doppler raise shows institutional belief in DeFi, the potential for rapid multipliers remains in retail-friendly presales like Mutuum Finance (MUTM). Its hybrid lending model, revenue-driven tokenomics, audited security, and fast-growing community position it as a standout project in the 2025 DeFi landscape. With presale tokens quickly selling out and prices set to rise, Mutuum Finance offers investors a rare window to enter before broader adoption drives value higher.