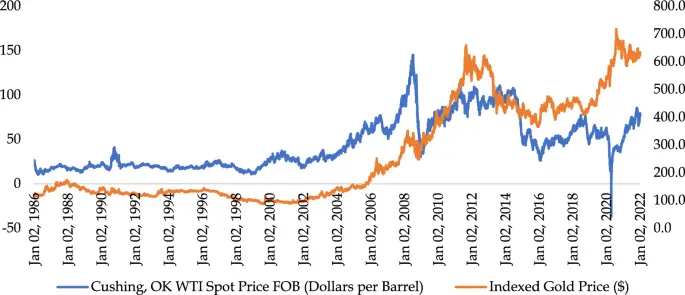

Gold and Oil Became Key Market Indicators in 2025

Gold and oil quietly became two of the most important economic indicators throughout 2025. While stock market volatility dominated headlines, the movement of these commodities offered deeper insight into global sentiment, inflation expectations, and geopolitical risk.

Their performance reflected the world’s struggle with shifting trade relationships, rate-cut uncertainty, and repeated geopolitical tensions that disrupted markets.

A Year of Political and Economic Uncertainty

Throughout 2025, gold and oil acted as mirrors of a global economy under stress. Gold reacted sharply to changes in inflation forecasts and central bank guidance, rising and falling with expectations of interest-rate adjustments.

Oil, meanwhile, faced constant pressure from production decisions, regional instability, and uneven global demand. These factors blended into a year defined by rapid price reversals and weak investor conviction.

Gold Responded Directly to Interest-Rate Shifts

Gold’s trajectory in 2025 highlighted its sensitivity to global monetary policy. When investors expected slower rate cuts, gold struggled. But as inflation pressures eased later in the year, gold regained momentum.

The commodity maintained its role as a hedge against uncertainty, especially when policy guidance from central banks appeared inconsistent or unclear.

Recommended Article: Trump Approves Nvidia’s Sale of Advanced AI Chips to China…

Oil Reflected the World’s Supply Vulnerabilities

Oil prices became a real-time gauge of supply risk. Production decisions by OPEC+ repeatedly influenced global pricing, while conflicts in key regions caused sudden spikes and dips.

Demand across major economies remained unpredictable. Growth slowed in some regions while others surprised with resilience, leaving traders balancing conflicting signals throughout the year.

What Gold May Signal for 2026

As the world moves into 2026, gold stands at the center of a delicate macro environment. Its performance will depend heavily on inflation trends and whether central banks commit to more aggressive easing cycles.

If global policy shifts toward coordinated rate cuts, gold could enjoy prolonged support—particularly if equity markets begin to show signs of fatigue after extended rallies.

Oil’s Outlook Depends on Supply Discipline and Global Demand

Oil enters 2026 with unresolved tensions. OPEC+ discipline will determine the strength of price floors, while non-OPEC countries continue to influence supply dynamics. Meanwhile, the global shift toward renewable energy introduces new long-term uncertainties.

Demand remains the biggest variable. China’s economic pace and overall global recovery will shape consumption patterns throughout the year.

What Traders Should Watch Going Into 2026

For active traders, gold and oil require a macro-informed strategy. Inflation data, policy statements, and geopolitical news can shift markets instantly. Commodity movements in 2025 demonstrated that long-term positioning must align with both monetary expectations and structural changes in global demand.

Analysts suggest that 2026 may bring clearer trends: gold following central-bank easing cycles, and oil trading within a tighter range shaped by disciplined production and gradual demand recovery.